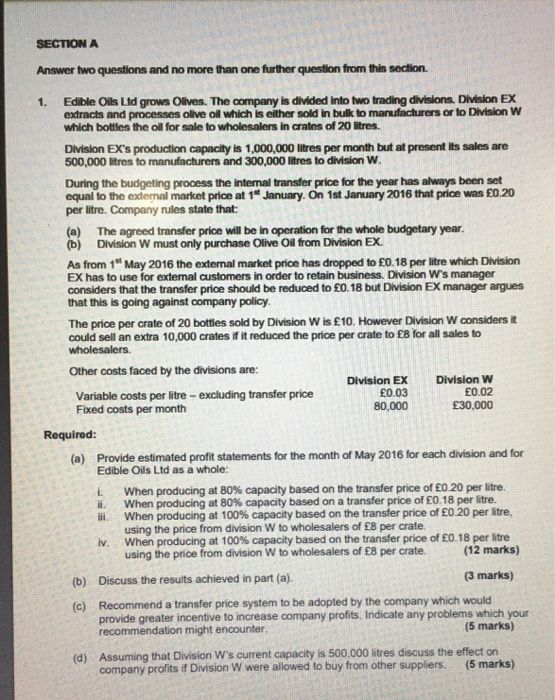

SECTION A 1. Answer two questions and no more than one further question from this section. Edible Oils Ltd grows Olives. The company is divided into two trading divisions. Division EX extracts and processes olive oil which is either sold in bulk to manufacturers or to Division W which bottles the oil for sale to wholesalers in crates of 20 litres. Division EX's production capacity is 1,000,000 litres per month but at present its sales are 500,000 litres to manufacturers and 300,000 litres to division W. During the budgeting process the internal transfer price for the year has always been set equal to the external market price at 15 January. On 1st January 2016 that price was 0.20 per litre. Company rules state that: (a) The agreed transfer price will be in operation for the whole budgetary year. (b) Division W must only purchase Olive Oil from Division EX. As from 1" May 2016 the external market price has dropped to 0.18 per litre which Division EX has to use for external customers in order to retain business. Division W's manager considers that the transfer price should be reduced to 0. 18 but Division EX manager argues that this is going against company policy. The price per crate of 20 bottles sold by Division W is 10. However Division W considers it could sell an extra 10,000 crates if it reduced the price per crate to 8 for all sales to wholesalers. Other costs faced by the divisions are: Division EX Division W Variable costs per litre - excluding transfer price 0.03 0.02 Fixed costs per month 80,000 30,000 Required: (a) Provide estimated profit statements for the month of May 2016 for each division and for Edible Oils Ltd as a whole: When producing at 80% capacity based on the transfer price of 0.20 per litre. When producing at 80% capacity based on a transfer price of 0.18 per litre. il When producing at 100% capacity based on the transfer price of 0.20 per litre, using the price from division W to wholesalers of 8 per crate When producing at 100% capacity based on the transfer price of 0.18 per litre using the price from division W to wholesalers of 8 per crate. (12 marks) (b) Discuss the results achieved in part (a). (3 marks) (c) Recommend a transfer price system to be adopted by the company which would provide greater incentive to increase company profits, Indicate any problems which your recommendation might encounter. (5 marks) (d) Assuming that Division W's current capacity is 500,000 litres discuss the effect on company profits if Division W were allowed to buy from other suppliers. (5 marks) L iv