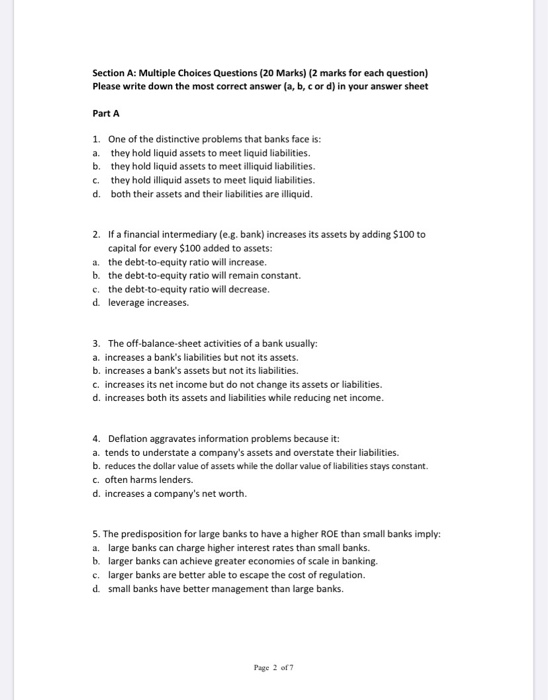

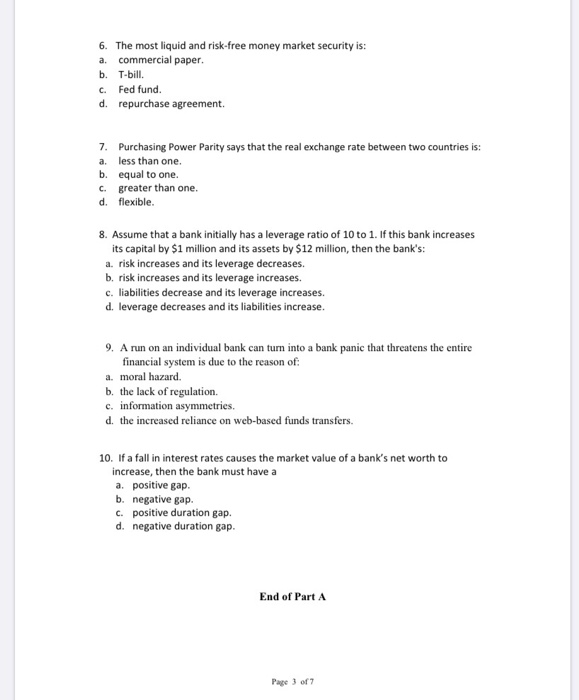

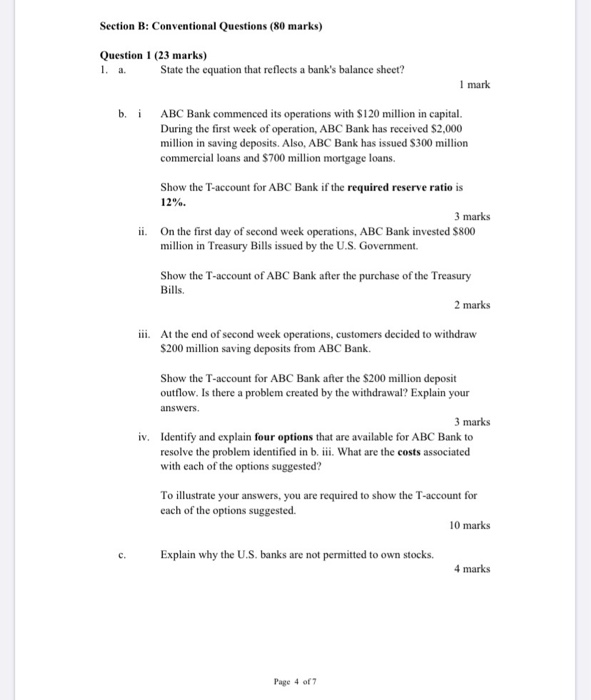

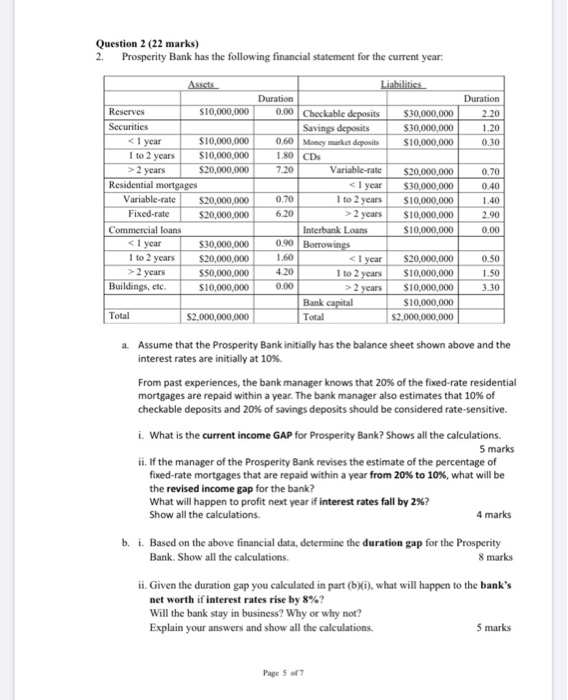

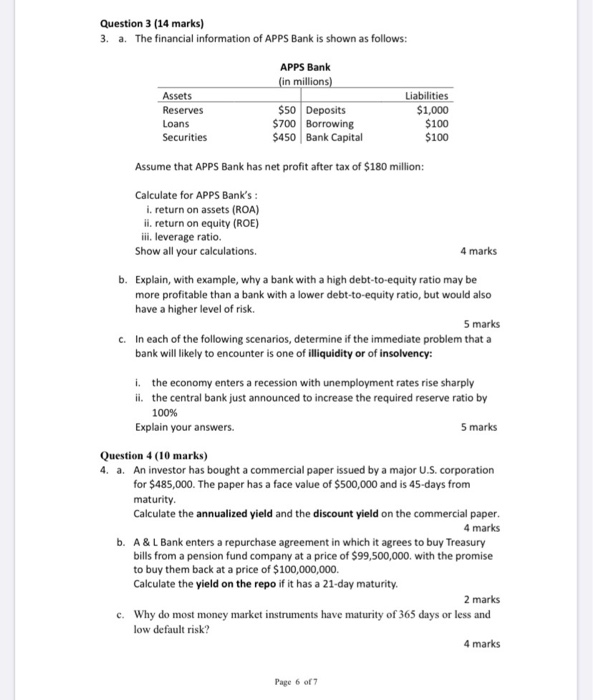

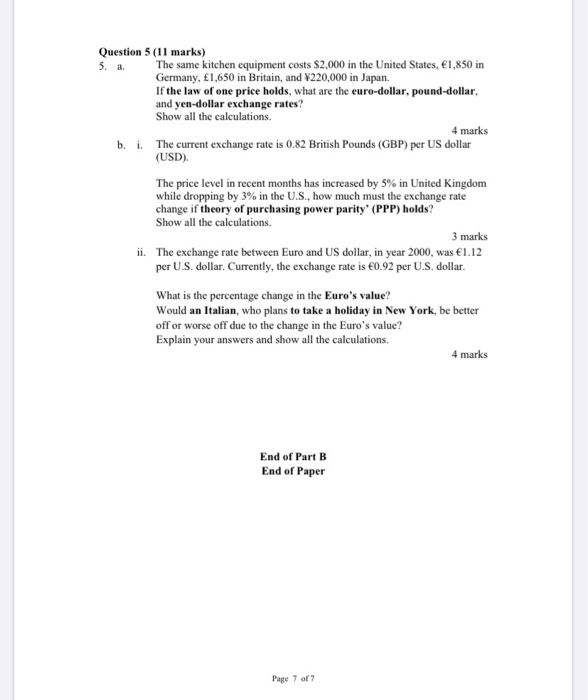

Section A: Multiple Choices Questions (20 Marks) (2 marks for each question) Please write down the most correct answer (a, b, cor d) in your answer sheet Part A 1. One of the distinctive problems that banks face is: a. they hold liquid assets to meet liquid liabilities. b. they hold liquid assets to meet illiquid liabilities. c. they hold illiquid assets to meet liquid liabilities. d. both their assets and their liabilities are illiquid. 2. If a financial intermediary (e.g. bank) increases its assets by adding $100 to capital for every $100 added to assets: a. the debt-to-equity ratio will increase. b. the debt-to-equity ratio will remain constant. c. the debt-to-equity ratio will decrease. d leverage increases 3. The off-balance-sheet activities of a bank usually: a. increases a bank's liabilities but not its assets. b. increases a bank's assets but not its liabilities. c. increases its net income but do not change its assets or liabilities. d. increases both its assets and liabilities while reducing net income. 4. Deflation aggravates information problems because it: a. tends to understate a company's assets and overstate their liabilities. b. reduces the dollar value of assets while the dollar value of liabilities stays constant c. often harms lenders. d. increases a company's net worth. 