Answered step by step

Verified Expert Solution

Question

1 Approved Answer

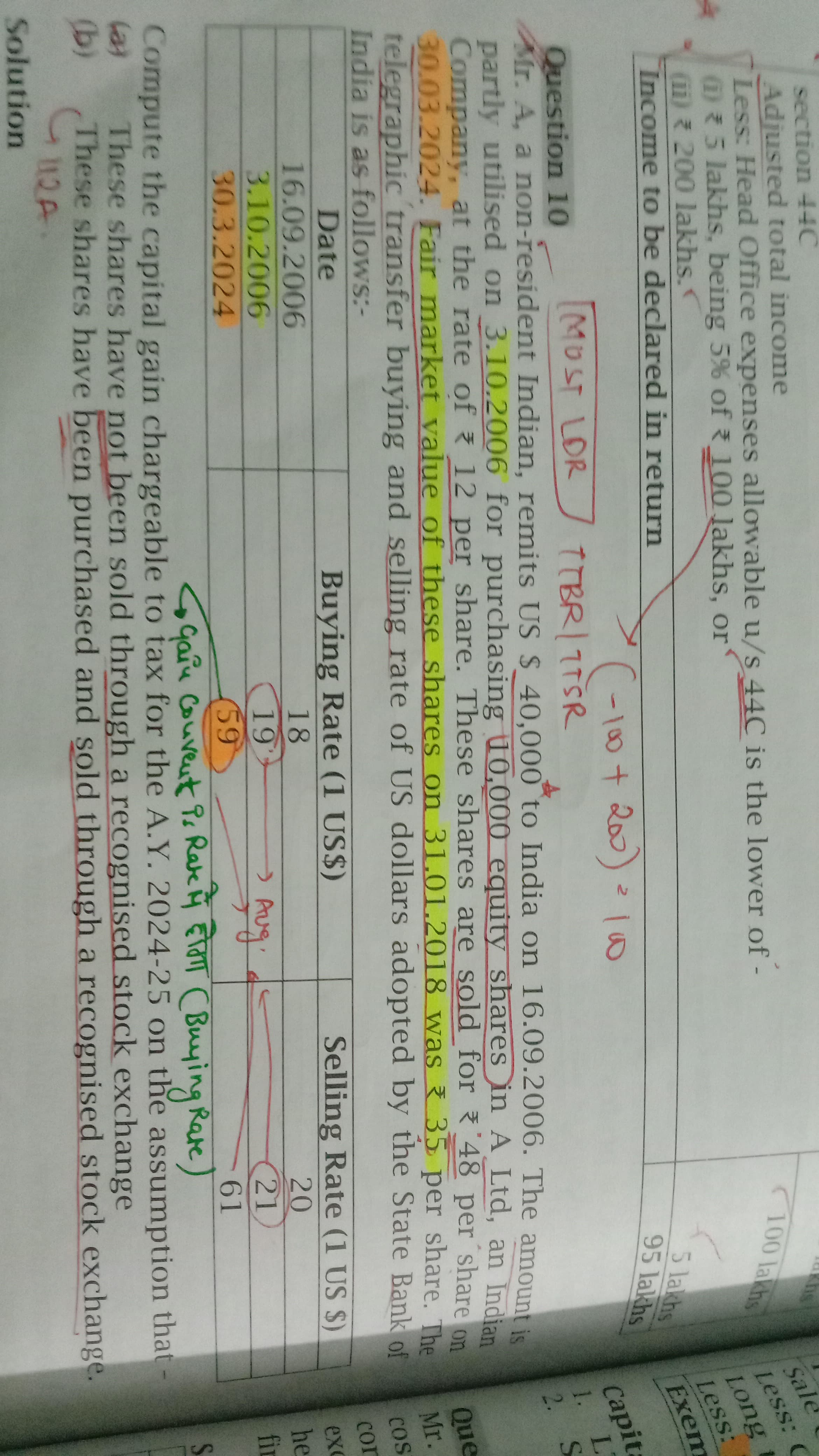

section 4 4 C Adjusted total income Less: Head Office expenses allowable u / s 4 4 C is the lower of - ( i

section C

Adjusted total income

Less: Head Office expenses allowable us C is the lower of

i lakhs, being of lakhs, or

ii lakhs.r

Income to be declared in return

Question

MOST LDR TTBRTTSR

Sir. A a nonresident Indian, remits US $ text th to India on The amount is partly utilised on for purchasing equity shares in A Ltd an Indian Company, at the rate of per share. These shares are sold for per share on Fair market value of these shares on was overline per share. The telegraphic transfer buying and selling rate of US dollars adopted by the State Bank of India is as follows:

Compute the capital gain chargeable to tax for the AY on the assumption that a These shares have not been sold through a recognised stock exchange

b These shares have been purchased and sold through a recognised stock exchange.

Solution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started