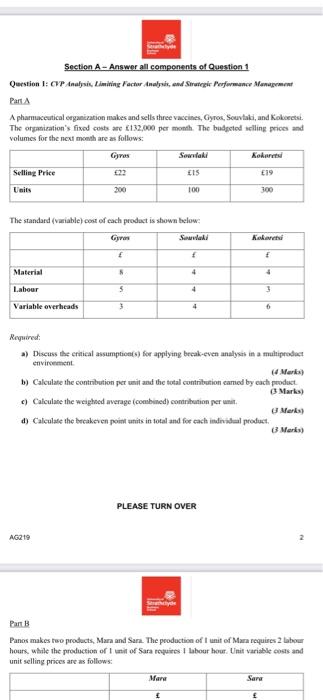

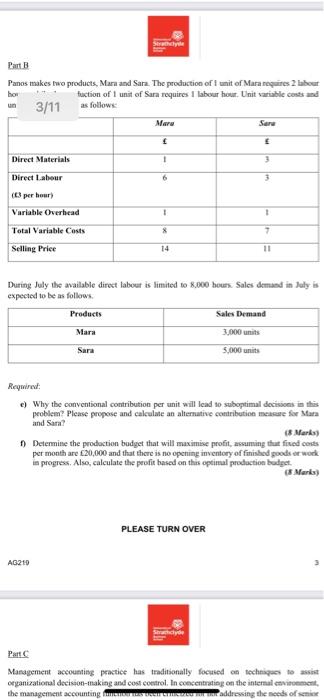

Section A - Answer all components of Question 1 Question 1: OVP Analysis. Limiting Factor Analysis and Strategic Performance Manage A pharmaceutical organization makes and sells three vaccines, Gyros, Souvlaki, and Kokoetst. The apaization's fixed costs 132,000 per month. The budgetodclling prices and volumes for the next month are as follows: Gres Sowohl Koka Selling Price EIS Units 200 100 300 E19 The standard (variable) cost of each product is shown below: Suwal Koki 4 4 Material Labour Variable overheads 5 4 3 4 6 Required: Discuss the critical assumption for applying becak-even analyses in a multiproduct environment (Mark) b) Calculate the contribution per unit and the total contribution camed by each product Marks) c) Calculate the weighted average (combined) contribution per unit Merks) d) Calculate the decakeven point units in total and for each individual produet. (3 Marks) PLEASE TURN OVER AG2 Pan B Panos makes two products, Mara and Sara The production of unit of Mara requires 2 tubo hours, while the production of unit of Sara requires I labour hour. Unit variable costs and unit selling prices are as follows: Mara Sara E Part B Panos makes two products, Mara and Sara. The production of unit of Mara recies 2 labot hou fuction of 1 unit of Sara requires 1 labour how Unitatible costs and as follows: 3/11 Mara San E Direct Materials 1 3 Direct Labour 6 3 663 per hour Variable Overhead Total Variable Costs ! 1 X 7 Selling Price 14 II During July the available direct labour is limited to 8.000 hours Sales demand in July is expected to be as follows Products Sales Demand Mara 3,000 units Sara 5,000 units Required: e) Why the conventional contribution per unit will lead to suboptimal decisions in this problem? Please propose and calculate an alternative contribution mere for Mara and Sara? 18 Marks Determine the production budget that will maximise profit, assuming that fixed costs per month are 20,000 and that there is no opening inventory of finished goods or work in progress. Also, calculate the profit based on this optimal production budget Marks) PLEASE TURN OVER AG210 Part Management accounting practice has traditionally focused on techniques to assist organizational decision-making and cost control. In concentrating on the internal comment the management accounting addressing the needs of semice PLEASE TURN OVER AG219 Part Management accounting practice has traditionally focused on techniques to Organizational decision-making and cost control. In concentrating on the internal mement the management accounting function has been criticized for at addressing the needs of smir management to enable effective strategic planning. In particular, the criticism has focused on inadequate provision of information which analyzes the organation's exposure to environmental change and its progress towards the achievement of corporate objectives Required ) Briefly explain how strategic management accounting (SMA) can provide information that meets the requirements of senior managers to realize corporate objectives (Il Marks) [Totat: 40 marks] PLEASE TURN OVER AG219 Section A - Answer all components of Question 1 Question 1: OVP Analysis. Limiting Factor Analysis and Strategic Performance Manage A pharmaceutical organization makes and sells three vaccines, Gyros, Souvlaki, and Kokoetst. The apaization's fixed costs 132,000 per month. The budgetodclling prices and volumes for the next month are as follows: Gres Sowohl Koka Selling Price EIS Units 200 100 300 E19 The standard (variable) cost of each product is shown below: Suwal Koki 4 4 Material Labour Variable overheads 5 4 3 4 6 Required: Discuss the critical assumption for applying becak-even analyses in a multiproduct environment (Mark) b) Calculate the contribution per unit and the total contribution camed by each product Marks) c) Calculate the weighted average (combined) contribution per unit Merks) d) Calculate the decakeven point units in total and for each individual produet. (3 Marks) PLEASE TURN OVER AG2 Pan B Panos makes two products, Mara and Sara The production of unit of Mara requires 2 tubo hours, while the production of unit of Sara requires I labour hour. Unit variable costs and unit selling prices are as follows: Mara Sara E Part B Panos makes two products, Mara and Sara. The production of unit of Mara recies 2 labot hou fuction of 1 unit of Sara requires 1 labour how Unitatible costs and as follows: 3/11 Mara San E Direct Materials 1 3 Direct Labour 6 3 663 per hour Variable Overhead Total Variable Costs ! 1 X 7 Selling Price 14 II During July the available direct labour is limited to 8.000 hours Sales demand in July is expected to be as follows Products Sales Demand Mara 3,000 units Sara 5,000 units Required: e) Why the conventional contribution per unit will lead to suboptimal decisions in this problem? Please propose and calculate an alternative contribution mere for Mara and Sara? 18 Marks Determine the production budget that will maximise profit, assuming that fixed costs per month are 20,000 and that there is no opening inventory of finished goods or work in progress. Also, calculate the profit based on this optimal production budget Marks) PLEASE TURN OVER AG210 Part Management accounting practice has traditionally focused on techniques to assist organizational decision-making and cost control. In concentrating on the internal comment the management accounting addressing the needs of semice PLEASE TURN OVER AG219 Part Management accounting practice has traditionally focused on techniques to Organizational decision-making and cost control. In concentrating on the internal mement the management accounting function has been criticized for at addressing the needs of smir management to enable effective strategic planning. In particular, the criticism has focused on inadequate provision of information which analyzes the organation's exposure to environmental change and its progress towards the achievement of corporate objectives Required ) Briefly explain how strategic management accounting (SMA) can provide information that meets the requirements of senior managers to realize corporate objectives (Il Marks) [Totat: 40 marks] PLEASE TURN OVER AG219