Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SECTION A Attempt BOTH questions in this section. Each question is worth 25 marks. 10 marks are awarded for the quality of the Excel

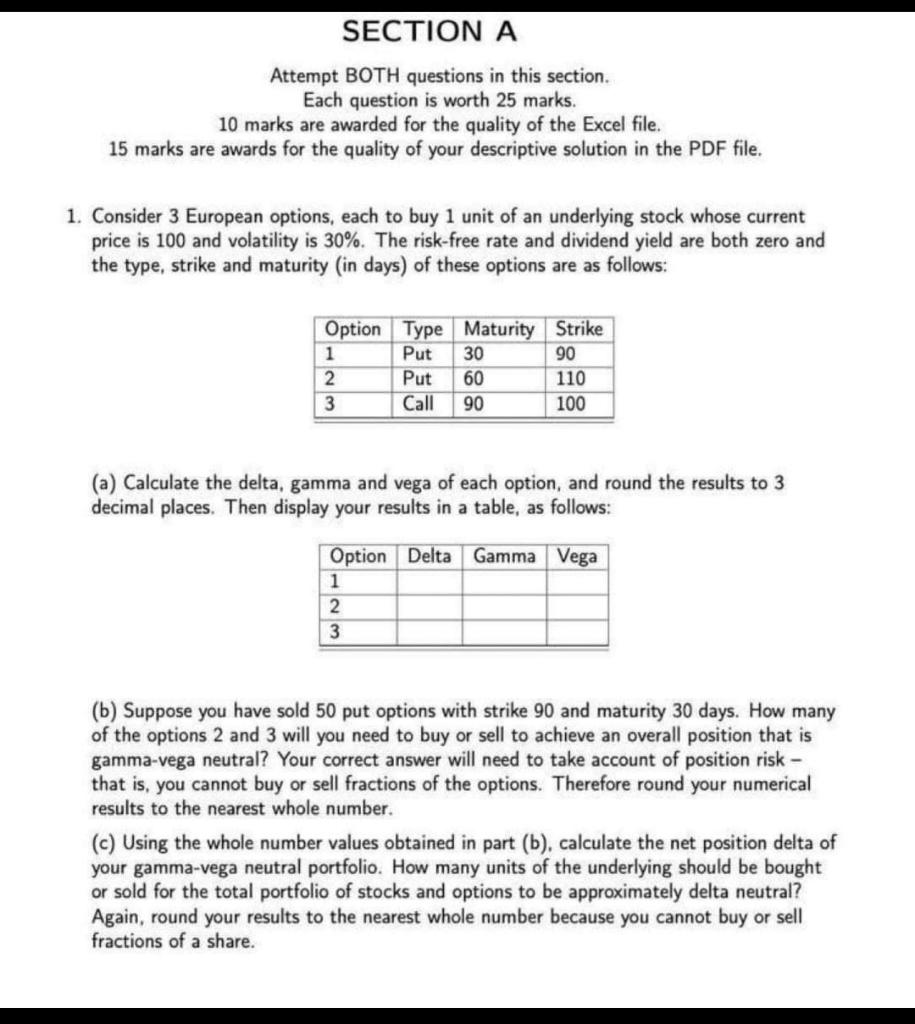

SECTION A Attempt BOTH questions in this section. Each question is worth 25 marks. 10 marks are awarded for the quality of the Excel file. 15 marks are awards for the quality of your descriptive solution in the PDF file. 1. Consider 3 European options, each to buy 1 unit of an underlying stock whose current price is 100 and volatility is 30%. The risk-free rate and dividend yield are both zero and the type, strike and maturity (in days) of these options are as follows: Option Type Maturity Strike 1 Put 30 90 2 Put 60 110 3 Call 90 100 (a) Calculate the delta, gamma and vega of each option, and round the results to 3 decimal places. Then display your results in a table, as follows: Option Delta Gamma Vega 1 2 3 (b) Suppose you have sold 50 put options with strike 90 and maturity 30 days. How many of the options 2 and 3 will you need to buy or sell to achieve an overall position that is gamma-vega neutral? Your correct answer will need to take account of position risk - that is, you cannot buy or sell fractions of the options. Therefore round your numerical results to the nearest whole number. (c) Using the whole number values obtained in part (b), calculate the net position delta of your gamma-vega neutral portfolio. How many units of the underlying should be bought or sold for the total portfolio of stocks and options to be approximately delta neutral? Again, round your results to the nearest whole number because you cannot buy or sell fractions of a share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started