5. The predisposition for large banks to have a higher ROE than small banks imply: a large banks can charge higher interest rates than small banks. b. larger banks can achieve greater economies of scale in banking. c. larger banks are better able to escape the cost of regulation. d. small banks have better management than large banks. Page 2 of 7 6. The most liquid and risk-free money market security is: a. commercial paper. b. T-bill. C. Fed fund. d. repurchase agreement. 7. Purchasing Power Parity says that the real exchange rate between two countries is: a. less than one. b. equal to one. c. greater than one. d. flexible 8. Assume that a bank initially has a leverage ratio of 10 to 1. If this bank increases its capital by $1 million and its assets by $12 million, then the bank's: a. risk increases and its leverage decreases. b. risk increases and its leverage increases. c. liabilities decrease and its leverage increases. d. leverage decreases and its liabilities increase. 9. A run on an individual bank can turn into a bank panic that threatens the entire financial system is due to the reason of: a. moral hazard b. the lack of regulation c. information asymmetries. d. the increased reliance on web-based funds transfers. 10. If a fall in interest rates causes the market value of a bank's net worth to increase, then the bank must have a a. positive gap. b. negative gap. C. positive duration gap. d. negative duration gap. End of Part A Page 3 of 7 Section B: Conventional Questions (80 marks) Question 1 (23 marks) State the equation that reflects a bank's balance sheet? 1 mark b. i ABC Bank commenced its operations with $120 million in capital. During the first week of operation, ABC Bank has received $2,000 million in saving deposits. Also, ABC Bank has issued $300 million commercial loans and $700 million mortgage loans. Show the T-account for ABC Bank if the required reserve ratio is 12%. 