Answered step by step

Verified Expert Solution

Question

1 Approved Answer

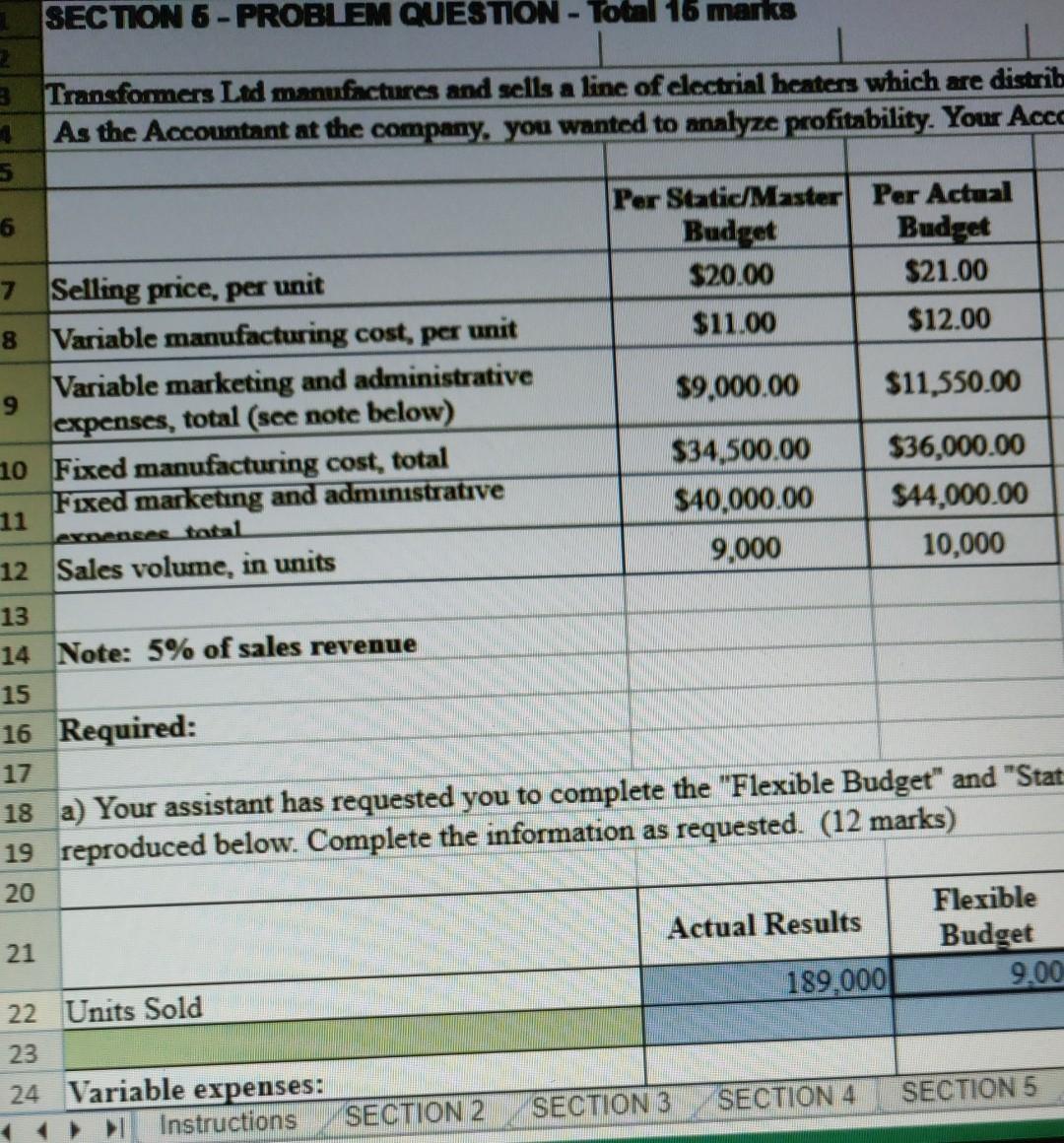

SECTION 6 - PROBLEM QUESTION - Total 16 marka Transformers Ltd manufactures and sells a line of electrial beaters which are distrib As the Accountant

