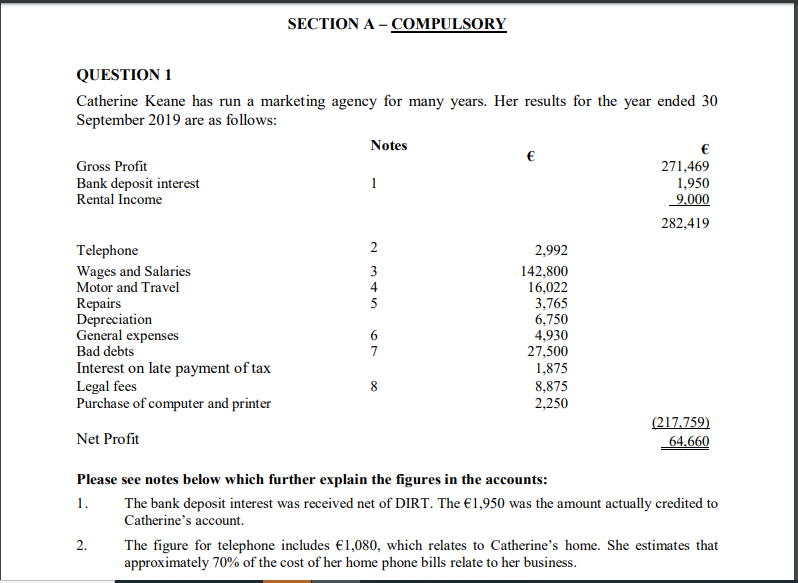

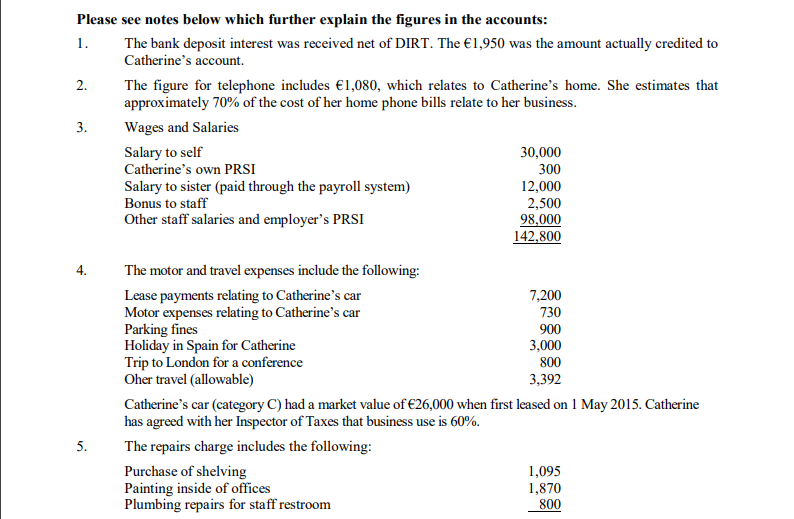

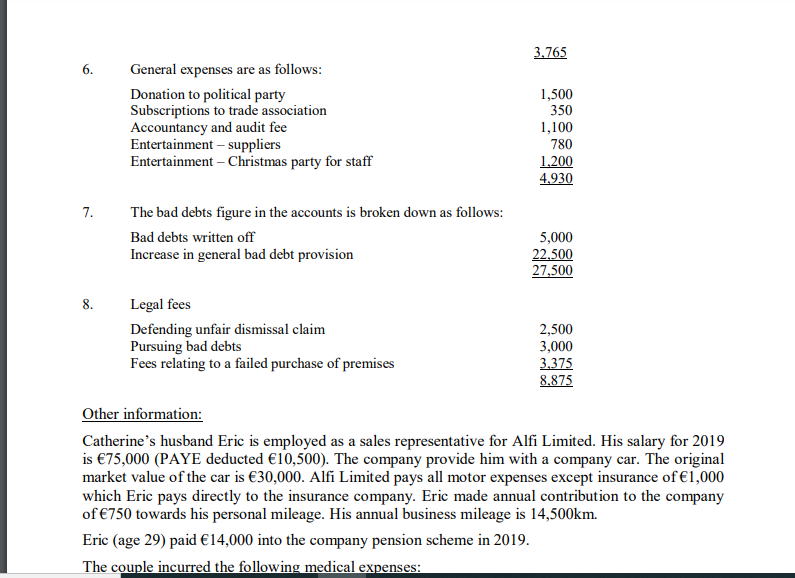

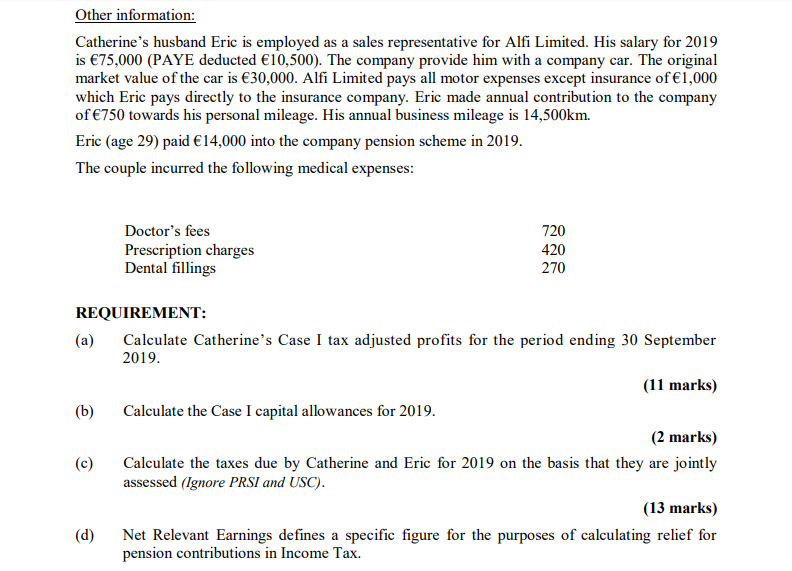

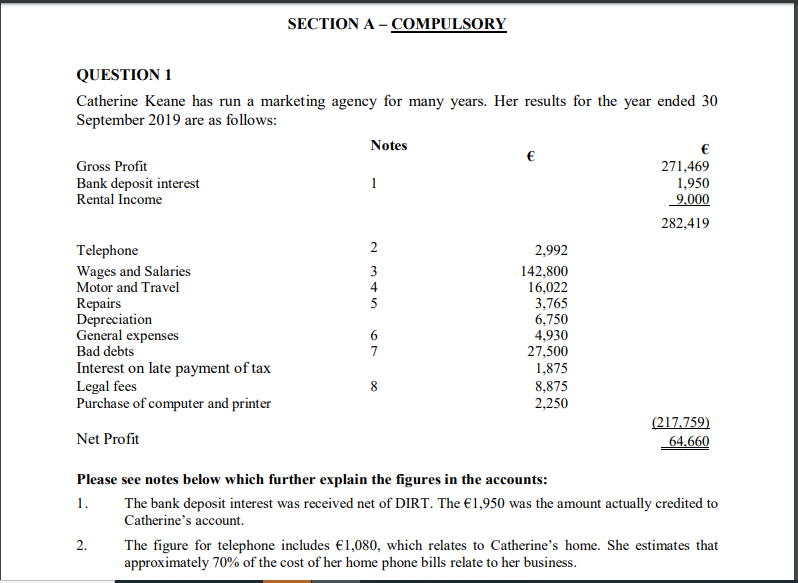

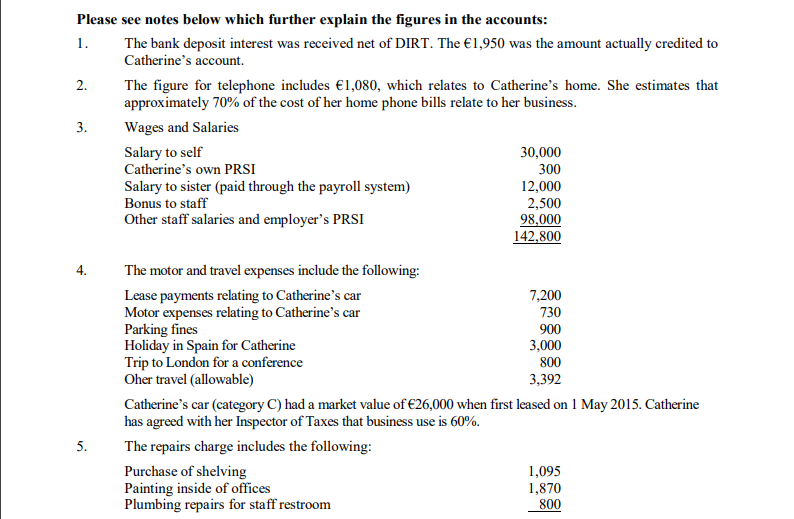

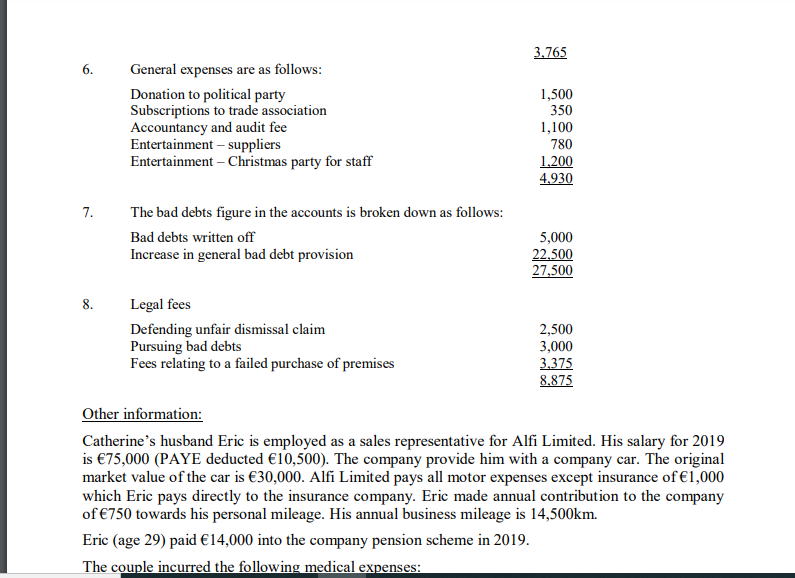

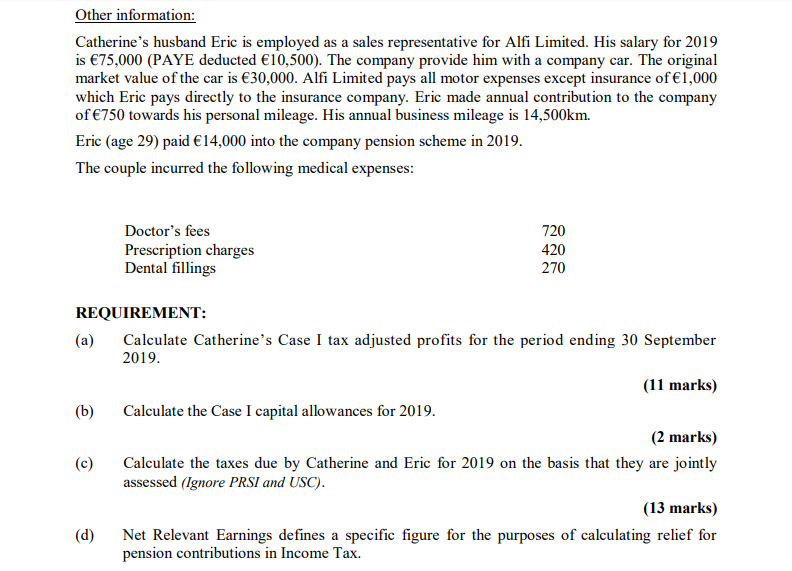

SECTION A -COMPULSORY QUESTION 1 Catherine Keane has run a marketing agency for many years. Her results for the year ended 30 September 2019 are as follows: Notes Gross Profit 271,469 Bank deposit interest 1,950 Rental Income 9,000 282,419 Telephone 2 2,992 Wages and Salaries 3 142,800 Motor and Travel 4 16,022 Repairs 5 3,765 Depreciation 6,750 General expenses 6 4,930 Bad debts 7 27,500 Interest on late payment of tax 1,875 Legal fees 8,875 Purchase of computer and printer 2,250 (217,759) Net Profit 64,660 8 Please see notes below which further explain the figures in the accounts: 1. The bank deposit interest was received net of DIRT. The 1,950 was the amount actually credited to Catherine's account. 2. The figure for telephone includes 1,080, which relates to Catherine's home. She estimates that approximately 70% of the cost of her home phone bills relate to her business. Please see notes below which further explain the figures in the accounts: 1. The bank deposit interest was received net of DIRT. The 1,950 was the amount actually credited to Catherine's account. 2. The figure for telephone includes 1,080, which relates to Catherine's home. She estimates that approximately 70% of the cost of her home phone bills relate to her business. 