Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SECTION A (40 marks): Answer ALL Questions in this section. QUESTION ONE i in-charge Limited (In-Charge) acquired a Land for GHS 3,000 in Year 1

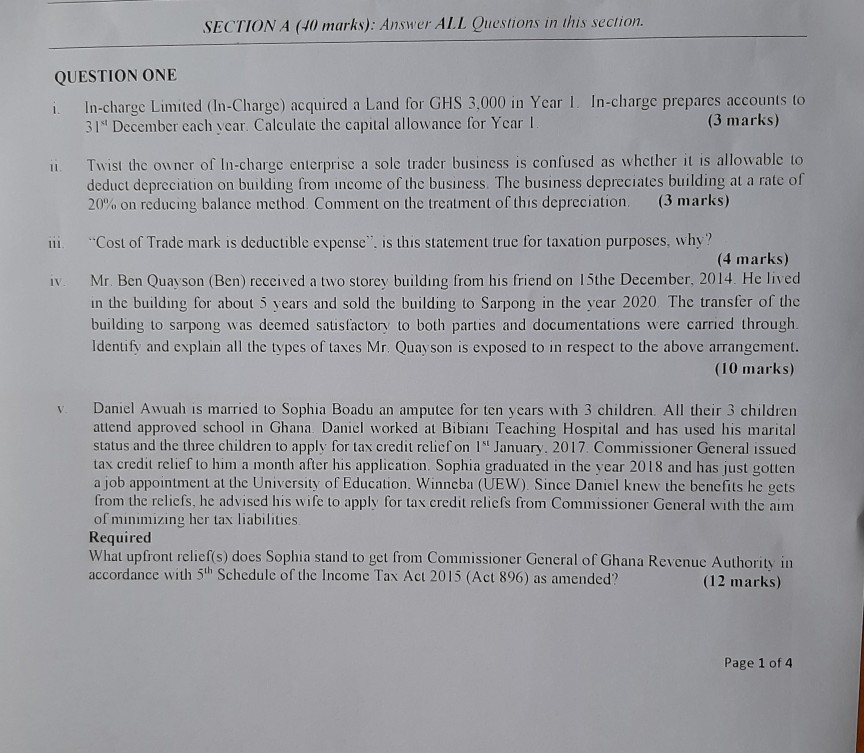

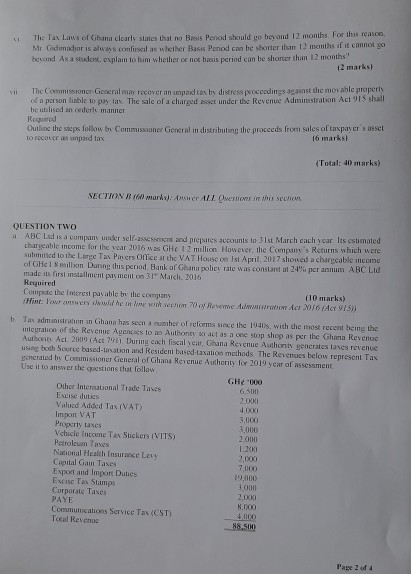

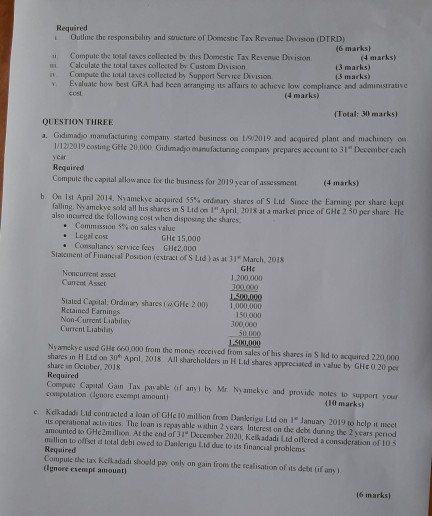

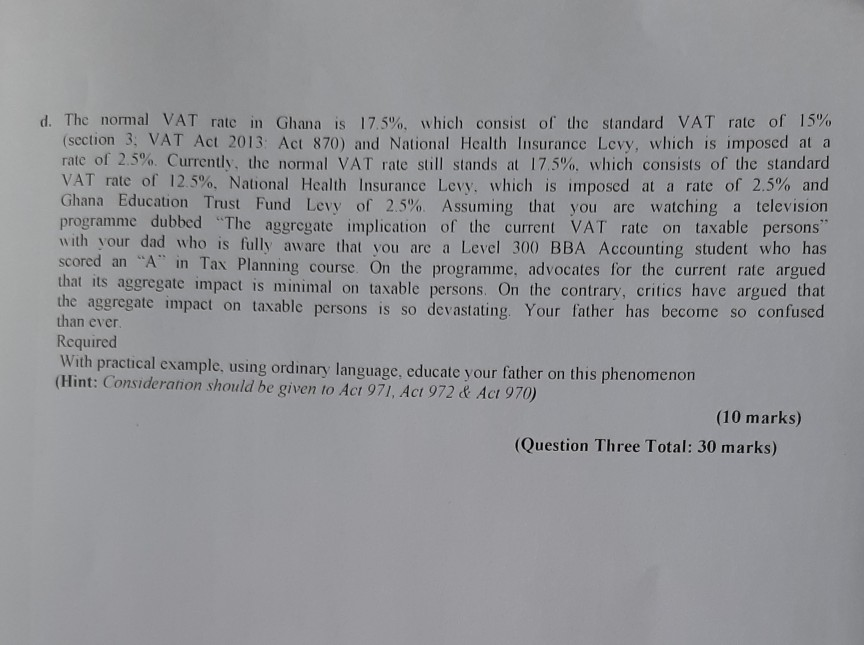

SECTION A (40 marks): Answer ALL Questions in this section. QUESTION ONE i in-charge Limited (In-Charge) acquired a Land for GHS 3,000 in Year 1 In-charge prepares accounts to 31" December each year. Calculate the capital allowance for Year I. (3 marks) 11 Twist the owner of In-charge enterprise a sole trader business is confused as whether it is allowable to deduct depreciation on building from income of the business. The business depreciates building at a rate of 20% on reducing balance method. Comment on the treatment of this depreciation (3 marks) IV "Cost of Trade mark is deductible expense". is this statement true for taxation purposes, why? (4 marks) Mr. Ben Quayson (Ben) received a two storey building from his friend on 15the December, 2014. He lived in the building for about 5 years and sold the building to Sarpong in the year 2020 The transfer of the building to sarpong was deemed satisfactory to both parties and documentations were carried through Identify and explain all the types of taxes Mr. Quayson is exposed to in respect to the above arrangement. (10 marks) V Daniel Awuah is married to Sophia Boadu an amputee for ten years with 3 children. All their 3 children attend approved school in Ghana Daniel worked at Bibiani Teaching Hospital and has used his marital status and the three children to apply for tax credit relief on 1" January, 2017. Commissioner General issued tax credit relief to him a month after his application. Sophia graduated in the year 2018 and has just gotten a job appointment at the University of Education. Winneba (UEW). Since Daniel knew the benefits he gets from the reliefs, he advised his wife to apply for tax credit reliefs from Commissioner General with the aim of minimizing her tax liabilities Required What upfront relief(s) does Sophia stand to get from Commissioner General of Ghana Revenue Authority in accordance with 5th Schedule of the Income Tax Act 2015 (Act 896) as amended? (12 marks) Page 1 of 4 The Tax Laws of Ghana clearly states that no Basis Period should go beyond 12 months. For this reason Mr Gidmacher is always confused as whether Basis Perod can be shorter than 12 months if it cannot go besond As a student, explain to him whether or not basis period can be shorter than 12 months 12 marks! The Commissioner General recover an unpaid tax by distress proceedings against the movable properly of a person able to pay tax The sale of a charged asset under the Revenue Administration Act 915 shall be utilised an orderly manner Required Outline the steps follow on Commissaoner General in distributing the proceeds from sales of taxpayer's asset to recover an unpad lax 16 marks) (Total: 40 marks) SECTION 160 marks): Answer ALL Oestions in the schon QUESTION TWO * ABC Led is a company under self-assessment