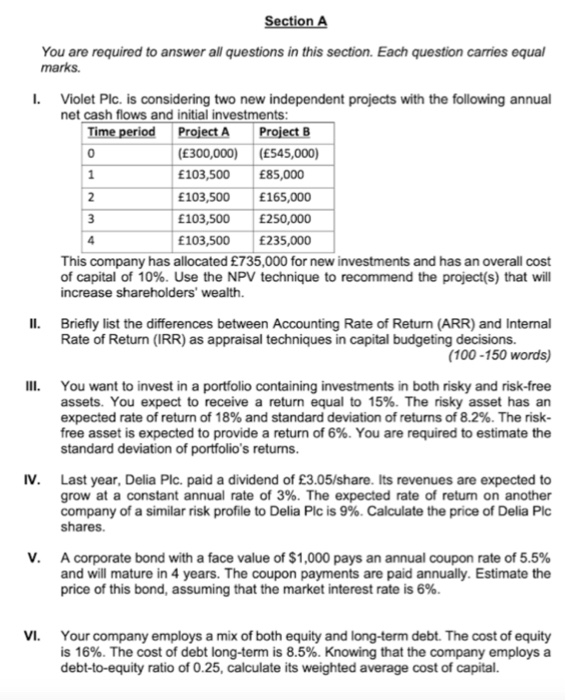

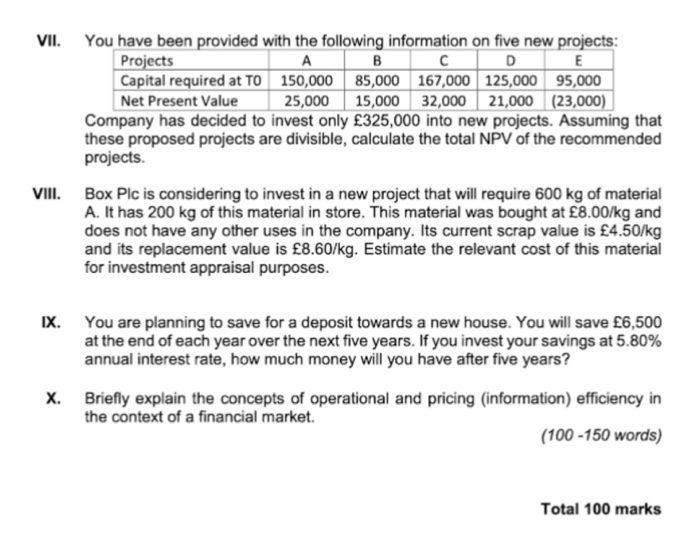

Section A You are required to answer all questions in this section. Each question carries equal marks. Violet Plc. is considering two new independent projects with the following annual net cash flows and initial investments: Time period Project A Project B (300,000) (545,000) 103,500 85,000 103,500 165,000 103,500 250,000 103,500 235,000 This company has allocated 735,000 for new investments and has an overall cost of capital of 10%. Use the NPV technique to recommend the project(s) that will increase shareholders' wealth. Briefly list the differences between Accounting Rate of Return (ARR) and Internal Rate of Return (IRR) as appraisal techniques in capital budgeting decisions. (100-150 words) III. You want to invest in a portfolio containing investments in both risky and risk-free assets. You expect to receive a return equal to 15%. The risky asset has an expected rate of return of 18% and standard deviation of returns of 8.2%. The risk- free asset is expected to provide a return of 6%. You are required to estimate the standard deviation of portfolio's returns. IV. Last year, Delia Plc. paid a dividend of 3.05/share. Its revenues are expected to grow at a constant annual rate of 3%. The expected rate of return on another company of a similar risk profile to Delia Plc is 9%. Calculate the price of Delia Plc shares. A corporate bond with a face value of $1,000 pays an annual coupon rate of 5.5% and will mature in 4 years. The coupon payments are paid annually. Estimate the price of this bond, assuming that the market interest rate is 6%. VI. Your company employs a mix of both equity and long-term debt. The cost of equity is 16%. The cost of debt long-term is 8.5%. Knowing that the company employs a debt-to-equity ratio of 0.25, calculate its weighted average cost of capital. VII. You have been provided with the following information on five new projects: Projects A B C D E Capital required at TO 150,000 85,000 167,000 125,000 95,000 Net Present Value 25,000 15,000 32,000 21,000 (23,000) Company has decided to invest only 325,000 into new projects. Assuming that these proposed projects are divisible, calculate the total NPV of the recommended projects. VIII. Box Plc is considering to invest in a new project that will require 600 kg of material A. It has 200 kg of this material in store. This material was bought at 8.00/kg and does not have any other uses in the company. Its current scrap value is 4.50/kg and its replacement value is 8.60/kg. Estimate the relevant cost of this material for investment appraisal purposes IX. You are planning to save for a deposit towards a new house. You will save 6,500 at the end of each year over the next five years. If you invest your savings at 5.80% annual interest rate, how much money will you have after five years? X Briefly explain the concepts of operational and pricing (information) efficiency in the context of a financial market. (100 - 150 words) Total 100 marks