3. Wages and Salaries Salary to self 30,000 Catherine's own PRSI 300 Salary to sister (paid through the payroll system) 12,000 Bonus to staff 2,500 Other staff salaries and employer's PRSI 98,000 142,800 4. The motor and travel expenses include the following: Lease payments relating to Catherine's car 7,200 Motor expenses relating to Catherine's car 730 Parking fines 900 Holiday in Spain for Catherine 3,000 Trip to London for a conference 800 Oher travel (allowable) 3,392 Catherine's car (category C) had a market value of 26,000 when first leased on 1 May 2015. Catherine has agreed with her Inspector of Taxes that business use is 60%. 5. The repairs charge includes the following: Purchase of shelving 1,095 Painting inside of offices 1,870 Plumbing repairs for staff restroom 800 3,765 6. General expenses are as follows: Donation to political party Subscriptions to trade association Accountancy and audit fee Entertainment - suppliers Entertainment - Christmas party for staff 1,500 350 1,100 780 1,200 4,930 7. The bad debts figure in the accounts is broken down as follows: Bad debts written off Increase in general bad debt provision 5,000 22,500 27,500 8. Legal fees Defending unfair dismissal claim Pursuing bad debts Fees relating to a failed purchase of premises 2,500 3,000 3,375 8,875 Other information: Catherine's husband Eric is employed as a sales representative for Alfi Limited. His salary for 2019 is 75,000 (PAYE deducted 10,500). The company provide him with a company car. The original market value of the car is 30,000. Alfi Limited pays all motor expenses except insurance of 1,000 which Eric pays directly to the insurance company. Eric made annual contribution to the company of 750 towards his personal mileage. His annual business mileage is 14,500km. Eric (age 29) paid 14,000 into the company pension scheme in 2019. The couple incurred the following medical expenses: Other information: Catherine's husband Eric is employed as a sales representative for Alfi Limited. His salary