and prepares accounts to 31st March each year. Its estimated chargeable income for the year 2016 was GHe 1 million However the Company's Returns which were submitted to the Lange Tax Pansers Onice at the VAT House on 1st April, 2017 showed a chargeable income of Ghel million During this period, Bank of Ghana policy rate was constant at 24% per annum ABC Lid made its first installment payment on 31" March 2016 Required Compute the interest payable by the company (10 marks) Hint: Your answery wld hy in me with a 70 y Revere Adwo der 2016 ( 975 b Tas administration in Ghana has seen a number of reforms since the 1940s, with the most recent being the integration of the Revenue Agencies to an Authonty to act as a one stop shop as per the Ghana Revenue Authority Act 2009 (Act 29). During each liscal year Ghana Revenue Authority generates Lanes revenue using both Source based-lation and Resident based-lanation methods The Revenues below represent Tax enerated by Commissioner General of Ghana Revenue Authority for 2019 year of assessment Use it to answer the questions that follow GH000 Other International Trade Taxes 6500 Excise duties 2.000 Value Added Tax (VAT) Import VAT 3.000 Property taxes 3.000 Vehicle Income Tax Stickers (VITS) 2.00 Petroleum Tas 1.200 National Health Insurance Lory 2.000 Capital Gain Taxes 7.000 Export and Import Duties 19.000 Excisc Tas Stamps 1000 Corporate Taxes 2.000 PAYE 8.000 Communications Service Tax (CST) Tocal Revenue 88,500 Page 2 of 4 1 Required Outline the responsibility and structure of Domestic Tax Revenue Division (DTRD) (6 marks Compute the total ses collected by this Domestic Tax Revenue Division (4 marks) Calculate the total taxes collected by Custom Division 13 marks) Compute the total taxes collected by Support Service Division 13 marks) Evaluate how best GRA had been arranging its affairs to achieve low compliance and administrative cost (4 marks) Total: 30 marks) QUESTION THREE a. Gidimado manufacturing company started business on 1/9/2019 and acquired plant and machinery on 1/12/2019 costing GH 20,000. Gidimado manufacturing company prepares account to 31" December each year Required Compute the capital allowance for the business for 2019 year of assessment (4 marks) b. On Ist April 2014. Nyamekye acquired 55% ordinary shares of 5 Lid Since the Earning per share kept falling. Nameve sold all his shares in Suid on 1" April, 2018 at a market price of GHC 230 per share. He also incurred the following cost when disposing the shares Commission 5% on sales value Legal cost GH 15,000 Consultancy service fees GHt2,000 Statement of Financial Position extract of S Lid as at 31 March, 2018 GH Noncurrent asset 1.200.000 Current Asset 100.000 1.300.000 Stated Capital Ordinary shares (GHe 2.00) 1,000,000 Retained Earnings 150.000 Non-Current Liability 100.000 Current Liability 50.000 1.500.000 Nyamekye used Gt660.000 from the money received from sales of his shares in Sled to acquired 220.000 shares in H Lid on 30 April 2018 All shareholders in Lidshares appreciated in value by GHE 20 per share in October 2018 Required Compute Capital Gain Tax pable of any by Mr Nyamekye and