Question

SECTION A Answer ALL the questions in this section. QUESTION 1 REQUIRED Prepare the Cash Budget for a project of Mega Enterprises for the period

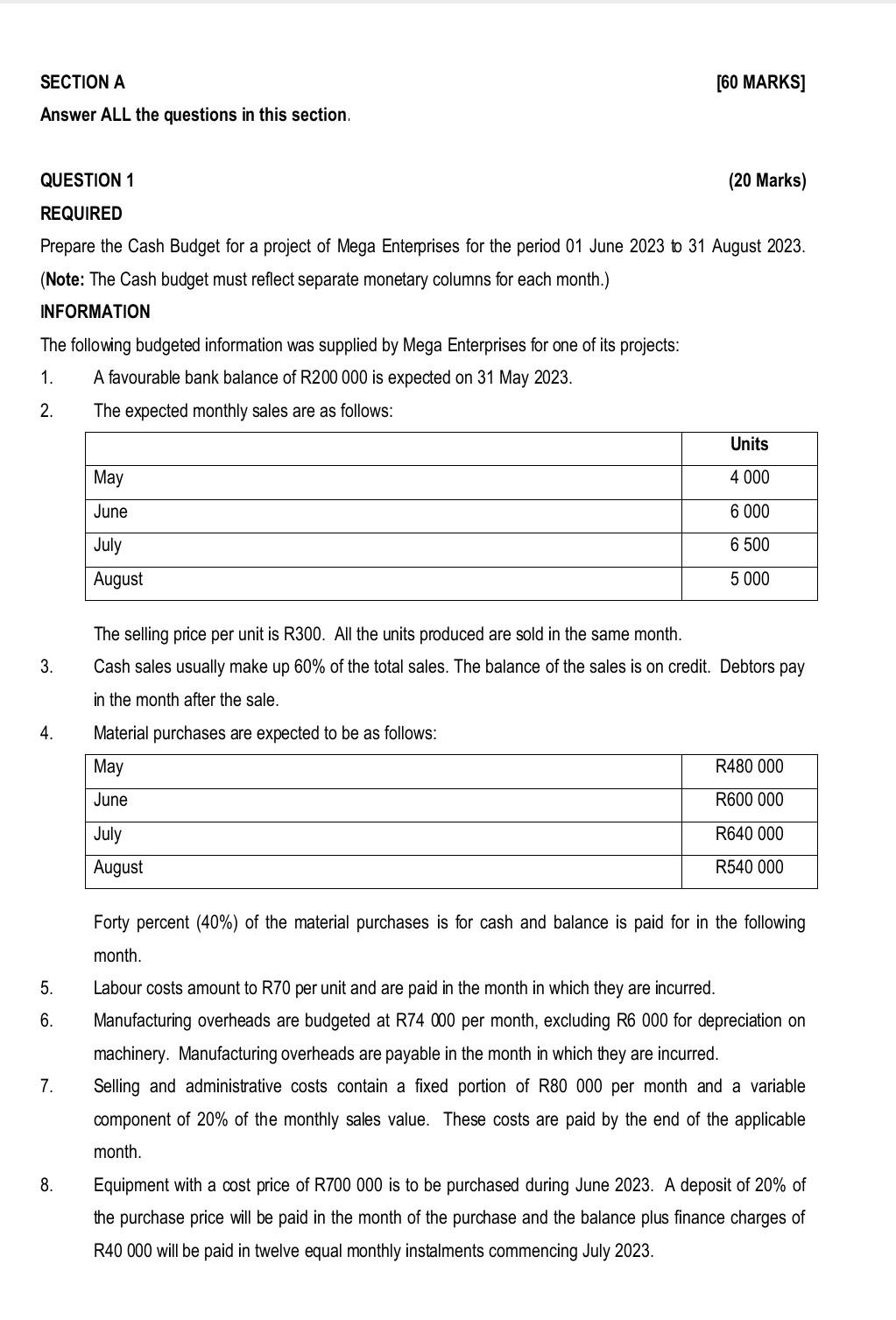

SECTION A Answer ALL the questions in this section. QUESTION 1 REQUIRED Prepare the Cash Budget for a project of Mega Enterprises for the period 01 June 2023 to 31 August 2023. (Note: The Cash budget must reflect separate monetary columns for each month.) INFORMATION The following budgeted information was supplied by Mega Enterprises for one of its projects: 1. A favourable bank balance of R200 000 is expected on 31 May 2023. 2. The expected monthly sales are as follows: 3. 4. 5. 6. 7. 8. May June July August [60 MARKS]

June (20 Marks) July August The selling price per unit is R300. All the units produced are sold in the same month. Cash sales usually make up 60% of the total sales. The balance of the sales is on credit. Debtors pay in the month after the sale. Material purchases are expected to be as follows: May Units 4 000 6 000 6 500 5 000 R480 000 R600 000 R640 000 R540 000 Forty percent (40%) of the material purchases is for cash and balance is paid for in the following month. Labour costs amount to R70 per unit and are paid in the month in which they are incurred. Manufacturing overheads are budgeted at R74 000 per month, excluding R6 000 for depreciation on machinery. Manufacturing overheads are payable in the month in which they are incurred. Selling and administrative costs contain a fixed portion of R80 000 per month and a variable component of 20% of the monthly sales value. These costs are paid by the end of the applicable month. Equipment with a cost price of R700 000 is to be purchased during June 2023. A deposit of 20% of the purchase price will be paid in the month of the purchase and the balance plus finance charges of R40 000 will be paid in twelve equal monthly instalments commencing July 2023.

SECTION A [60 MARKS] Answer ALL the questions in this section. QUESTION 1 (20 Marks) REQUIRED Prepare the Cash Budget for a project of Mega Enterprises for the period 01 June 2023 to 31 August 2023. (Note: The Cash budget must reflect separate monetary columns for each month.) INFORMATION The following budgeted information was supplied by Mega Enterprises for one of its projects: 1. A favourable bank balance of R200 000 is expected on 31 May 2023. 2. The expected monthly sales are as follows: The selling price per unit is R300. All the units produced are sold in the same month. 3. Cash sales usually make up 60% of the total sales. The balance of the sales is on credit. Debtors pay in the month after the sale. 4. Material purchases are expected to be as follows: Forty percent (40%) of the material purchases is for cash and balance is paid for in the following month. 5. Labour costs amount to R70 per unit and are paid in the month in which they are incurred. 6. Manufacturing overheads are budgeted at R74 000 per month, excluding R6 000 for depreciation on machinery. Manufacturing overheads are payable in the month in which they are incurred. 7. Selling and administrative costs contain a fixed portion of R80 000 per month and a variable component of 20% of the monthly sales value. These costs are paid by the end of the applicable month. 8. Equipment with a cost price of R700 000 is to be purchased during June 2023. A deposit of 20% of the purchase price will be paid in the month of the purchase and the balance plus finance charges of R40 000 will be paid in twelve equal monthly instalments commencing July 2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started