for 2019 is 75,000 (PAYE deducted 10,500). The company provide him with a company car. The original market value of the car is 30,000. Alfi Limited pays all motor expenses except insurance of 1,000 which Eric pays directly to the insurance company. Eric made annual contribution to the company of 750 towards his personal mileage. His annual business mileage is 14,500km. Eric (age 29) paid 14,000 into the company pension scheme in 2019. The couple incurred the following medical expenses: Doctor's fees Prescription charges Dental fillings 720 420 270 REQUIREMENT: (a) Calculate Catherine's Case I tax adjusted profits for the period ending 30 September 2019. (11 marks) Calculate the Case I capital allowances for 2019. (2 marks) Calculate the taxes due by Catherine and Eric for 2019 on the basis that they are jointly assessed (Ignore PRSI and USC). (13 marks) (d) Net Relevant Earnings defines a specific figure for the purposes of calculating relief for pension contributions in Income Tax. (b) (C) (11) How is the figure calculated? (2 marks) Total (30 marks) SECTION A -COMPULSORY QUESTION 1 Catherine Keane has run a marketing agency for many years. Her results for the year ended 30 September 2019 are as follows: Notes Gross Profit 271,469 Bank deposit interest 1,950 Rental Income 9,000 282,419 Telephone 2 2,992 Wages and Salaries 3 142,800 Motor and Travel 4 16,022 Repairs 5 3,765 Depreciation 6,750 General expenses 6 4,930 Bad debts 7 27,500 Interest on late payment of tax 1,875 Legal fees 8,875 Purchase of computer and printer 2,250 (217,759) Net Profit 64,660 8 Please see notes below which further explain the figures in the accounts: 1. The bank deposit interest was received net of DIRT. The 1,950 was the amount actually credited to Catherine's account. 