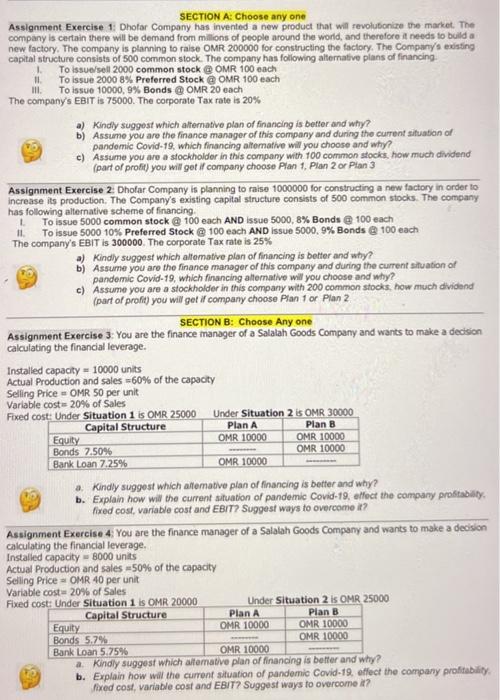

SECTION A: Choose any one Assignment Exercise 1 Dhofar Company has invented a new product that will revolutionize the market. The company is certain there will be demand from millions of people around the world, and therefore it needs to build a new factory. The company is planning to raise OMR 200000 for constructing the factory. The Company's existing capital structure consists of 500 common stock. The company has following alternative plans of financing To issue/sell 2000 common stock @ OMR 100 each II. To Issue 2000 8% Preferred Stock @ OMR 100 each III. To issue 10000,9% Bonds @ OMR 20 each The company's EBIT is 75000. The corporate Tax rate is 20% a) Kindly suggest which alternative plan of financing is better and why? b) Assume you are the finance manager of this company and during the current situation of pandemic Covid-19, which financing alternative will you choose and why? c) Assume you are a stockholder in this company with 100 common stock, how much dividend (part of profit) you will get il company choose Plan 1. Plan 2 or Plan 3 Assignment Exercise 2: Dhofar Company is planning to raise 1000000 for constructing a new factory in order to increase its production. The Company's existing capital structure consists of 500 common stocks. The company has following alternative scheme of financing 1 To issue 5000 common stock @ 100 each AND issue 5000,8% Bonds @ 100 each II. To issue 5000 10% Preferred Stock @ 100 each AND Issue 5000.9% Bonds @100 each The company's EBIT is 300000. The corporate Tax rate is 25% a) Kindly suggest which alterative plan of financing is better and why? b) Assume you are the finance manager of this company and during the current situation of pandemic Covid-19, which financing alternative will you choose and why? c) Assume you are a stockholder in this company with 200 common stooks. how much dividend (part of profit) you will get il company choose Plan 1 or Plan 2 SECTION B: Choose Any one Assignment Exercise 3: You are the finance manager of a Salalah Goods Company and wants to make a decision calculating the financial leverage. Installed capacity = 10000 units Actual Production and sales -60% of the capacity Selling Price OMR 50 per unit Variable cost=20% of Sales Fixed cost: Under Situation 1 is OMR 25000 Under Situation 2 is OMR 30000 Capital Structure Plan A Plan B Equity OMR 10000 OMR 10000 Bonds 7.50% OMR 10000 Bank Loan 7.25% OMR 10000 a. Kindly suggest which allomative plan of financing is better and why? b. Explain how will the current situation of pandemic Covid-19, affect the company profitability, fired cost, variable cost and EBIT? Suggest ways to overcome it? Assignment Exercise 4: You are the finance manager of a Salalah Goods Company and wants to make a decision calculating the financial leverage, Installed capacity 8000 units Actual Production and sales -50% of the capacity Selling Price - OMR 40 per unit Variable cost 20% of Sales Fixed cost: Under Situation 1 is OMR 20000 Under Situation 2 is OMR 25000 Capital Structure Plan A Plan B Equity OMR 10000 OMR 10000 Bonds 5.7% OMR 10000 Bank Loan 5.75% OMR 10000 a. Kindly suggest which alternative plan of financing is better and why? b. Explain how will the current situation of pandemic Cavid-19. affect the company profitability Mixed cost, variable cost and EBIT? Suggest ways to overcome it