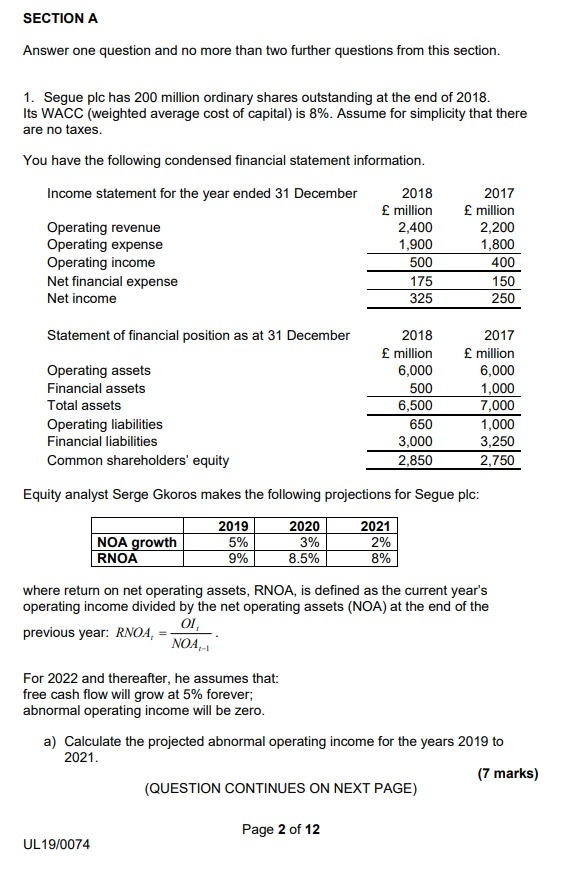

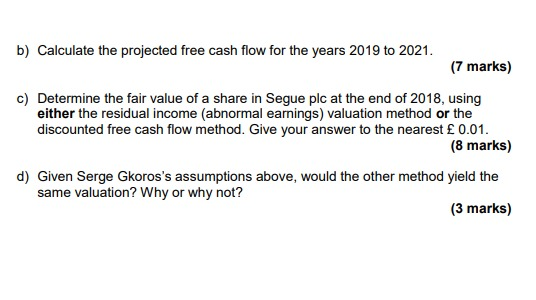

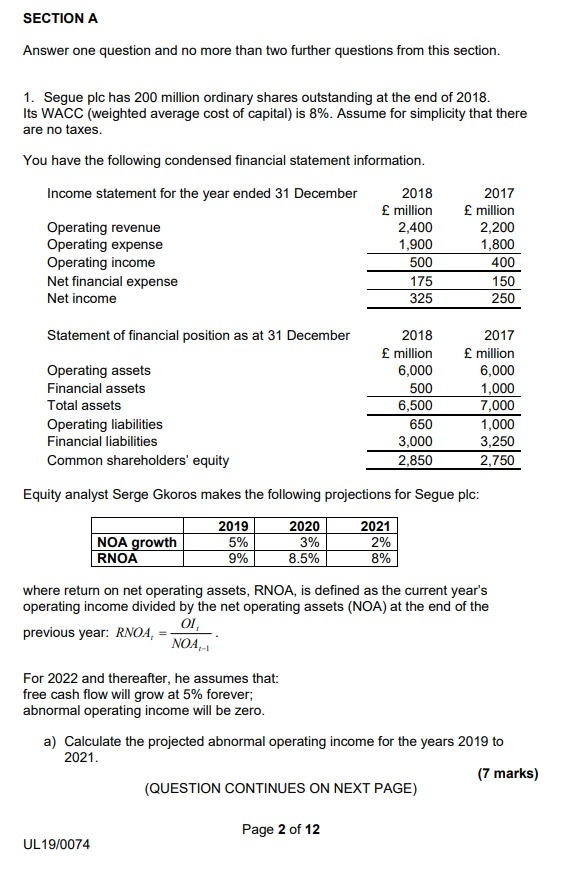

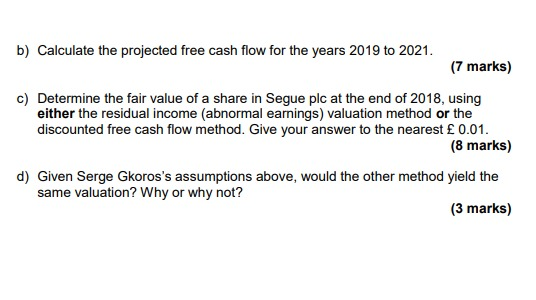

SECTION A Answer one question and no more than two further questions from this section. 1. Segue plc has 200 million ordinary shares outstanding at the end of 2018. Its WACC (weighted average cost of capital) is 8%. Assume for simplicity that there are no taxes. You have the following condensed financial statement information. Income statement for the year ended 31 December 2018 2017 million million Operating revenue 2,400 2,200 Operating expense 1,900 1,800 Operating income 500 400 Net financial expense 175 Net income 325 250 150 Statement of financial position as at 31 December Operating assets Financial assets Total assets Operating liabilities Financial liabilities Common shareholders' equity 2018 million 6,000 500 6,500 650 3,000 2,850 2017 million 6,000 1,000 7,000 1,000 3,250 2,750 Equity analyst Serge Gkoros makes the following projections for Segue plc: 2019 2020 2021 NOA growth 5% 3% 2% RNOA 9% 8.5% 8% where return on net operating assets, RNOA, is defined as the current year's operating income divided by the net operating assets (NOA) at the end of the OI previous year: RNOA, NOA-1 For 2022 and thereafter, he assumes that: free cash flow will grow at 5% forever; abnormal operating income will be zero. a) Calculate the projected abnormal operating income for the years 2019 to 2021. (7 marks) (QUESTION CONTINUES ON NEXT PAGE) Page 2 of 12 UL19/0074 b) Calculate the projected free cash flow for the years 2019 to 2021. (7 marks) c) Determine the fair value of a share in Segue plc at the end of 2018, using either the residual income (abnormal earnings) valuation method or the discounted free cash flow method. Give your answer to the nearest 0.01. (8 marks) d) Given Serge Gkoros's assumptions above, would the other method yield the same valuation? Why or why not? (3 marks) SECTION A Answer one question and no more than two further questions from this section. 