Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SECTION 2 : Choose two ( 2 ) questions from this section Question 2 ( i ) Briefly identify and discuss three types of dividend

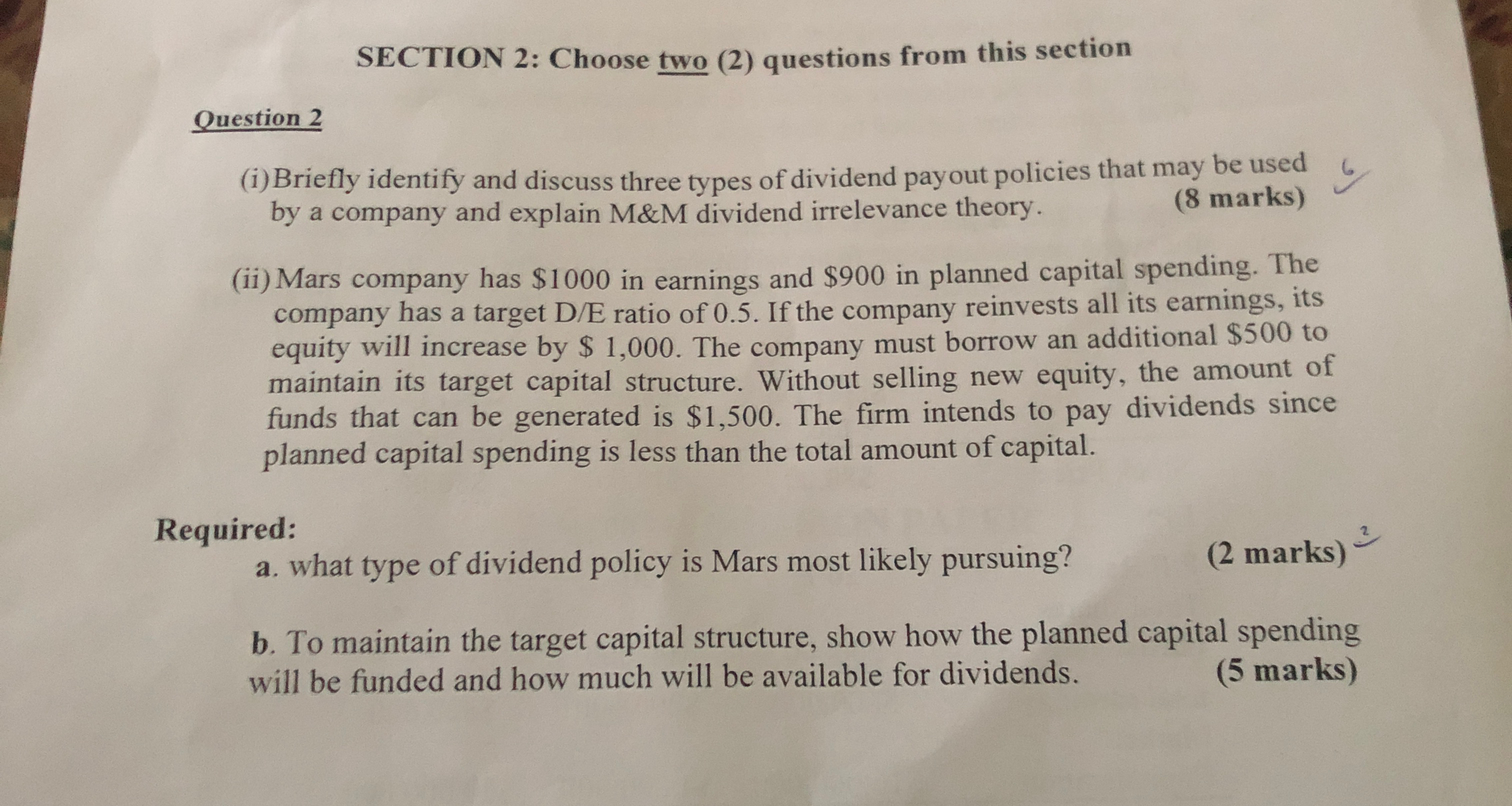

SECTION : Choose two questions from this section Question i Briefly identify and discuss three types of dividend payout policies that may be used by a company and explain M&M dividend irrelevance theory. marks ii Mars company has $ in earnings and $ in planned capital spending. The company has a target ratio of If the company reinvests all its earnings, its equity will increase by $ The company must borrow an additional $ to maintain its target capital structure. Without selling new equity, the amount of funds that can be generated is $ The firm intends to pay dividends since planned capital spending is less than the total amount of capital. Required: a what type of dividend policy is Mars most likely pursuing? marks b To maintain the target capital structure, show how the planned capital spending will be funded and how much will be available for dividends. marks

SECTION : Choose two questions from this section

Question

i Briefly identify and discuss three types of dividend payout policies that may be used by a company and explain M&M dividend irrelevance theory. marks

ii Mars company has $ in earnings and $ in planned capital spending. The company has a target ratio of If the company reinvests all its earnings, its equity will increase by $ The company must borrow an additional $ to maintain its target capital structure. Without selling new equity, the amount of funds that can be generated is $ The firm intends to pay dividends since planned capital spending is less than the total amount of capital.

Required:

a what type of dividend policy is Mars most likely pursuing?

marks

b To maintain the target capital structure, show how the planned capital spending will be funded and how much will be available for dividends.

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started