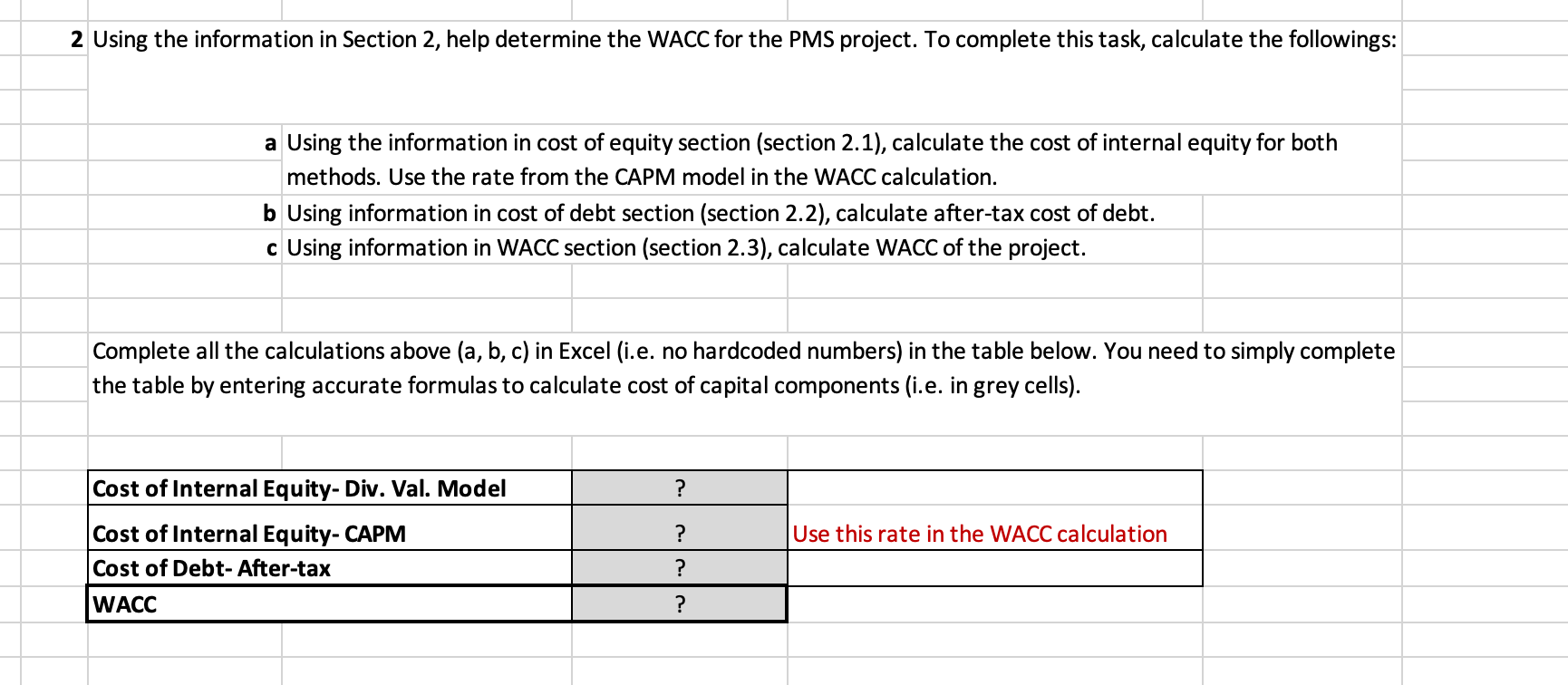

Section 2. Financing Considerations Craig Jones consults with his finance manager and asks her recommendation for the financing options for this investment. Traditionally, such large scale technology investments are financed with a combined funds of internal equity and debt financing (bank loans), and the Jones' Hotel uses Weighted Average Cost of Capital (WACC) method to calculate the cost of capital. For the PMS project, Jones asked his finance manager to calculate and present the cost components to finance the new PMS investment. Below are the information that the finance team uses to calculate cost of debt, cost of equity and WACC. 2.1. Cost of Equity If equity is used to finance capital projects, Jones's Hotel uses internal equity. There are two common models to estimate cost of internal equity: 1. Dividend valuation model, and 2. Capital asset pricing model (CAPM). The following information is availabe for finance team to calculate cost of internal equity using both methods. 1 For dividend valuation method: Jones' common stock is selling for $52 per share, pays a current dividend of $3 per share, and earnings and dividends are expected to grow at a 4% rate into the foreseeable future. 2 For CAPM method: Jones' stock beta is at 1.7, the expected risk-free rate of return is 3.3%, and the expected market return is 9.1%. I 2.2. Cost of Debt Jones' Hotels works with a national bank for bank loans to finance technology investments. The most recent correspondance with the bank reveals that Jones' can use a long-term bank loan at 14% interest rate (before-tax) to finance the PMS investment. Jones' average tax rate is 21%. 2.3.Weighted Average Cost of Capital 3. For the previous technology investments that were financed with a combination of equity and debt, Jones' Hotels used 45% equity financing and 55% debt financing. The finance team predicts that same proportion of equity and debt financing would be appropriate for the proposed PMS project. 2 Using the information in Section 2, help determine the WACC for the PMS project. To complete this task, calculate the followings: a Using the information in cost of equity section (section 2.1), calculate the cost of internal equity for both methods. Use the rate from the CAPM model in the WACC calculation. b Using information in cost of debt section (section 2.2), calculate after-tax cost of debt. c Using information in WACC section (section 2.3), calculate WACC of the project. Complete all the calculations above (a, b, c) in Excel (i.e. no hardcoded numbers) in the table below. You need to simply complete the table by entering accurate formulas to calculate cost of capital components (i.e. in grey cells). ? ? Use this rate in the WACC calculation Cost of Internal Equity-Div. Val. Model Cost of Internal Equity- CAPM Cost of Debt-After-tax WACC