Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SECTION A - APPLICATION QUESTIONS Question 1 - Personal Tax 15 Marks Johnson with three dependents works for the private sector in Madang. He earns

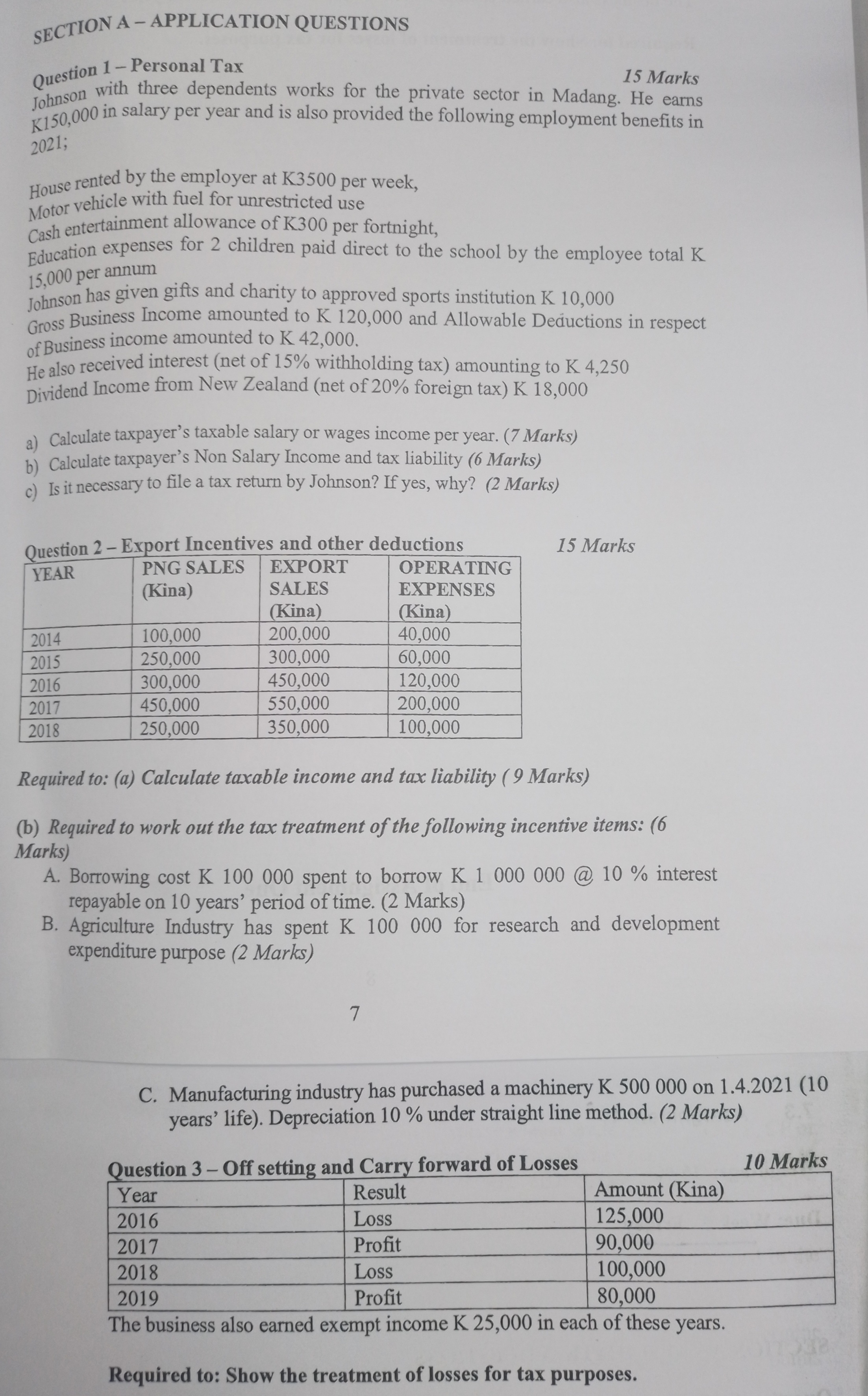

SECTION A - APPLICATION QUESTIONS Question 1 - Personal Tax 15 Marks Johnson with three dependents works for the private sector in Madang. He earns \\( \\mathrm{K} 150,000 \\) in salary per year and is also provided the following employment benefits in 2021; House rented by the employer at K3500 per week, Motor vehicle with fuel for unrestricted use Cash entertainment allowance of \\( \\mathrm{K} 300 \\) per fortnight, Education expenses for 2 children paid direct to the school by the employee total \\( \\mathrm{K} \\) 15,000 per annum Johnson has given gifts and charity to approved sports institution K 10,000 Gross Business Income amounted to K 120,000 and Allowable Deciuctions in respect of Business income amounted to \\( \\mathrm{K} 42,000 \\). He also received interest (net of \15 withholding tax) amounting to \\( \\mathrm{K} 4,250 \\) Dividend Income from New Zealand (net of 20\\% foreign tax) K 18,000 a) Calculate taxpayer's taxable salary or wages income per year. (7 Marks) b) Calculate taxpayer's Non Salary Income and tax liability (6 Marks) c) Is it necessary to file a tax return by Johnson? If yes, why? (2 Marks) 15 Marks Required to: (a) Calculate taxable income and tax liability (9 Marks) (b) Required to work out the tax treatment of the following incentive items: (6 Marks) A. Borrowing cost K 100000 spent to borrow K 1000000 @ \10 interest repayable on 10 years' period of time. (2 Marks) B. Agriculture Industry has spent K 100000 for research and development expenditure purpose (2 Marks) 7 C. Manufacturing industry has purchased a machinery K 500000 on 1.4.2021 (10 years' life). Depreciation \10 under straight line method. (2 Marks) The business also earned exempt income \\( K \\) \\( \\angle \\supset, 0 U \\cup \\) in each or tnese years. Required to: Show the treatment of losses for tax purposes

