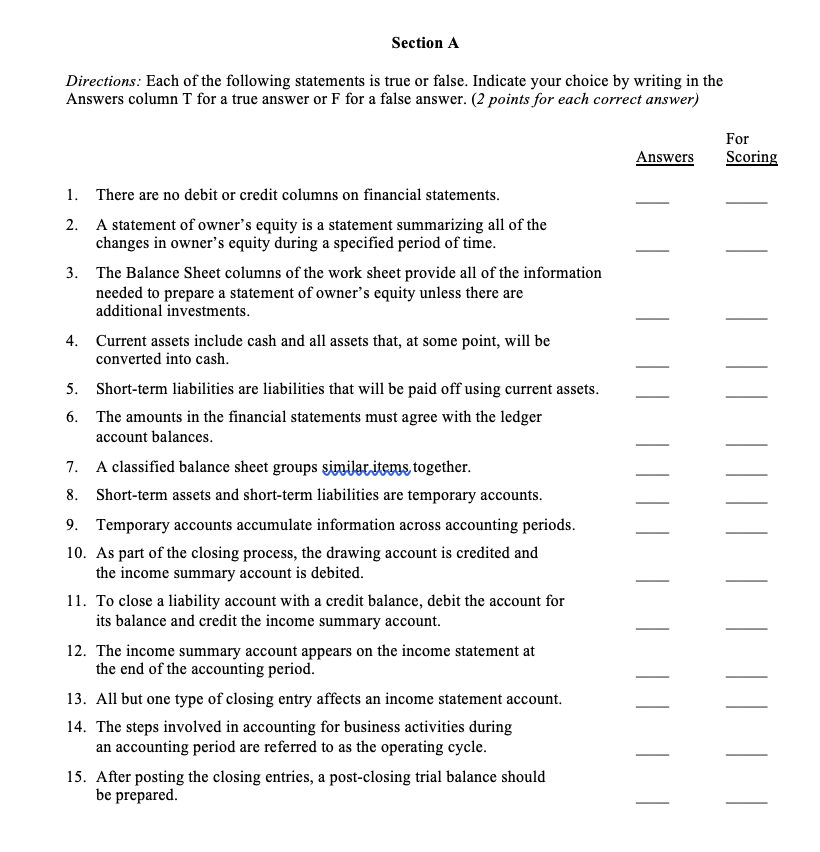

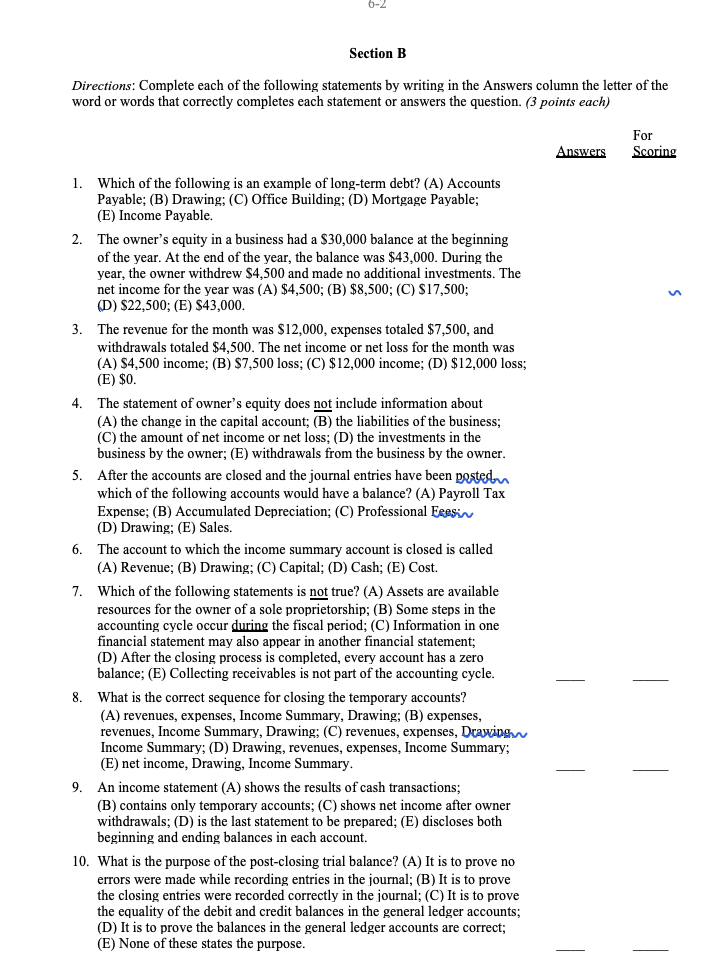

Section A Directions: Each of the following statements is true or false. Indicate your choice by writing in the Answers column T for a true answer or F for a false answer. (2 points for each correct answer) Answers For Scoring 1. There are no debit or credit columns on financial statements. 2. A statement of owner's equity is a statement summarizing all of the changes in owner's equity during a specified period of time. 3. The Balance Sheet columns of the work sheet provide all of the information needed to prepare a statement of owner's equity unless there are additional investments. 4. Current assets include cash and all assets that, at some point, will be converted into cash. 5. Short-term liabilities are liabilities that will be paid off using current assets. 6. The amounts in the financial statements must agree with the ledger account balances. 7. A classified balance sheet groups similar items together. 8. Short-term assets and short-term liabilities are temporary accounts. 9. Temporary accounts accumulate information across accounting periods. 10. As part of the closing process, the drawing account is credited and the income summary account is debited. 11. To close a liability account with a credit balance, debit the account for its balance and credit the income summary account. 12. The income summary account appears on the income statement at the end of the accounting period. 13. All but one type of closing entry affects an income statement account. 14. The steps involved in accounting for business activities during an accounting period are referred to as the operating cycle. 15. After posting the closing entries, a post-closing trial balance should be prepared. 6-2 Section B Directions: Complete each of the following statements by writing in the Answers column the letter of the word or words that correctly completes each statement or answers the question. (3 points each) Answers For Scoring 6. 1. Which of the following is an example of long-term debt? (A) Accounts Payable; (B) Drawing: (C) Office Building; (D) Mortgage Payable; (E) Income Payable. 2. The owner's equity in a business had a $30,000 balance at the beginning of the year. At the end of the year, the balance was $43,000. During the year, the owner withdrew $4,500 and made no additional investments. The net income for the year was (A) $4,500; (B) $8,500; (C) $17,500; (D) $22,500; (E) $43,000. 