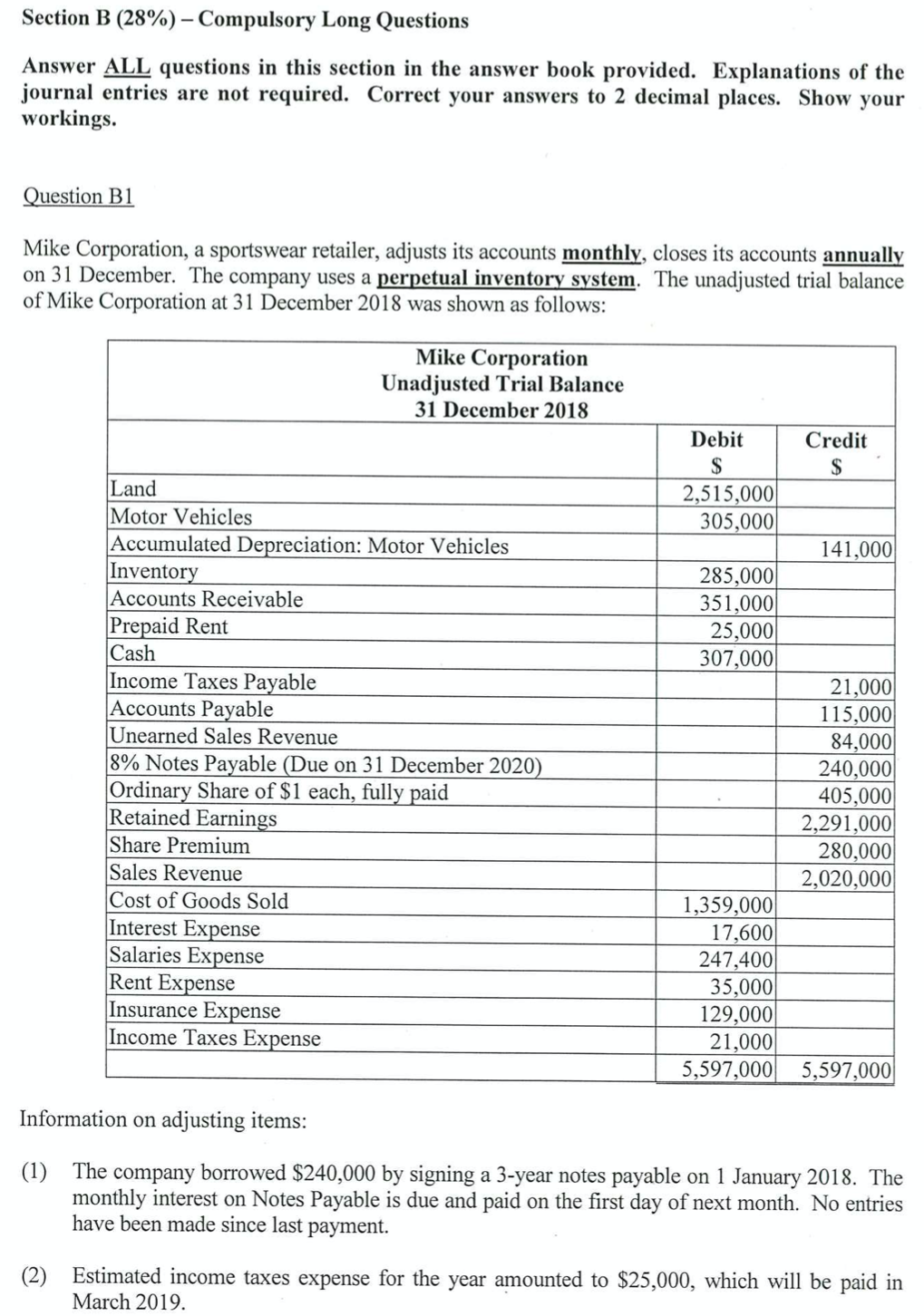

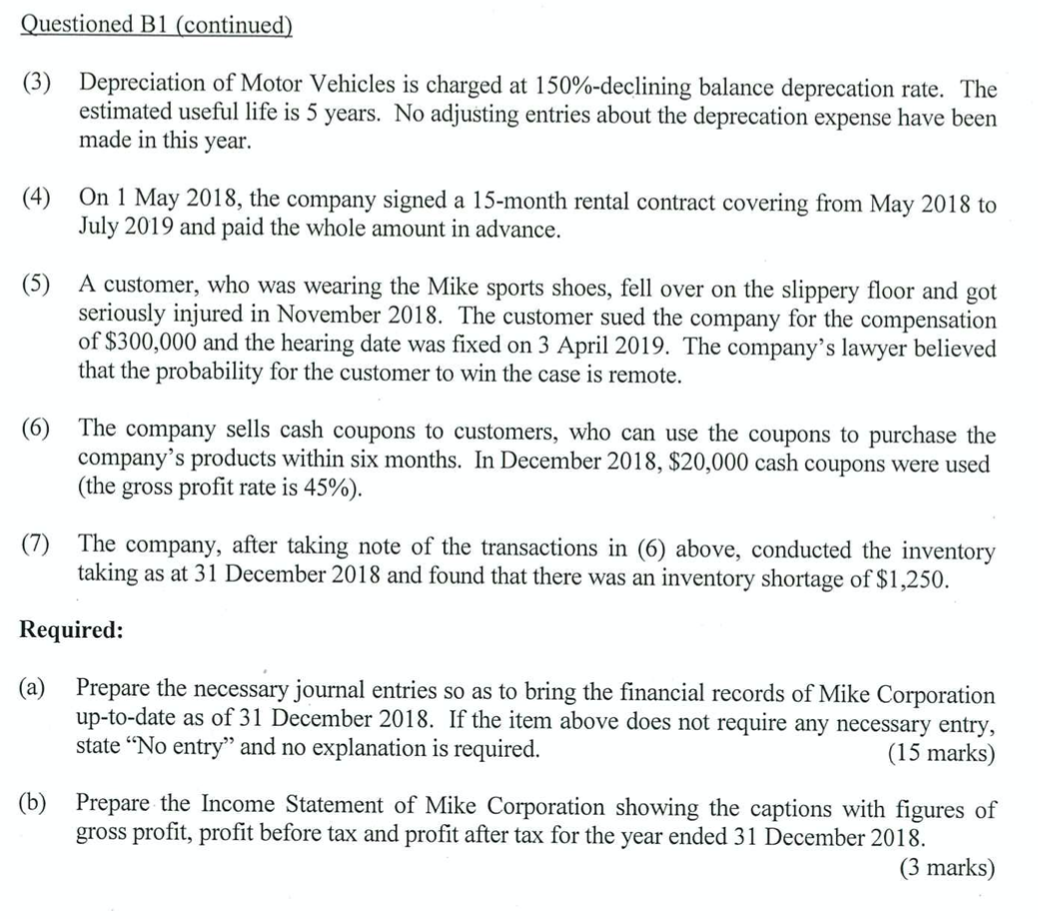

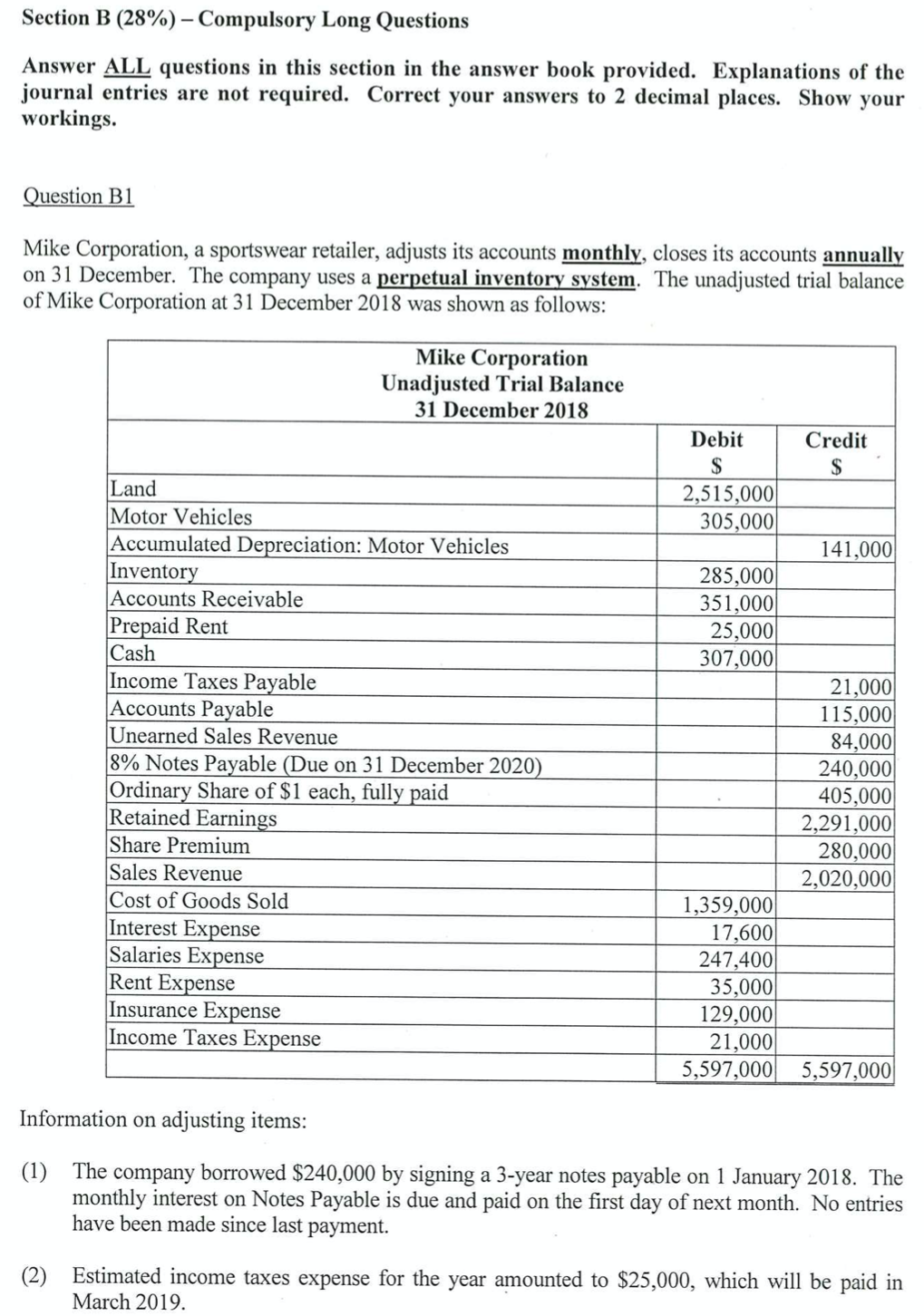

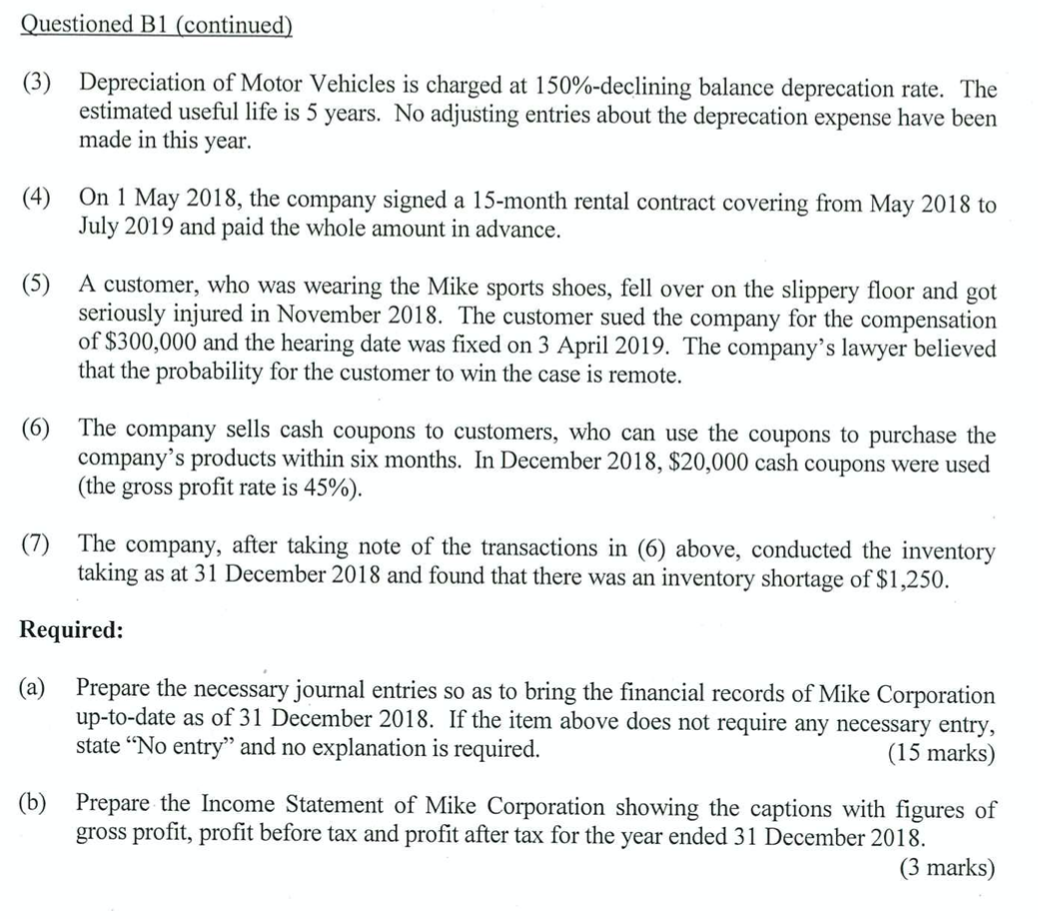

Section B (28%) - Compulsory Long Questions Answer ALL questions in this section in the answer book provided. Explanations of the journal entries are not required. Correct your answers to 2 decimal places. Show your workings. Question B1 Mike Corporation, a sportswear retailer, adjusts its accounts monthly, closes its accounts annually on 31 December. The company uses a perpetual inventory system. The unadjusted trial balance of Mike Corporation at 31 December 2018 was shown as follows: Mike Corporation Unadjusted Trial Balance 31 December 2018 Debit Credit S 2,515,000 305,000 141,000 285,000 351,000 25,000 307,000 Land Motor