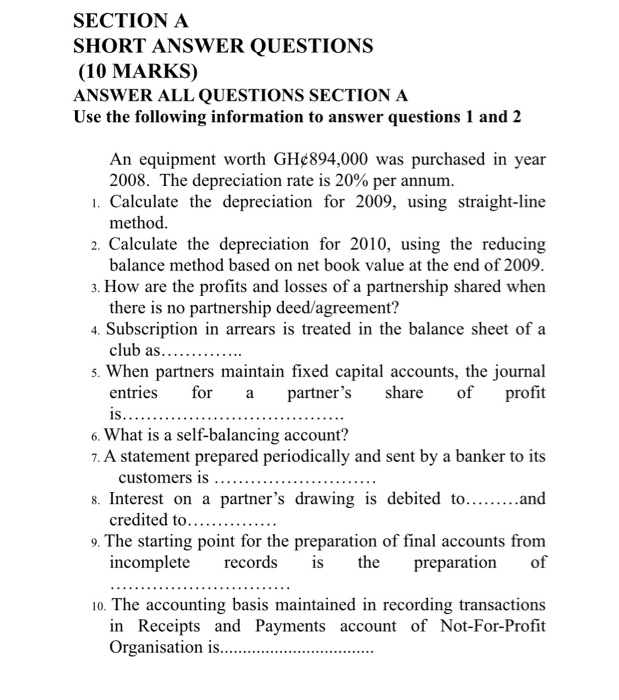

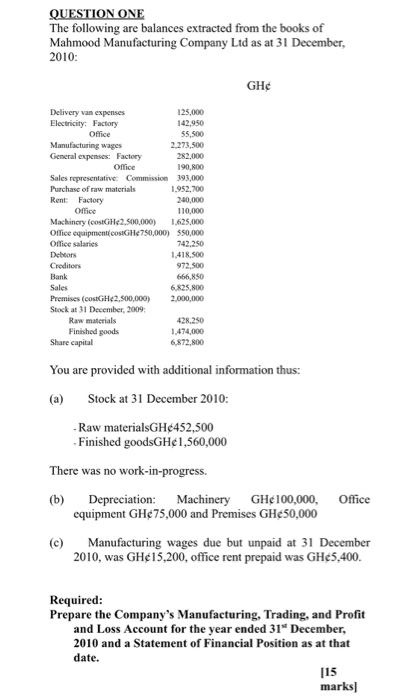

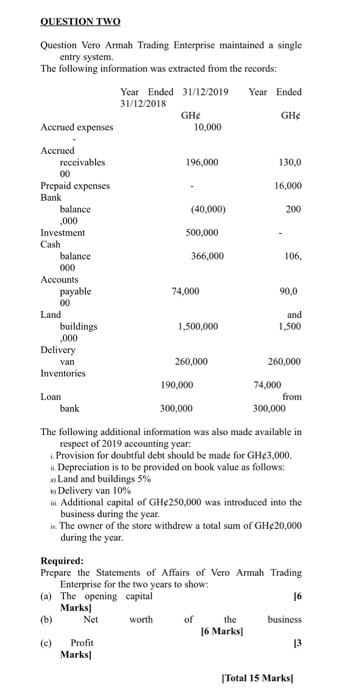

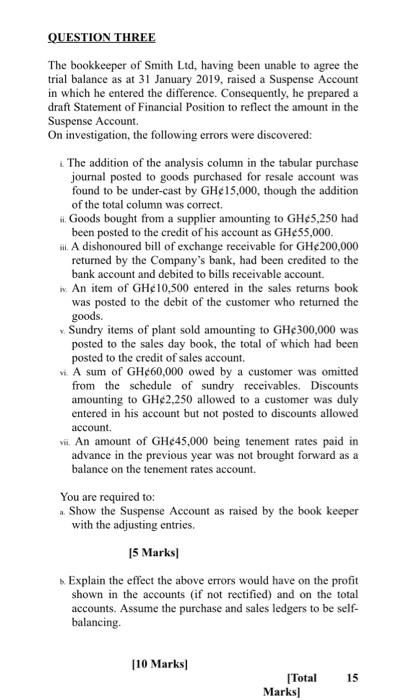

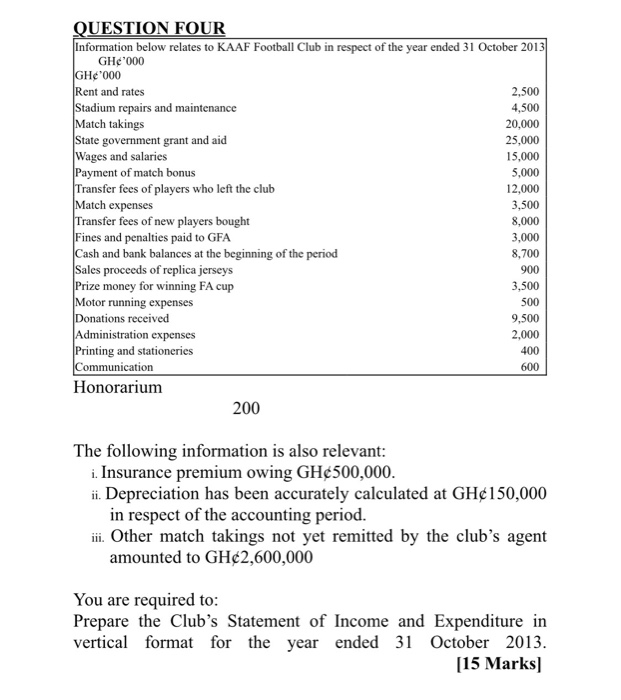

SECTION A SHORT ANSWER QUESTIONS (10 MARKS) ANSWER ALL QUESTIONS SECTION A Use the following information to answer questions 1 and 2 An equipment worth GH894,000 was purchased in year 2008. The depreciation rate is 20% per annum. 1. Calculate the depreciation for 2009, using straight-line method. 2. Calculate the depreciation for 2010, using the reducing balance method based on net book value at the end of 2009. 3. How are the profits and losses of a partnership shared when there is no partnership deed/agreement? 4. Subscription in arrears is treated in the balance sheet of a club as....... 5. When partners maintain fixed capital accounts, the journal entries for a partner's share of profit is...... 6. What is a self-balancing account? 7. A statement prepared periodically and sent by a banker to its customers is .... 8. Interest on a partner's drawing is debited to.........and credited to......... 9. The starting point for the preparation of final accounts from incomplete records is the preparation of 10. The accounting basis maintained in recording transactions in Receipts and Payments account of Not-For-Profit Organisation is..... QUESTION ONE The following are balances extracted from the books of Mahmood Manufacturing Company Ltd as at 31 December, 2010: GH Delivery van expenses 125,000 Electricity: Factory 142,950 Office 55,500 Manufacturing wages 2.273.500 General expenses: Factory 282,000 Office 190,800 Sales representative Commission 393,000 Purchase of raw materials 1.952,700 Rent: Factory 240,000 Office 110,000 Machinery (ostGH 2,500,000) 1.625,000 Office equipment(CosIGH750,000) $50,000 Oflice salaries 742.250 Debtors 1,418,500 Creditors 972.500 Bank 666,850 Sales 6.825,800 Premises (costGH(2,500,000) 2,000,000 Stock at 31 December 2009 Raw materials 428.250 Finished goods 1,474,000 Share capital 6,872,800 You are provided with additional information thus: (a) Stock at 31 December 2010: - Raw materialsGH452,500 - Finished goodsGH1,560,000 There was no work-in-progress. (b) Depreciation: