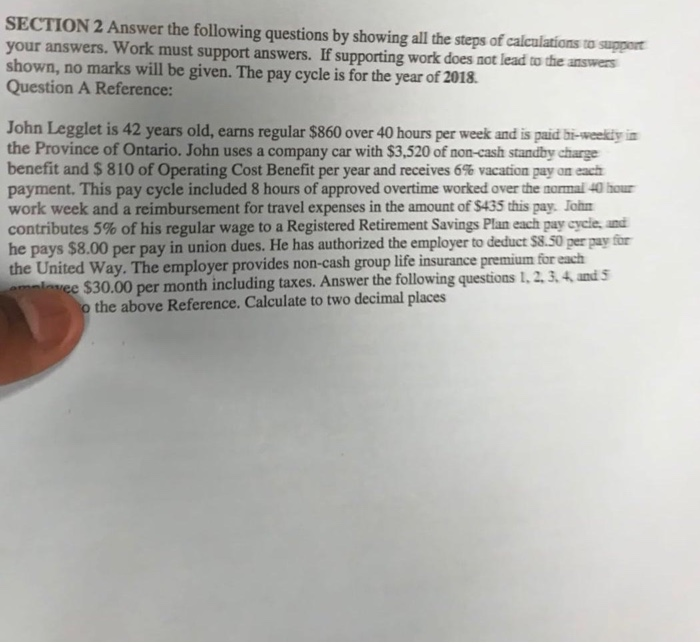

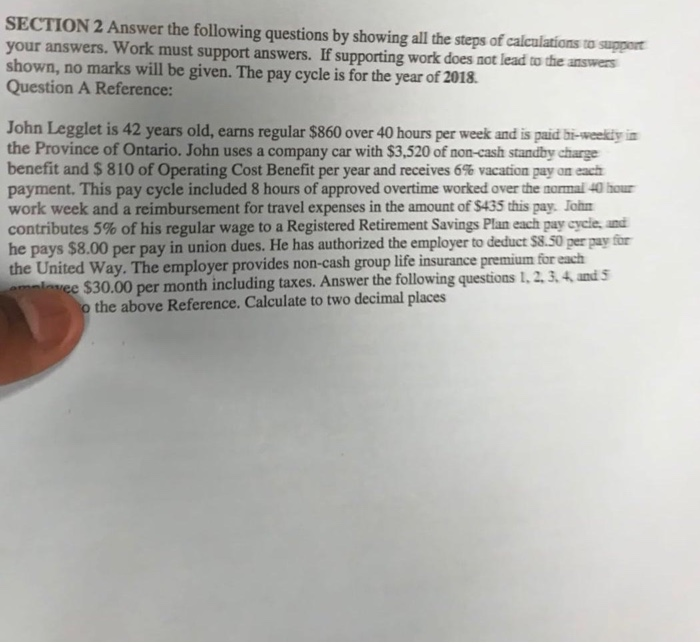

SECTION 2 Answer the following questions by showing all the steps of calculations to support your answers. Work must support answers. If supporting work does not lead to the answers shown, no marks will be given. The pay cycle is for the year of 2018 Question A Reference: John Legglet is 42 years old, earns regular $860 over 40 hours per week and is paid bi-weekly is the Province of Ontario. John uses a company car with $3,520 of non-cash standby charge benefit and $ 810 of Operating Cost Benefit per year and receives 6% vacation pay on each payment. This pay cycle included 8 hours of approved overtime worked over the normal 40 hour work week and a reimbursement for travel expenses in the amount of $435 this pay. John contributes 5% of his regular wage to a Registered Retirement Savings Plan each pay cycle, and he pays $8.00 per pay in union dues. He has authorized the employer to deduct $8.50 per pay for the United Way. The employer provides non-cash group life insurance premium for each minvee $30.00 per month including taxes. Answer the following questions 1. 2. 3. 4 and 5 o the above Reference. Calculate to two decimal places SECTION 2 Answer the following questions by showing all the steps of calculations to support your answers. Work must support answers. If supporting work does not lead to the answers shown, no marks will be given. The pay cycle is for the year of 2018 Question A Reference: John Legglet is 42 years old, earns regular $860 over 40 hours per week and is paid bi-weekly is the Province of Ontario. John uses a company car with $3,520 of non-cash standby charge benefit and $ 810 of Operating Cost Benefit per year and receives 6% vacation pay on each payment. This pay cycle included 8 hours of approved overtime worked over the normal 40 hour work week and a reimbursement for travel expenses in the amount of $435 this pay. John contributes 5% of his regular wage to a Registered Retirement Savings Plan each pay cycle, and he pays $8.00 per pay in union dues. He has authorized the employer to deduct $8.50 per pay for the United Way. The employer provides non-cash group life insurance premium for each minvee $30.00 per month including taxes. Answer the following questions 1. 2. 3. 4 and 5 o the above Reference. Calculate to two decimal places