Vehicles Accumulated Depreciation: Motor Vehicles Inventory Accounts Receivable Prepaid Rent Cash Income Taxes Payable Accounts Payable Unearned Sales Revenue 8% Notes Payable (Due on 31 December 2020) Ordinary Share of $1 each, fully paid Retained Earnings Share Premium Sales Revenue Cost of Goods Sold Interest Expense Salaries Expense Rent Expense Insurance Expense Income Taxes Expense 21,000 115,000 84,000 240,000 405,000 2,291,000 280,000 2,020,000 1,359,000 17,600 247,400 35,000 129,000 21,000 5,597,000 5,597,000 Information on adjusting items: (1) The company borrowed $240,000 by signing a 3-year notes payable on 1 January 2018. The monthly interest on Notes Payable is due and paid on the first day of next month. No entries have been made since last payment. Estimated income taxes expense for the year amounted to $25,000, which will be paid in March 2019. Questioned B1 (continued) Depreciation of Motor Vehicles is charged at 150%-declining balance deprecation rate. The estimated useful life is 5 years. No adjusting entries about the deprecation expense have been made in this year. (4) On 1 May 2018, the company signed a 15-month rental contract covering from May 2018 to July 2019 and paid the whole amount in advance. (5) A customer, who was wearing the Mike sports shoes, fell over on the slippery floor and got seriously injured in November 2018. The customer sued the company for the compensation of $300,000 and the hearing date was fixed on 3 April 2019. The company's lawyer believed that the probability for the customer to win the case is remote. The company sells cash coupons to customers, who can use the coupons to purchase the company's products within six months. In December 2018, $20,000 cash coupons were used (the gross profit rate is 45%). The company, after taking note of the transactions in (6) above, conducted the inventory taking as at 31 December 2018 and found that there was an inventory shortage of $1,250. Required: (a) Prepare the necessary journal entries so as to bring the financial records of Mike Corporation up-to-date as of 31 December 2018. If the item above does not require any necessary entry, state "No entry and no explanation is required. (15 marks) (b) Prepare the Income Statement of Mike Corporation showing the captions with figures of gross profit, profit before tax and profit after tax for the year ended 31 December 2018