Answered step by step

Verified Expert Solution

Question

1 Approved Answer

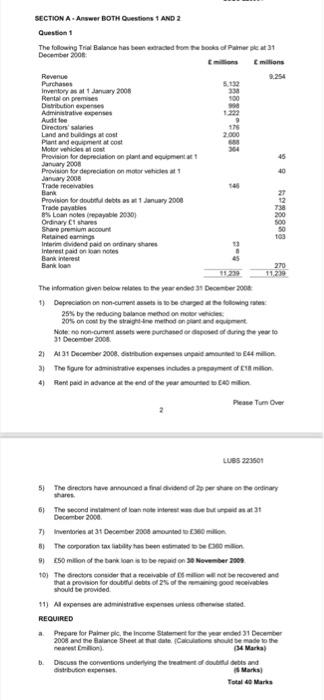

SECTION A- Answer BOTH Questions 1 AND 2 Question 1 The following Trial Balance has been extracted from the books of Palmer plc at 31

SECTION A- Answer BOTH Questions 1 AND 2 Question 1 The following Trial Balance has been extracted from the books of Palmer plc at 31 December 2008: millions millions Revenue Purchases Inventory as at 1 January 2008 Rental on premises Distribution expenses Administrative expenses Audit fee Directors' salaries Land and buildings at cost Plant and equipment at cost Motor vehicles at cost Provision for depreciation on plant and equipment at 1 January 2008 Provision for depreciation on motor vehicles at 1 January 2008 Trade receivables Bank Provision for doubtful debts as at 1 January 2008 Trade payables 8% Loan notes (repayable 2030) Ordinary 1 shares Share premium account Retained earnings Interim dividend paid on ordinary shares Interest paid on loan notes Bank interest Bank loan 5,132 338 100 998 1,222 9 176 2,000 688 364 6) 146 2 a. 13 8 45 The information given below relates to the year ended 31 December 2008: 1) Depreciation on non-current assets is to be charged at the following rates: 25% by the reducing balance method on motor vehicles; 20% on cost by the straight-line method on plant and equipment. 11,239 9,254 2) At 31 December 2008, distribution expenses unpaid amounted to 44 million. The figure for administrative expenses includes a prepayment of 18 million. 4) Rent paid in advance at the end of the year amounted to 40 million. 3) Note: no non-current assets were purchased or disposed of during the year to 31 December 2008. 270 11,239 LUBS 223501 27 12 738 200 500 50 103 5) The directors have announced a final dividend of 2p per share on the ordinary shares. 45 40 Please Turn Over The second instalment of loan note interest was due but unpaid as at 31 December 2008. 7) Inventories at 31 December 2008 amounted to 360 million. 8) The corporation tax liability has been estimated to be 360 million. 9) 50 million of the bank loan is to be repaid on 30 November 2009. 10) The directors consider that a receivable of 6 million will not be recovered and that a provision for doubtful debts of 2% of the remaining good receivables should be provided. 11) All expenses are administrative expenses unless otherwise stated. REQUIRED b. Discuss the conventions underlying the treatment of doubtful debts and distribution expenses. (6 Marks) Total 40 Marks Prepare for Palmer plc, the Income Statement for the year ended 31 December 2008 and the Balance Sheet at that date. (Calculations should be made to the nearest million). (34 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started