Answered step by step

Verified Expert Solution

Question

1 Approved Answer

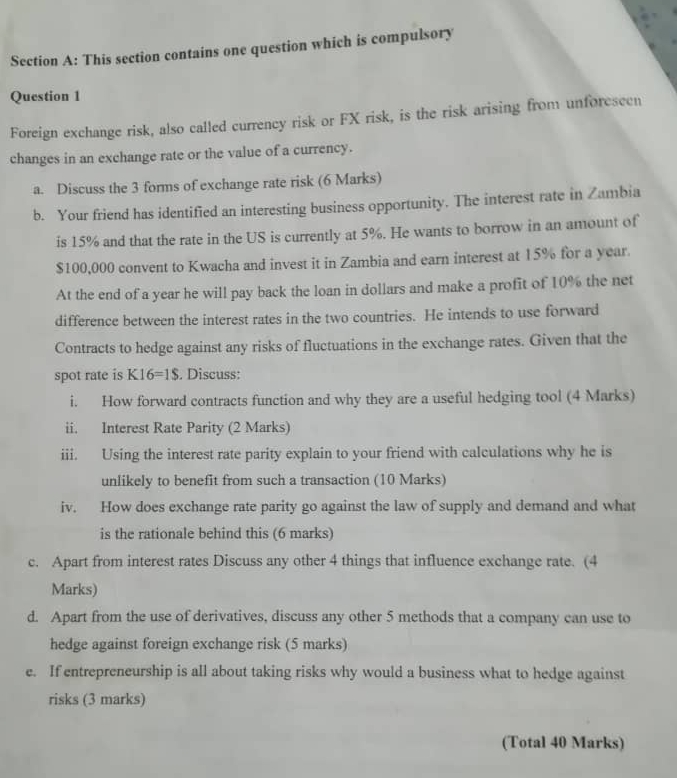

Section A: This section contains one question which is compulsory Question 1 Foreign exchange risk, also called currency risk or FX risk, is the

Section A: This section contains one question which is compulsory Question 1 Foreign exchange risk, also called currency risk or FX risk, is the risk arising from unforeseen changes in an exchange rate or the value of a currency. a. Discuss the 3 forms of exchange rate risk (6 Marks) b. Your friend has identified an interesting business opportunity. The interest rate in Zambia is 15% and that the rate in the US is currently at 5%. He wants to borrow in an amount of $100,000 convent to Kwacha and invest it in Zambia and earn interest at 15% for a year. At the end of a year he will pay back the loan in dollars and make a profit of 10% the net difference between the interest rates in the two countries. He intends to use forward Contracts to hedge against any risks of fluctuations in the exchange rates. Given that the spot rate is K16=1$. Discuss: i. ii. iii. iv. How forward contracts function and why they are a useful hedging tool (4 Marks) Interest Rate Parity (2 Marks) Using the interest rate parity explain to your friend with calculations why he is unlikely to benefit from such a transaction (10 Marks) How does exchange rate parity go against the law of supply and demand and what is the rationale behind this (6 marks) c. Apart from interest rates Discuss any other 4 things that influence exchange rate. (4 Marks) d. Apart from the use of derivatives, discuss any other 5 methods that a company can use to hedge against foreign exchange risk (5 marks) e. If entrepreneurship is all about taking risks why would a business what to hedge against risks (3 marks) (Total 40 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started