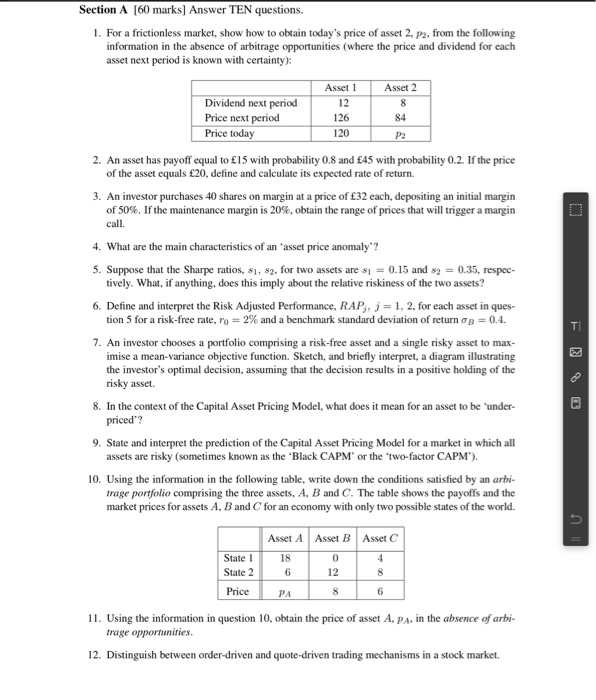

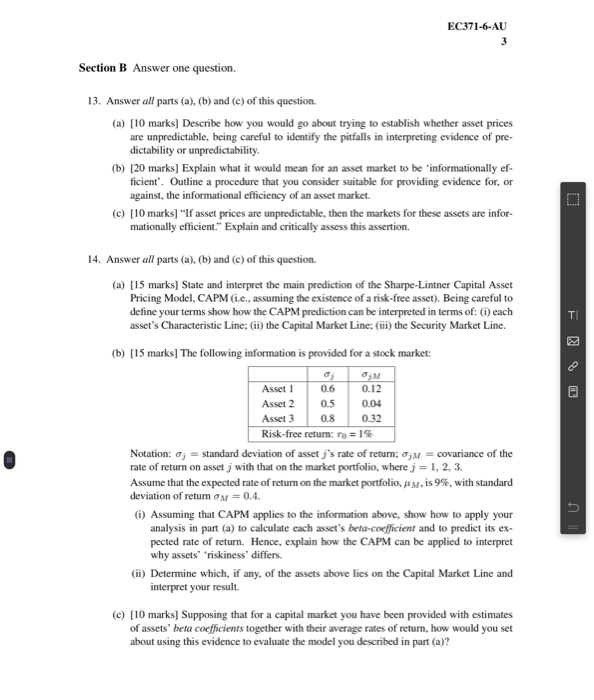

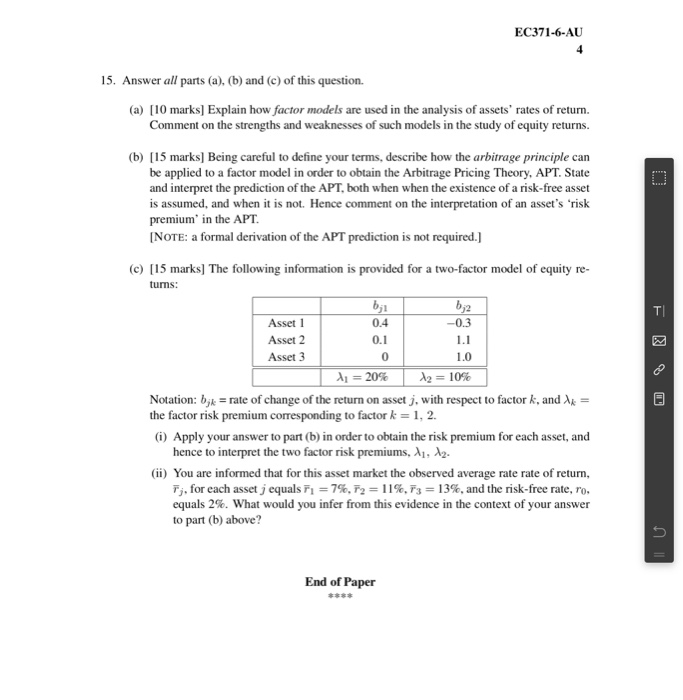

Section A [60 marks] Answer TEN questions. 1. For a frictionless market, show how to obtain today's price of asset 2. P2, from the following information in the absence of arbitrage opportunities (where the price and dividend for each asset next period is known with certainty): Asset 2 Dividend next period Price next period Price today Asset 1 12 126 120 84 P2 2. An asset has payoff equal to 15 with probability 0.8 and 45 with probability 0.2. If the price of the asset equals 20, define and calculate its expected rate of return 3. An investor purchases 40 shares on margin at a price of 32 each, depositing an initial margin of 50%. If the maintenance margin is 20%, obtain the range of prices that will trigger a margin call. 4. What are the main characteristics of an 'asset price anomaly"? 5. Suppose that the Sharpe ratios, 81, 82, for two assets are 81 = 0.15 and 2 = 0.35, respec- tively. What, if anything, does this imply about the relative riskiness of the two assets? 6. Define and interpret the Risk Adjusted Performance, RAP, j = 1, 2, for each asset in ques. tion 5 for a risk-free rate, Yo = 2% and a benchmark standard deviation of return =0.4. 7. An investor chooses a portfolio comprising a risk-free asset and a single risky asset to max. imise a mean-variance objective function. Sketch, and briefly interpret, a diagram illustrating the investor's optimal decision, assuming that the decision results in a positive holding of the risky asset. 8. In the context of the Capital Asset Pricing Model, what does it mean for an asset to be 'under- priced? 9. State and interpret the prediction of the Capital Asset Pricing Model for a market in which all assets are risky (sometimes known as the 'Black CAPM or the two-factor CAPM). 10. Using the information in the following table, write down the conditions satisfied by an arbi- trage portfolio comprising the three assets, A, B and C. The table shows the payoffs and the market prices for assets A, B and C for an economy with only two possible states of the world. Asset C State 1 State 2 Asset A 18 6 Asset B 0 12 Price PA 11. Using the information in question 10, obtain the price of asset A. PA, in the absence of arbi- trage opportunities 12. Distinguish between order-driven and quote-driven trading mechanisms in a stock market. EC371-6-AU Section B Answer one question. 13. Answer all parts (a), (b) and (c) of this question. (a) [10 marks] Describe how you would go about trying to establish whether asset prices are unpredictable, being careful to identify the pitfalls in interpreting evidence of pre- dictability or unpredictability. (b) [20 marks] Explain what it would mean for an asset market to be 'informationally ef- ficient. Outline a procedure that you consider suitable for providing evidence for, or against the informational efficiency of an asset market. (c) [10 marks) "If asset prices are unpredictable, then the markets for these assets are infor- mationally efficient." Explain and critically assess this assertion. 