Machinery GH100,000, Office equipment GH75,000 and Premises GH50,000 (c) Manufacturing wages due but unpaid at 31 December 2010, was GH15,200, office rent prepaid was GH5,400. Required: Prepare the Company's Manufacturing, Trading, and Profit and Loss Account for the year ended 31" December, 2010 and a Statement of Financial Position as at that date. [15 marks QUESTION TWO Question Vero Armah Trading Enterprise maintained a single entry system. The following information was extracted from the records: Year Ended 31/12/2019 Year Ended 31/12/2018 GHC GH Accrued expenses 10,000 196,000 130,0 16,000 (40,000) 200 500,000 366,000 106, Accrued receivables 00 Prepaid expenses Bank balance ,000 Investment Cash balance 000 Accounts payable 00 Land buildings ,000 Delivery van Inventories 74,000 90,0 1,500,000 and 1,500 260,000 260,000 190,000 Loan bank 74,000 from 300,000 300,000 The following additional information was also made available in respect of 2019 accounting year: Provision for doubtful debt should be made for GH3,000. ii. Depreciation is to be provided on book value as follows: a) Land and buildings 5% Delivery van 10% ii. Additional capital of GH250,000 was introduced into the business during the year. in. The owner of the store withdrew a total sum of GH20,000 during the year. Required: Prepare the Statements of Affairs of Vero Armah Trading Enterprise for the two years to show: (a) The opening capital 16 Marks Net worth of the business 16 Marks (e) Profit 13 Marks [Total 15 Marks QUESTION THREE The bookkeeper of Smith Ltd, having been unable to agree the trial balance as at 31 January 2019, raised a Suspense Account in which he entered the difference. Consequently, he prepared a draft Statement of Financial Position to reflect the amount in the Suspense Account On investigation, the following errors were discovered: i. The addition of the analysis column in the tabular purchase journal posted to goods purchased for resale account was found to be under-cast by GH15,000, though the addition of the total column was correct. Goods bought from a supplier amounting to GH5,250 had been posted to the credit of his account as GH55,000. ili. A dishonoured bill of exchange receivable for