1. Segue plc has 200 million ordinary shares outstanding at the end of 2018. Its WACC (weighted average cost of capital) is 8%. Assume for simplicity that there are no taxes. You have the following condensed financial statement information. Income statement for the year ended 31 December 2018 2017 million million Operating revenue 2,400 2,200 Operating expense 1,900 1,800 Operating income 500 400 Net financial expense 175 Net income 325 250 150 Statement of financial position as at 31 December Operating assets Financial assets Total assets Operating liabilities Financial liabilities Common shareholders' equity 2018 million 6,000 500 6,500 650 3,000 2,850 2017 million 6,000 1,000 7,000 1,000 3,250 2,750 Equity analyst Serge Gkoros makes the following projections for Segue plc: 2019 2020 2021 NOA growth 5% 3% 2% RNOA 9% 8.5% 8% where return on net operating assets, RNOA, is defined as the current year's operating income divided by the net operating assets (NOA) at the end of the OI previous year: RNOA, NOA-1 For 2022 and thereafter, he assumes that: free cash flow will grow at 5% forever; abnormal operating income will be zero. a) Calculate the projected abnormal operating income for the years 2019 to 2021. (7 marks) (QUESTION CONTINUES ON NEXT PAGE) Page 2 of 12 UL19/0074 b) Calculate the projected free cash flow for the years 2019 to 2021. (7 marks) c) Determine the fair value of a share in Segue plc at the end of 2018, using either the residual income (abnormal earnings) valuation method or the discounted free cash flow method. Give your answer to the nearest 0.01. (8 marks) d) Given Serge Gkoros's assumptions above, would the other method yield the same valuation? Why or why not