14. Answer all parts (a), (b) and (c) of this question (a) [15 marks] State and interpret the main prediction of the Sharpe-Lintner Capital Asset Pricing Model, CAPM (i.e., assuming the existence of a risk-free asset). Being careful to define your terms show how the CAPM prediction can be interpreted in terms of: (i) each asset's Characteristic Line; (ii) the Capital Market Line: (1) the Security Market Line. (b) [15 marks] The following information is provided for a stock market: OOM Asset 0.6 0.12 Asset 2 0.5 0.04 Asset 3 0 .8 0.32 Risk-free return: Ti = 1% Notation: 0; = standard deviation of asset j's rate of retum; n = covariance of the rate of return on asset j with that on the market portfolio, where j = 1, 2, 3. Assume that the expected rate of return on the market portfolio M. is 9%, with standard deviation of return on = 0.4. (i) Assuming that CAPM applies to the information above, show how to apply your analysis in part (a) to calculate each asset's beta-coefficient and to predict its ex- pected rate of return. Hence, explain how the CAPM can be applied to interpret why assets riskiness' differs. (ii) Determine which, if any, of the assets above lies on the Capital Market Line and interpret your result. (c) [10 marks] Supposing that for a capital market you have been provided with estimates of assets' beta coefficients together with their average rates of return, how would you set about using this evidence to evaluate the model you described in part (a)? EC371-6-AU 15. Answer all parts (a), (b) and (c) of this question. (a) [10 marks) Explain how factor models are used in the analysis of assets' rates of return. Comment on the strengths and weaknesses of such models in the study of equity returns. (b) [15 marks] Being careful to define your terms, describe how the arbitrage principle can be applied to a factor model in order to obtain the Arbitrage Pricing Theory, APT. State and interpret the prediction of the APT, both when when the existence of a risk-free asset is assumed, and when it is not. Hence comment on the interpretation of an asset's risk premium in the APT. [NOTE: a formal derivation of the APT prediction is not required.) 0.4 1.1 (c) [15 marks) The following information is provided for a two-factor model of equity re- tums: bji 62 Asset 1 -0.3 Asset 2 0.1 Asset 3 0 A = 20% 12 = 10% Notation: bjx = rate of change of the return on assetj, with respect to factor k, and = the factor risk premium corresponding to factor k = 1, 2. (i) Apply your answer to part (b) in order to obtain the risk premium for each asset, and hence to interpret the two factor risk premiums, 11. 12. (ii) You are informed that for this asset market the observed average rate rate of return, Ti, for each asset ; equals F1 = 7%, T2 = 11%, F3 = 13%, and the risk-free rate, ro. equals 2%. What would you infer from this evidence in the context of your answer to part (b) above? End of Paper