provide notes to support you computation (Ignore exempl amount (10 marks) c Kekadati Lid contracted a loan of GHe 10 million from Dunkeng Lad on 19 January 2019 to help at moet its operational activities. The loan is repayable within 2 years Interest on the debt during the 2 years period amounted to GHe million. At the end of 1" December 2020. Keladadi Lid offered a consideration of 10 5 million to offset it total debt owed to Dunkerigu Led due to its financial problems Required Compute the tax Kelladadi should pay only on gain from the realisation of its debt fifa Ignore exempt amount) 16 marks) d. The normal VAT rate in Ghana is 17.5%, which consist of the standard VAT rate of 15% (section 3: VAT Act 2013: Act 870) and National Health Insurance Levy, which is imposed at a rate of 2.5%. Currently, the normal VAT rate still stands at 17.5%, which consists of the standard VAT rate of 12.5%, National Health Insurance Levy, which is imposed at a rate of 2.5% and Ghana Education Trust Fund Levy of 25%. Assuming that you are watching a television programme dubbed "The aggregate implication of the current VAT rate on taxable persons with your dad who is fully aware that you are a Level 300 BBA Accounting student who has scored an "A" in Tax Planning course. On the programme, advocates for the current rate argued that its aggregate impact is minimal on taxable persons. On the contrary, critics have argued that the aggregate impact on taxable persons is so devastating Your father has become so confused than ever. Required With practical example, using ordinary language, educate your father on this phenomenon (Hint: Consideration should be given to Act 971, Act 972 & Act 970) (10 marks) (Question Three Total: 30 marks) SECTION A (40 marks): Answer ALL Questions in this section. QUESTION ONE i in-charge Limited (In-Charge) acquired a Land for GHS 3,000 in Year 1 In-charge prepares accounts to 31" December each year. Calculate the capital allowance for Year I. (3 marks) 11 Twist the owner of In-charge enterprise a sole trader business is confused as whether it is allowable to deduct depreciation on building from income of the business. The business depreciates building at a rate of 20% on reducing balance method. Comment on the treatment of this depreciation (3 marks) IV "Cost of Trade mark is deductible expense". is this statement true for taxation purposes, why? (4 marks) Mr. Ben Quayson (Ben) received a two storey building from his friend on 15the December, 2014. He lived in the building for about 5 years and sold the building to Sarpong in the year 2020 The transfer of the building to sarpong was deemed satisfactory to both parties and documentations were carried through Identify and explain all the types of taxes Mr. Quayson is exposed to in respect to the above arrangement. (10 marks) V Daniel Awuah is married to Sophia Boadu an amputee for ten years with 3 children. All their 3 children attend approved school in Ghana Daniel worked at Bibiani Teaching Hospital and has used his marital status and the three children to apply for tax credit relief on 1" January, 2017. Commissioner General issued tax credit relief