2. The figure for telephone includes 1,080, which relates to Catherine's home. She estimates that approximately 70% of the cost of her home phone bills relate to her business. Please see notes below which further explain the figures in the accounts: 1. The bank deposit interest was received net of DIRT. The 1,950 was the amount actually credited to Catherine's account. 2. The figure for telephone includes 1,080, which relates to Catherine's home. She estimates that approximately 70% of the cost of her home phone bills relate to her business. 3. Wages and Salaries Salary to self 30,000 Catherine's own PRSI 300 Salary to sister (paid through the payroll system) 12,000 Bonus to staff 2,500 Other staff salaries and employer's PRSI 98,000 142,800 4. The motor and travel expenses include the following: Lease payments relating to Catherine's car 7,200 Motor expenses relating to Catherine's car 730 Parking fines 900 Holiday in Spain for Catherine 3,000 Trip to London for a conference 800 Oher travel (allowable) 3,392 Catherine's car (category C) had a market value of 26,000 when first leased on 1 May 2015. Catherine has agreed with her Inspector of Taxes that business use is 60%. 5. The repairs charge includes the following: Purchase of shelving 1,095 Painting inside of offices 1,870 Plumbing repairs for staff restroom 800 3,765 6. General expenses are as follows: Donation to political party Subscriptions to trade association Accountancy and audit fee Entertainment - suppliers Entertainment - Christmas party for staff 1,500 350 1,100 780 1,200 4,930 7. The bad debts figure in the accounts is broken down as follows: Bad debts written off Increase in general bad debt provision 5,000 22,500 27,500 8. Legal fees Defending unfair dismissal claim Pursuing bad debts Fees relating to a failed purchase of premises 