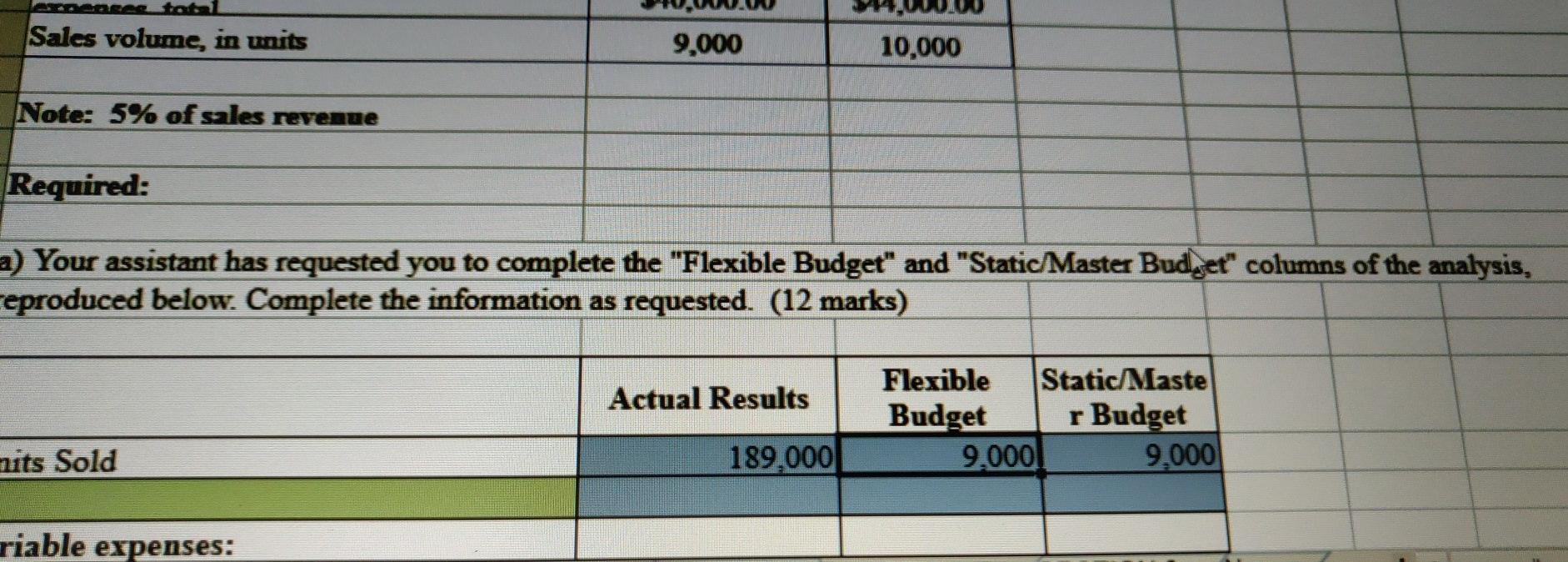

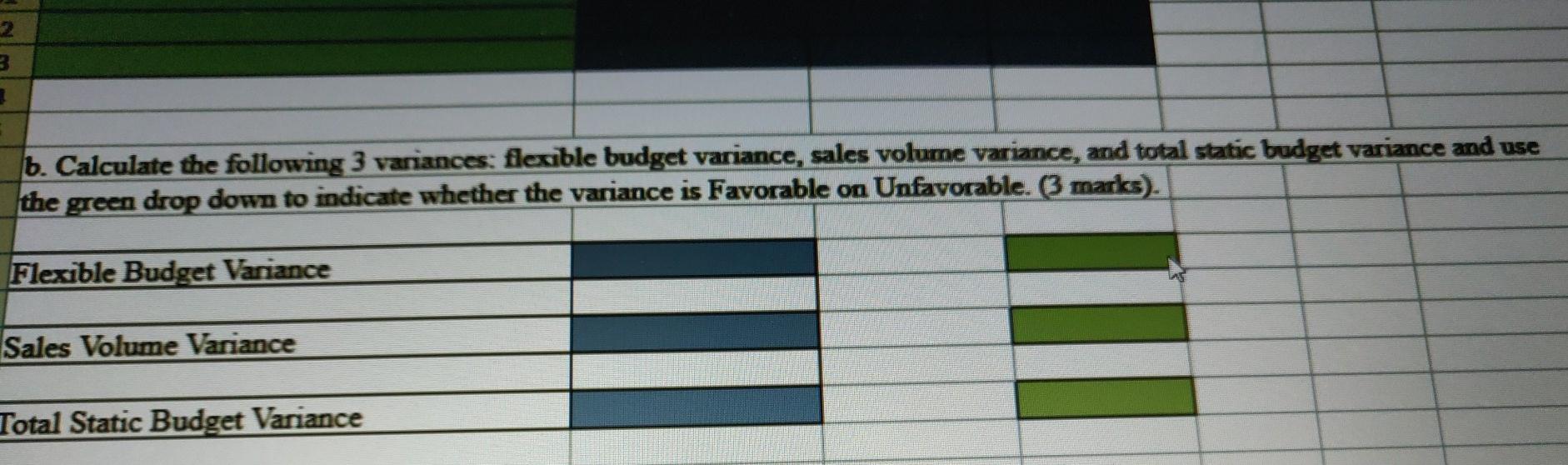

SECTION 6 - PROBLEM QUESTION - Total 16 marka Transformers Ltd manufactures and sells a line of electrial beaters which are distrib As the Accountant at the company. you wanted to analyze profitability. Your Acco 6 Per Static/Master Per Actual Budget Budget 7 Selling price, per unit $20.00 $21.00 8 Variable manufacturing cost, per unit $11.00 $12.00 Variable marketing and administrative 9 $9,000.00 $11,550.00 expenses, total (see note below) 10 Fixed manufacturing cost, total $34,500.00 $36,000.00 11 Fixed marketing and administrative $40,000.00 $44,000.00 expenses total 12 Sales volume, in units 9,000 10,000 13 14 Note: 5% of sales revenue 15 16 Required: 17 18 a) Your assistant has requested you to complete the "Flexible Budget" and "Stat 19 reproduced below. Complete the information as requested. (12 marks) 20 Flexible 21 Actual Results Budget 189.000 9.00 22 Units Sold 23 24 Variable expenses: Instructions SECTION 2 SECTION 3 SECTION 4 SECTION 5 Sales volume, in units 9,000 10,000 Note: 5% of sales revenue Required: a) Your assistant has requested you to complete the "Flexible Budget" and "Static Master Budget" columns of the analysis, reproduced below. Complete the information as requested. (12 marks) Actual Results Flexible Static/Maste Budget r Budget 9,000 9,000 nits Sold 189,000 riable expenses: 2 2 b. Calculate the following 3 variances: flexible budget variance, sales volume variance, and total static budget variance and use the green drop down to indicate whether the variance is Favorable on Unfavorable. (3 marks). Flexible Budget Variance Sales Volume Variance Total Static Budget Variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started