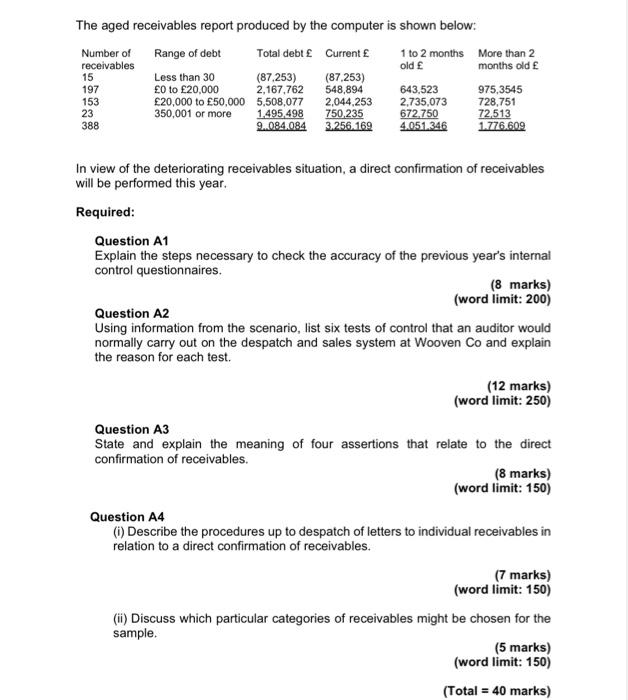

Section A (40 marks) Case study - Answer ALL questions in this section. Introduction - audit firm You are an audit senior in Vauld & Co, a firm providing audit and assurance services. At the request of an audit partner, you are preparing the audit programme for the income and receivables systems of Wooven Co. Audit documentation is available from the previous year's audit, including internal control questionnaires and audit programmes for the despatch and sales system. The audit approach last year did not involve the use of computer-assisted audit techniques (CAATs): the same approach will be taken this year. As far as you are aware, Wooven's system of internal control has not changed in the last year. Client background sales system Wooven Co is a wholesaler of electrical goods such as kettles, televisions, MP3 players, etc. The company maintains one large warehouse in a major city. The customers of Wooven are always owners of small retail shops, where electrical goods are sold to members of the public. Wooven only sells to authorised customers; following appropriate credit checks, each customer is given a Wooven identification card to confirm their status. The card must be used to obtain goods from the warehouse. Despatch and sales system The despatch and sales system operates as follows: 1. Customers visit Wooven's warehouse and load the goods they require into their vans after showing their Wooven identification card to the despatch staff. 2. A pre-numbered goods despatch note (GDN) is produced and signed by the customer and a member of Wooven's despatch staff confirming goods taken. 3. One copy of the GDN is sent to the accounts department, the second copy is retained in the despatch department. 4. Accounts staff enter goods despatch information onto the computerised sales system. The GDN is signed. 5. The computer system produces the sales invoice, with reference to the inventory master file for product details and prices, maintains the sales day book and also the receivables ledger. The receivables control account is balanced by the computer 6. Invoices are printed out and sent to each customer in the post with paper copies maintained in the accounts department. Invoices are compared to GDNs by accounts staff and signed 7. Paper copies of the receivables ledger control account and list of aged receivables are also available. 8. Error reports are produced showing breaks in the GDN sequence. Information on receivables The chief accountant has informed you that receivables days have increased from 45 to 60 days over the last year. The aged receivables report produced by the computer is shown below: Number of Range of debt Total debt Current 1 to 2 months More than 2 receivables old months old 15 Less than 30 (87.253) (87.253) 197 0 to 20,000 2,167,762 548,894 643,523 975,3545 153 20,000 to 50,000 5,508,077 2,044.253 2.735,073 728,751 23 350,001 or more 1.495 498 750 235 672.750 72,513 388 9.084.084 3.256.169 4.051.346 1.776.609 In view of the deteriorating receivables situation, a direct confirmation of receivables will be performed this year. Required: Question A1 Explain the steps necessary to check the accuracy of the previous year's internal control questionnaires. (8 marks) (word limit: 200) Question A2 Using information from the scenario, list six tests of control that an auditor would normally carry out on the despatch and sales system at Wooven Co and explain the reason for each test. (12 marks) (word limit: 250) Question A3 State and explain the meaning of four assertions that relate to the direct confirmation of receivables. (8 marks) (word limit: 150) Question A4 (0) Describe the procedures up to despatch of letters to individual receivables in relation to a direct confirmation of receivables. (7 marks) (word limit: 150) (ii ) Discuss which particular categories of receivables might be chosen for the sample. (5 marks) (word limit: 150) (Total = 40 marks)