Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Section 2 An investor in India has about $5 million to invest. He is faced with the following countries : Canada or South Africa or

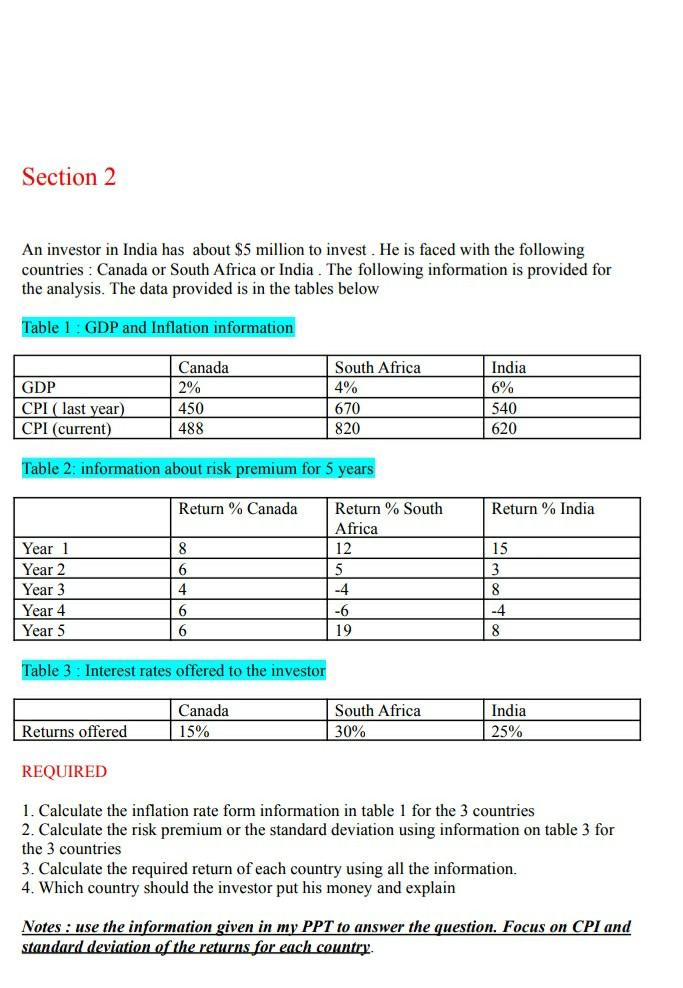

Section 2 An investor in India has about $5 million to invest. He is faced with the following countries : Canada or South Africa or India. The following information is provided for the analysis. The data provided is in the tables below Table 1 : GDP and Inflation information South Africa 4% India 6% GDP CPI ( last year) CPI (current) Canada 2% 450 488 670 540 820 620 Table 2: information about risk premium for 5 years Return % Canada Return % India Year 1 Year 2 Year 3 Year 4 Year 5 8 6 4 6 6 Return % South Africa 12 5 -4 -6 19 15 3 8 -4 8 Table 3 : Interest rates offered to the investor Canada 15% South Africa 30% India 25% Returns offered REQUIRED 1. Calculate the inflation rate form information in table 1 for the 3 countries 2. Calculate the risk premium or the standard deviation using information on table 3 for the 3 countries 3. Calculate the required return of each country using all the information. 4. Which country should the investor put his money and explain Notes : use the information given in my PPT to answer the question. Focus on CPI and standard deviation of the returns for each country. Section 2 An investor in India has about $5 million to invest. He is faced with the following countries : Canada or South Africa or India. The following information is provided for the analysis. The data provided is in the tables below Table 1 : GDP and Inflation information South Africa 4% India 6% GDP CPI ( last year) CPI (current) Canada 2% 450 488 670 540 820 620 Table 2: information about risk premium for 5 years Return % Canada Return % India Year 1 Year 2 Year 3 Year 4 Year 5 8 6 4 6 6 Return % South Africa 12 5 -4 -6 19 15 3 8 -4 8 Table 3 : Interest rates offered to the investor Canada 15% South Africa 30% India 25% Returns offered REQUIRED 1. Calculate the inflation rate form information in table 1 for the 3 countries 2. Calculate the risk premium or the standard deviation using information on table 3 for the 3 countries 3. Calculate the required return of each country using all the information. 4. Which country should the investor put his money and explain Notes : use the information given in my PPT to answer the question. Focus on CPI and standard deviation of the returns for each country

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started