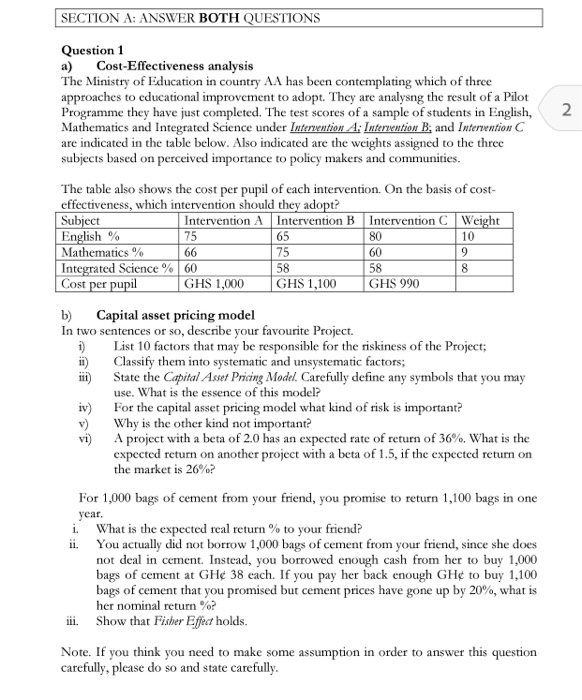

SECTION A: ANSWER BOTH QUESTIONS N 65 75 66 80 60 58 10 9 8 Question 1 a) Cost-Effectiveness analysis The Ministry of Education in country AA has been contemplating which of three approaches to educational improvement to adopt. They are analysng the result of a Pilot Programme they have just completed. The test scores of a sample of students in English, Mathematics and Integrated Science under Intervention A; Intervention B; and Intervention C are indicated in the table below. Also indicated are the weights assigned to the three subjects based on perceived importance to policy makers and communities. The table also shows the cost per pupil of each intervention. On the basis of cost- effectiveness, which intervention should they adopt? Subject Intervention A Intervention B Intervention C Weight English % Mathematics % 75 Integrated Science % 60 58 Cost per pupil GHS 1,000 GHS 1,100 GHS 990 b) Capital asset pricing model In two sentences or so, describe your favourite Project. 1) List 10 factors that may be responsible for the riskiness of the Project; ii) Classify them into systematic and unsystematic factors; State the Capital Asset Pricing Model. Carefully define any symbols that you may use. What is the essence of this model? iv) For the capital asset pricing model what kind of risk is important? v) Why is the other kind not important? vi) A project with a beta of 2.0 has an expected rate of return of 36%, What is the expected return on another project with a beta of 1.5, if the expected return on the market is 26% For 1,000 bags of cement from your friend, you promise to return 1,100 bags in one year. i. What is the expected real return to your friend? ii. You actually did not borrow 1,000 bags of cement from your friend, since she does not deal in cement. Instead, you borrowed enough cash from her to buy 1,000 bags of cement at GH 38 each. If you pay her back enough GH to buy 1,100 bags of cement that you promised but cement prices have gone up by 20%, what is her nominal return %? iii. Show that Fisher Effect holds. Note. If you think you need to make some assumption in order to answer this question carefully, please do so and state carefully. SECTION A: ANSWER BOTH QUESTIONS N 65 75 66 80 60 58 10 9 8 Question 1 a) Cost-Effectiveness analysis The Ministry of Education in country AA has been contemplating which of three approaches to educational improvement to adopt. They are analysng the result of a Pilot Programme they have just completed. The test scores of a sample of students in English, Mathematics and Integrated Science under Intervention A; Intervention B; and Intervention C are indicated in the table below. Also indicated are the weights assigned to the three subjects based on perceived importance to policy makers and communities. The table also shows the cost per pupil of each intervention. On the basis of cost- effectiveness, which intervention should they adopt? Subject Intervention A Intervention B Intervention C Weight English % Mathematics % 75 Integrated Science % 60 58 Cost per pupil GHS 1,000 GHS 1,100 GHS 990 b) Capital asset pricing model In two sentences or so, describe your favourite Project. 1) List 10 factors that may be responsible for the riskiness of the Project; ii) Classify them into systematic and unsystematic factors; State the Capital Asset Pricing Model. Carefully define any symbols that you may use. What is the essence of this model? iv) For the capital asset pricing model what kind of risk is important? v) Why is the other kind not important? vi) A project with a beta of 2.0 has an expected rate of return of 36%, What is the expected return on another project with a beta of 1.5, if the expected return on the market is 26% For 1,000 bags of cement from your friend, you promise to return 1,100 bags in one year. i. What is the expected real return to your friend? ii. You actually did not borrow 1,000 bags of cement from your friend, since she does not deal in cement. Instead, you borrowed enough cash from her to buy 1,000 bags of cement at GH 38 each. If you pay her back enough GH to buy 1,100 bags of cement that you promised but cement prices have gone up by 20%, what is her nominal return %? iii. Show that Fisher Effect holds. Note. If you think you need to make some assumption in order to answer this question carefully, please do so and state carefully