Answered step by step

Verified Expert Solution

Question

1 Approved Answer

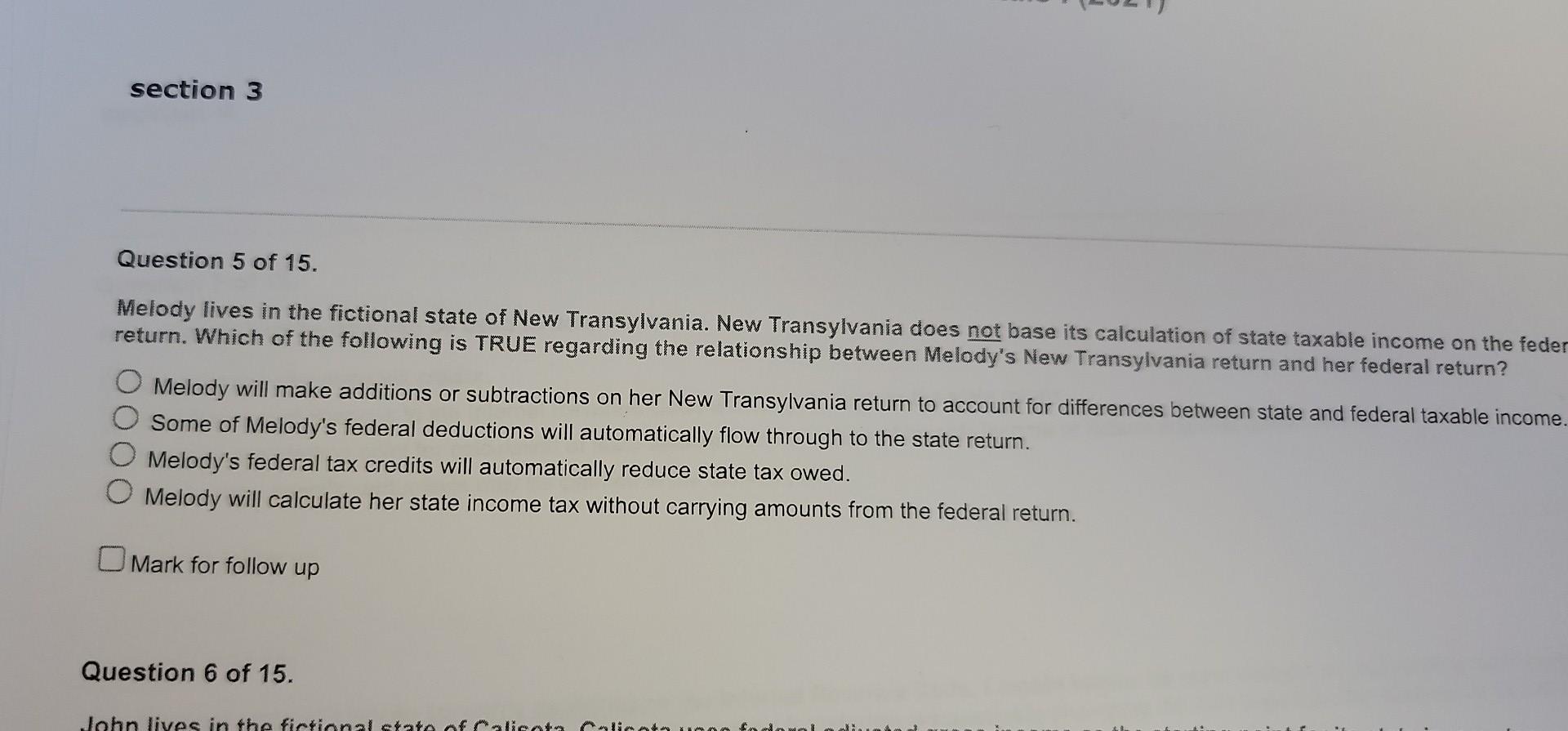

section 3 Question 5 of 15. Melody lives in the fictional state of New Transylvania. New Transylvania does not base its calculation of state taxable

section 3 Question 5 of 15. Melody lives in the fictional state of New Transylvania. New Transylvania does not base its calculation of state taxable income on the feder return. Which of the following is TRUE regarding the relationship between Melody's New Transylvania return and her federal return? O Melody will make additions or subtractions on her New Transylvania return to account for differences between state and federal taxable income. Some of Melody's federal deductions will automatically flow through to the state return. Melody's federal tax credits will automatically reduce state tax owed. O Melody will calculate her state income tax without carrying amounts from the federal return. Mark for follow up Question 6 of 15. John lives in the fictional catolicotylicotom

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started