to him a month after his application. Sophia graduated in the year 2018 and has just gotten a job appointment at the University of Education. Winneba (UEW). Since Daniel knew the benefits he gets from the reliefs, he advised his wife to apply for tax credit reliefs from Commissioner General with the aim of minimizing her tax liabilities Required What upfront relief(s) does Sophia stand to get from Commissioner General of Ghana Revenue Authority in accordance with 5th Schedule of the Income Tax Act 2015 (Act 896) as amended? (12 marks) Page 1 of 4 The Tax Laws of Ghana clearly states that no Basis Period should go beyond 12 months. For this reason Mr Gidmacher is always confused as whether Basis Perod can be shorter than 12 months if it cannot go besond As a student, explain to him whether or not basis period can be shorter than 12 months 12 marks! The Commissioner General recover an unpaid tax by distress proceedings against the movable properly of a person able to pay tax The sale of a charged asset under the Revenue Administration Act 915 shall be utilised an orderly manner Required Outline the steps follow on Commissaoner General in distributing the proceeds from sales of taxpayer's asset to recover an unpad lax 16 marks) (Total: 40 marks) SECTION 160 marks): Answer ALL Oestions in the schon QUESTION TWO * ABC Led is a company under self-assessment and prepares accounts to 31st March each year. Its estimated chargeable income for the year 2016 was GHe 1 million However the Company's Returns which were submitted to the Lange Tax Pansers Onice at the VAT House on 1st April, 2017 showed a chargeable income of Ghel million During this period, Bank of Ghana policy rate was constant at 24% per annum ABC Lid made its first installment payment on 31" March 2016 Required Compute the interest payable by the company (10 marks) Hint: Your answery wld hy in me with a 70 y Revere Adwo der 2016 ( 975 b Tas administration in Ghana has seen a number of reforms since the 1940s, with the most recent being the integration of the Revenue Agencies to an Authonty to act as a one stop shop as per the Ghana Revenue Authority Act 2009 (Act 29). During each liscal year Ghana Revenue Authority generates Lanes revenue using both Source based-lation and Resident based-lanation methods The Revenues below represent Tax enerated by Commissioner General of Ghana Revenue Authority for 2019 year of assessment Use it to answer the questions that follow GH000 Other International Trade Taxes 6500 Excise duties 2.000 Value Added Tax (VAT) Import VAT 3.000 Property taxes 3.000 Vehicle Income Tax Stickers (VITS) 2.00 Petroleum Tas 1.200 National Health Insurance Lory 2.000 Capital Gain Taxes 7.000 Export and Import Duties 19.000 Excisc Tas Stamps 1000 Corporate Taxes 2.000 PAYE 8.000 Communications Service Tax (CST) Tocal Revenue 88,500 Page 2 of 4 1 Required Outline the responsibility and structure of Domestic Tax Revenue Division (DTRD) (6 marks Compute the total ses collected by this Domestic Tax Revenue Division (4 marks) Calculate the total taxes collected by Custom Division 13 marks) Compute the total taxes collected by Support Service