Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SECTION 3: LONG QUESTIONS [45 marks] QUESTION 1 (45 marks) Benex Solutions is considering replacing one of their old copying machines to increase sales and

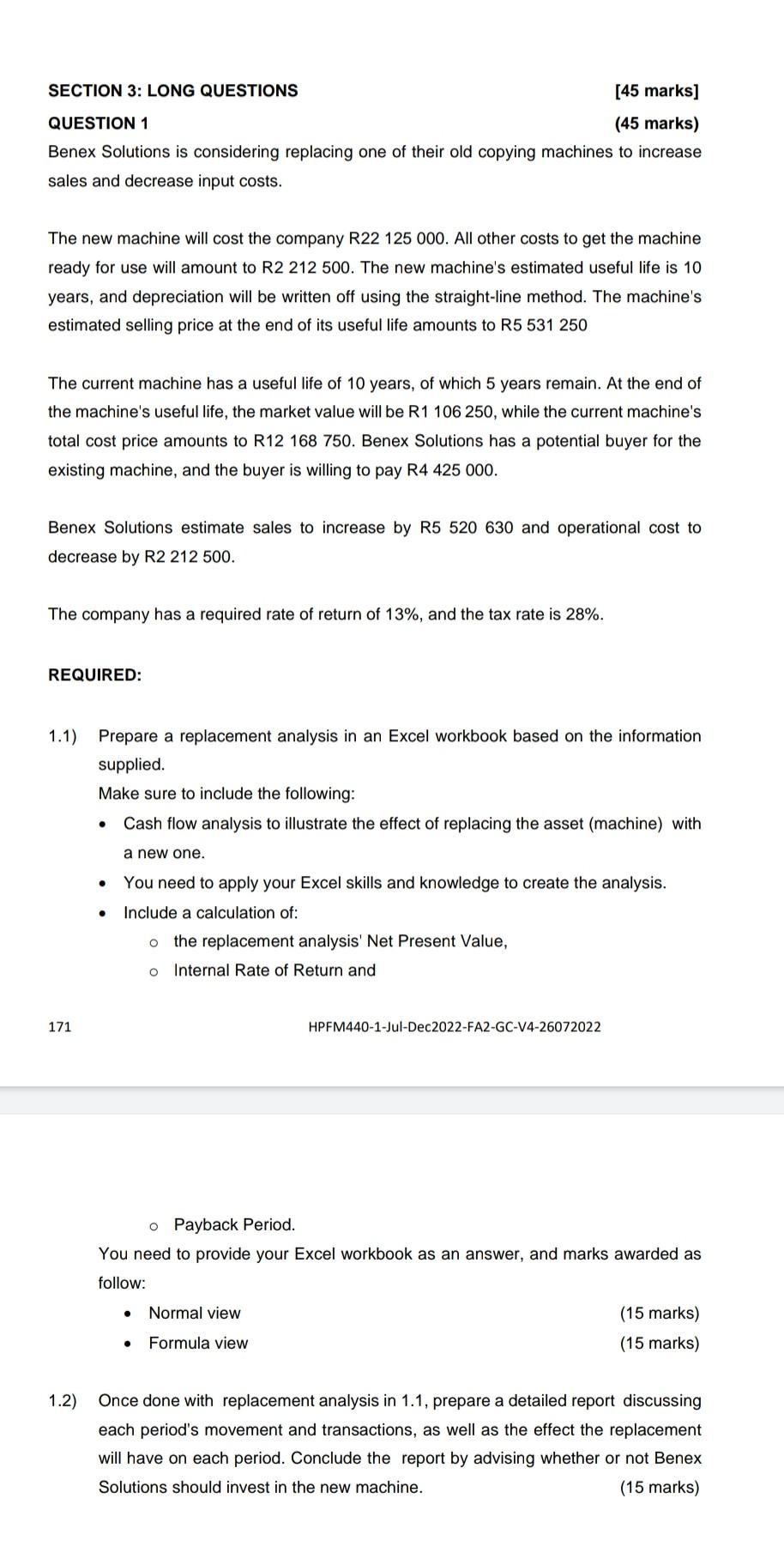

SECTION 3: LONG QUESTIONS [45 marks] QUESTION 1 (45 marks) Benex Solutions is considering replacing one of their old copying machines to increase sales and decrease input costs. The new machine will cost the company R22 125 000. All other costs to get the machine ready for use will amount to R2 212500 . The new machine's estimated useful life is 10 years, and depreciation will be written off using the straight-line method. The machine's estimated selling price at the end of its useful life amounts to R5 531250 The current machine has a useful life of 10 years, of which 5 years remain. At the end of the machine's useful life, the market value will be R1 106250 , while the current machine's total cost price amounts to R12 168750 . Benex Solutions has a potential buyer for the existing machine, and the buyer is willing to pay R4 425000 . Benex Solutions estimate sales to increase by R5 520630 and operational cost to decrease by R2 212500. The company has a required rate of return of 13%, and the tax rate is 28%. REQUIRED: 1.1) Prepare a replacement analysis in an Excel workbook based on the information supplied. Make sure to include the following: - Cash flow analysis to illustrate the effect of replacing the asset (machine) with a new one. - You need to apply your Excel skills and knowledge to create the analysis. - Include a calculation of: - the replacement analysis' Net Present Value, - Internal Rate of Return and 171 HPFM440-1-Jul-Dec2022-FA2-GC-V4-26072022 - Payback Period. You need to provide your Excel workbook as an answer, and marks awarded as follow: - Normal view (15 marks) - Formula view (15 marks) 1.2) Once done with replacement analysis in 1.1, prepare a detailed report discussing each period's movement and transactions, as well as the effect the replacement will have on each period. Conclude the report by advising whether or not Benex Solutions should invest in the new machine. (15 marks) SECTION 3: LONG QUESTIONS [45 marks] QUESTION 1 (45 marks) Benex Solutions is considering replacing one of their old copying machines to increase sales and decrease input costs. The new machine will cost the company R22 125 000. All other costs to get the machine ready for use will amount to R2 212500 . The new machine's estimated useful life is 10 years, and depreciation will be written off using the straight-line method. The machine's estimated selling price at the end of its useful life amounts to R5 531250 The current machine has a useful life of 10 years, of which 5 years remain. At the end of the machine's useful life, the market value will be R1 106250 , while the current machine's total cost price amounts to R12 168750 . Benex Solutions has a potential buyer for the existing machine, and the buyer is willing to pay R4 425000 . Benex Solutions estimate sales to increase by R5 520630 and operational cost to decrease by R2 212500. The company has a required rate of return of 13%, and the tax rate is 28%. REQUIRED: 1.1) Prepare a replacement analysis in an Excel workbook based on the information supplied. Make sure to include the following: - Cash flow analysis to illustrate the effect of replacing the asset (machine) with a new one. - You need to apply your Excel skills and knowledge to create the analysis. - Include a calculation of: - the replacement analysis' Net Present Value, - Internal Rate of Return and 171 HPFM440-1-Jul-Dec2022-FA2-GC-V4-26072022 - Payback Period. You need to provide your Excel workbook as an answer, and marks awarded as follow: - Normal view (15 marks) - Formula view (15 marks) 1.2) Once done with replacement analysis in 1.1, prepare a detailed report discussing each period's movement and transactions, as well as the effect the replacement will have on each period. Conclude the report by advising whether or not Benex Solutions should invest in the new machine. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started