2,500 3,000 3,375 8,875 Other information: Catherine's husband Eric is employed as a sales representative for Alfi Limited. His salary for 2019 is 75,000 (PAYE deducted 10,500). The company provide him with a company car. The original market value of the car is 30,000. Alfi Limited pays all motor expenses except insurance of 1,000 which Eric pays directly to the insurance company. Eric made annual contribution to the company of 750 towards his personal mileage. His annual business mileage is 14,500km. Eric (age 29) paid 14,000 into the company pension scheme in 2019. The couple incurred the following medical expenses: Other information: Catherine's husband Eric is employed as a sales representative for Alfi Limited. His salary for 2019 is 75,000 (PAYE deducted 10,500). The company provide him with a company car. The original market value of the car is 30,000. Alfi Limited pays all motor expenses except insurance of 1,000 which Eric pays directly to the insurance company. Eric made annual contribution to the company of 750 towards his personal mileage. His annual business mileage is 14,500km. Eric (age 29) paid 14,000 into the company pension scheme in 2019. The couple incurred the following medical expenses: Doctor's fees Prescription charges Dental fillings 720 420 270 REQUIREMENT: (a) Calculate Catherine's Case I tax adjusted profits for the period ending 30 September 2019. (11 marks) Calculate the Case I capital allowances for 2019. (2 marks) Calculate the taxes due by Catherine and Eric for 2019 on the basis that they are jointly assessed (Ignore PRSI and USC). (13 marks) (d) Net Relevant Earnings defines a specific figure for the purposes of calculating relief for pension contributions in Income Tax. (b) (C) (11) How is the figure calculated? (2 marks) Total (30 marks)