3 marks ii. On the first day of second week operations, ABC Bank invested $800 million in Treasury Bills issued by the U.S. Government. Show the T-account of ABC Bank after the purchase of the Treasury Bills. 2 marks iii. At the end of second week operations, customers decided to withdraw $200 million saving deposits from ABC Bank. Show the T-account for ABC Bank after the $200 million deposit outflow. Is there a problem created by the withdrawal? Explain your answers. 3 marks iv. Identify and explain four options that are available for ABC Bank to resolve the problem identified in b. iii. What are the costs associated with each of the options suggested? To illustrate your answers, you are required to show the T-account for each of the options suggested. 10 marks Explain why the U.S. banks are not permitted to own stocks. 4 marks c. Page 4 of 7 Duration 2.20 1.20 0.30 Question 2 (22 marks) 2. Prosperity Bank has the following financial statement for the current year: Assets Liabilities Duration Reserves $10,000,000 0.00 Checkable deposits $30,000,000 Securities Savings deposits $30,000,000 2 years $20,000,000 7.20 Variable-rate $20,000,000 Residential mortgages $30,000,000 Variable-rate $20,000,000 0.70 1 to 2 years $10,000,000 Fixed-rate $20.000.000 6.20 > 2 years S10,000,000 Commercial loans Interbank Loans $10,000,000 2 years S50,000,000 4.20 1 to 2 years S10,000,000 Buildings, etc. $10,000,000 0.00 > 2 years $10,000,000 Bank capital $10,000,000 Total $2,000,000,000 Total $2,000,000,000