Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Section 2 (8 points). Payback Period Mr. Kramer and Mr. Newman consider a couple of choices for starting a new business. One of those choices

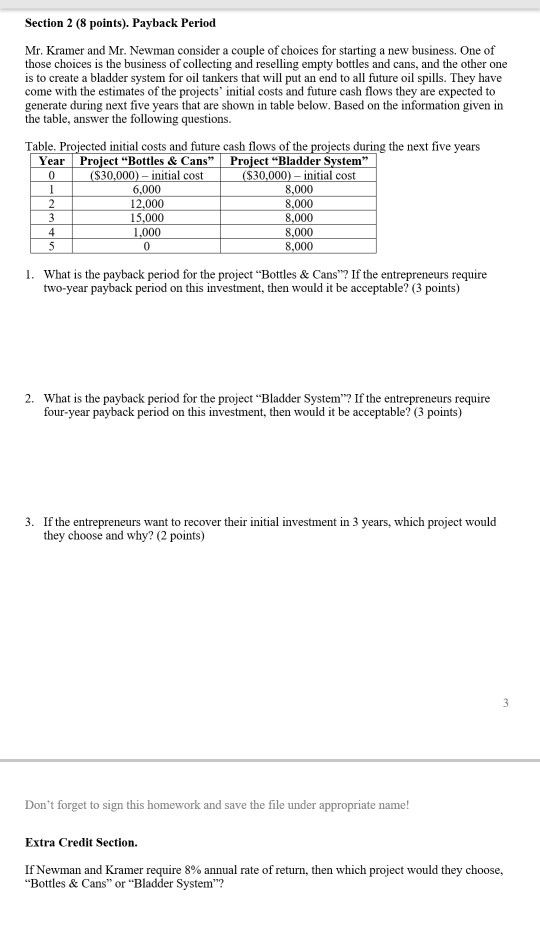

Section 2 (8 points). Payback Period Mr. Kramer and Mr. Newman consider a couple of choices for starting a new business. One of those choices is the business of collecting and reselling empty bottles and cans, and the other one is to create a bladder system for oil tankers that will put an end to all future oil spills. They have come with the estimates of the projects' initial costs and future cash flows they are expected to generate during next five years that are shown in table below. Based on the information given in the table, answer the following questions. Table. Pro initial costs and future cash flows of the projects during the next five years Year l Project "Bottles & Cans" | Project Bladder System", $30,000)-initial cost 6,000 12,000 15,000 1,000 $30,000)-initial cost 8,000 8,000 8,000 8,000 8,000 1. What is the payback period for the project "Bottles &Cans"? If the entrepreneurs require two-year payback period on this investment, then would it be acceptable? (3 points) 2. What is the payback period for the project "Bladder System? If the entrepreneurs require four-year payback period on this investment, then would it be acceptable? (3 points) 3. If the entrepreneurs want to recover their initial investment in 3 years, which project would they choose and why? (2 points) Don't forget to sign this homework and save the file under appropriate name! Extra Credit Section. If Newman and Kramer require 8% annual rate of return, then which project would they choose. Bottles & Cans" or "Bladder System

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started