3. The revenue for the month was $12,000, expenses totaled $7,500, and withdrawals totaled $4,500. The net income or net loss for the month was (A) $4,500 income; (B) $7,500 loss; (C) $12,000 income; (D) $12,000 loss; (E) $0. 4. The statement of owner's equity does not include information about (A) the change in the capital account; (B) the liabilities of the business; (C) the amount of net income or net loss; (D) the investments in the business by the owner; (E) withdrawals from the business by the owner. 5. After the accounts are closed and the journal entries have been posted which of the following accounts would have a balance? (A) Payroll Tax Expense; (B) Accumulated Depreciation; (C) Professional Feesi (D) Drawing; (E) Sales. The account to which the income summary account is closed is called (A) Revenue; (B) Drawing: (C) Capital; (D) Cash; (E) Cost. 7. Which of the following statements is not true? (A) Assets are available resources for the owner of a sole proprietorship; (B) Some steps in the accounting cycle occur during the fiscal period; (C) Information in one financial statement may also appear in another financial statement; (D) After the closing process is completed, every account has a zero balance; (E) Collecting receivables is not part of the accounting cycle. 8. What is the correct sequence for closing the temporary accounts? (A) revenues, expenses, Income Summary, Drawing; (B) expenses, revenues, Income Summary, Drawing: (C) revenues, expenses, Drawing Income Summary; (D) Drawing, revenues, expenses, Income Summary: (E) net income, Drawing, Income Summary. 9. An income statement (A) shows the results of cash transactions; (B) contains only temporary accounts; (C) shows net income after owner withdrawals; (D) is the last statement to be prepared; (E) discloses both beginning and ending balances in each account. 10. What is the purpose of the post-closing trial balance? (A) It is to prove no errors were made while recording entries in the journal; (B) It is to prove the closing entries were recorded correctly in the journal; (C) It is to prove the equality of the debit and credit balances in the general ledger accounts; (D) It is to prove the balances in the general ledger accounts are correct; (E) None of these states the purpose