GH200,000 returned by the Company's bank, had been credited to the bank account and debited to bills receivable account. iv. An item of GH10,500 entered in the sales returns book was posted to the debit of the customer who returned the goods. Sundry items of plant sold amounting to GH300,000 was posted to the sales day book, the total of which had been posted to the credit of sales account. vi. A sum of GH60,000 owed by a customer was omitted from the schedule of sundry receivables. Discounts amounting to GH2,250 allowed to a customer was duly entered in his account but not posted to discounts allowed vii. An amount of GH45,000 being tenement rates paid in advance in the previous year was not brought forward as a balance on the tenement rates account. You are required to: Show the Suspense Account as raised by the book keeper with the adjusting entries. 15 Marks b. Explain the effect the above errors would have on the profit shown in the accounts (if not rectified) and on the total accounts. Assume the purchase and sales ledgers to be self- balancing. account. [10 Marks 15 [Total Marks QUESTION FOUR Information below relates to KAAF Football Club in respect of the year ended 31 October 2013 GH'000 GH'000 Rent and rates 2,500 Stadium repairs and maintenance 4,500 Match takings 20,000 State government grant and aid 25,000 Wages and salaries 15,000 Payment of match bonus 5,000 Transfer fees of players who left the club 12,000 Match expenses 3,500 Transfer fees of new players bought 8,000 Fines and penalties paid to GFA 3,000 Cash and bank balances at the beginning of the period 8,700 Sales proceeds of replica jerseys Prize money for winning FA cup 3,500 Motor running expenses 500 Donations received 9,500 Administration expenses 2,000 Printing and stationeries 400 Communication 600 Honorarium 200 900 The following information is also relevant: i. Insurance premium owing GH500,000. ii. Depreciation has been accurately calculated at GH150,000 in respect of the accounting period. ii. Other match takings not yet remitted by the club's agent amounted to GH2,600,000 You are required to: Prepare the Club's Statement of Income and Expenditure in vertical format for the year ended 31 October 2013. [15 Marks)