Division 13 marks) Evaluate how best GRA had been arranging its affairs to achieve low compliance and administrative cost (4 marks) Total: 30 marks) QUESTION THREE a. Gidimado manufacturing company started business on 1/9/2019 and acquired plant and machinery on 1/12/2019 costing GH 20,000. Gidimado manufacturing company prepares account to 31" December each year Required Compute the capital allowance for the business for 2019 year of assessment (4 marks) b. On Ist April 2014. Nyamekye acquired 55% ordinary shares of 5 Lid Since the Earning per share kept falling. Nameve sold all his shares in Suid on 1" April, 2018 at a market price of GHC 230 per share. He also incurred the following cost when disposing the shares Commission 5% on sales value Legal cost GH 15,000 Consultancy service fees GHt2,000 Statement of Financial Position extract of S Lid as at 31 March, 2018 GH Noncurrent asset 1.200.000 Current Asset 100.000 1.300.000 Stated Capital Ordinary shares (GHe 2.00) 1,000,000 Retained Earnings 150.000 Non-Current Liability 100.000 Current Liability 50.000 1.500.000 Nyamekye used Gt660.000 from the money received from sales of his shares in Sled to acquired 220.000 shares in H Lid on 30 April 2018 All shareholders in Lidshares appreciated in value by GHE 20 per share in October 2018 Required Compute Capital Gain Tax pable of any by Mr Nyamekye and provide notes to support you computation (Ignore exempl amount (10 marks) c Kekadati Lid contracted a loan of GHe 10 million from Dunkeng Lad on 19 January 2019 to help at moet its operational activities. The loan is repayable within 2 years Interest on the debt during the 2 years period amounted to GHe million. At the end of 1" December 2020. Keladadi Lid offered a consideration of 10 5 million to offset it total debt owed to Dunkerigu Led due to its financial problems Required Compute the tax Kelladadi should pay only on gain from the realisation of its debt fifa Ignore exempt amount) 16 marks) d. The normal VAT rate in Ghana is 17.5%, which consist of the standard VAT rate of 15% (section 3: VAT Act 2013: Act 870) and National Health Insurance Levy, which is imposed at a rate of 2.5%. Currently, the normal VAT rate still stands at 17.5%, which consists of the standard VAT rate of 12.5%, National Health Insurance Levy, which is imposed at a rate of 2.5% and Ghana Education Trust Fund Levy of 25%. Assuming that you are watching a television programme dubbed "The aggregate implication of the current VAT rate on taxable persons with your dad who is fully aware that you are a Level 300 BBA Accounting student who has scored an "A" in Tax Planning course. On the programme, advocates for the current rate argued that its aggregate impact is minimal on taxable persons. On the contrary, critics have argued that the aggregate impact on taxable persons is so devastating Your father has become so confused than ever. Required With practical example, using ordinary language, educate your father on this phenomenon (Hint: Consideration should be given to Act 971, Act 972 & Act 970) (10 marks) (Question Three Total: 30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started