SECTION A - APPLICATION QUESTIONS Question 1 - Personal Tax 15 Marks Johnson with three dependents works for the private sector in Madang. He earns \\( \\mathrm{K} 150,000 \\) in salary per year and is also provided the following employment benefits in 2021; House rented by the employer at K3500 per week, Motor vehicle with fuel for unrestricted use Cash entertainment allowance of \\( \\mathrm{K} 300 \\) per fortnight, Education expenses for 2 children paid direct to the school by the employee total \\( \\mathrm{K} \\) 15,000 per annum Johnson has given gifts and charity to approved sports institution K 10,000 Gross Business Income amounted to K 120,000 and Allowable Deciuctions in respect of Business income amounted to \\( \\mathrm{K} 42,000 \\). He also received interest (net of \15 withholding tax) amounting to \\( \\mathrm{K} 4,250 \\) Dividend Income from New Zealand (net of 20\\% foreign tax) K 18,000 a) Calculate taxpayer's taxable salary or wages income per year. (7 Marks) b) Calculate taxpayer's Non Salary Income and tax liability (6 Marks) c) Is it necessary to file a tax return by Johnson? If yes, why? (2 Marks) 15 Marks Required to: (a) Calculate taxable income and tax liability (9 Marks) (b) Required to work out the tax treatment of the following incentive items: (6 Marks) A. Borrowing cost K 100000 spent to borrow K 1000000 @ \10 interest repayable on 10 years' period of time. (2 Marks) B. Agriculture Industry has spent K 100000 for research and development expenditure purpose (2 Marks) 7 C. Manufacturing industry has purchased a machinery K 500000 on 1.4.2021 (10 years' life). Depreciation \10 under straight line method. (2 Marks) The business also earned exempt income \\( K \\) \\( \\angle \\supset, 0 U \\cup \\) in each or tnese years. Required to: Show the treatment of losses for tax purposes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started