Answered step by step

Verified Expert Solution

Question

1 Approved Answer

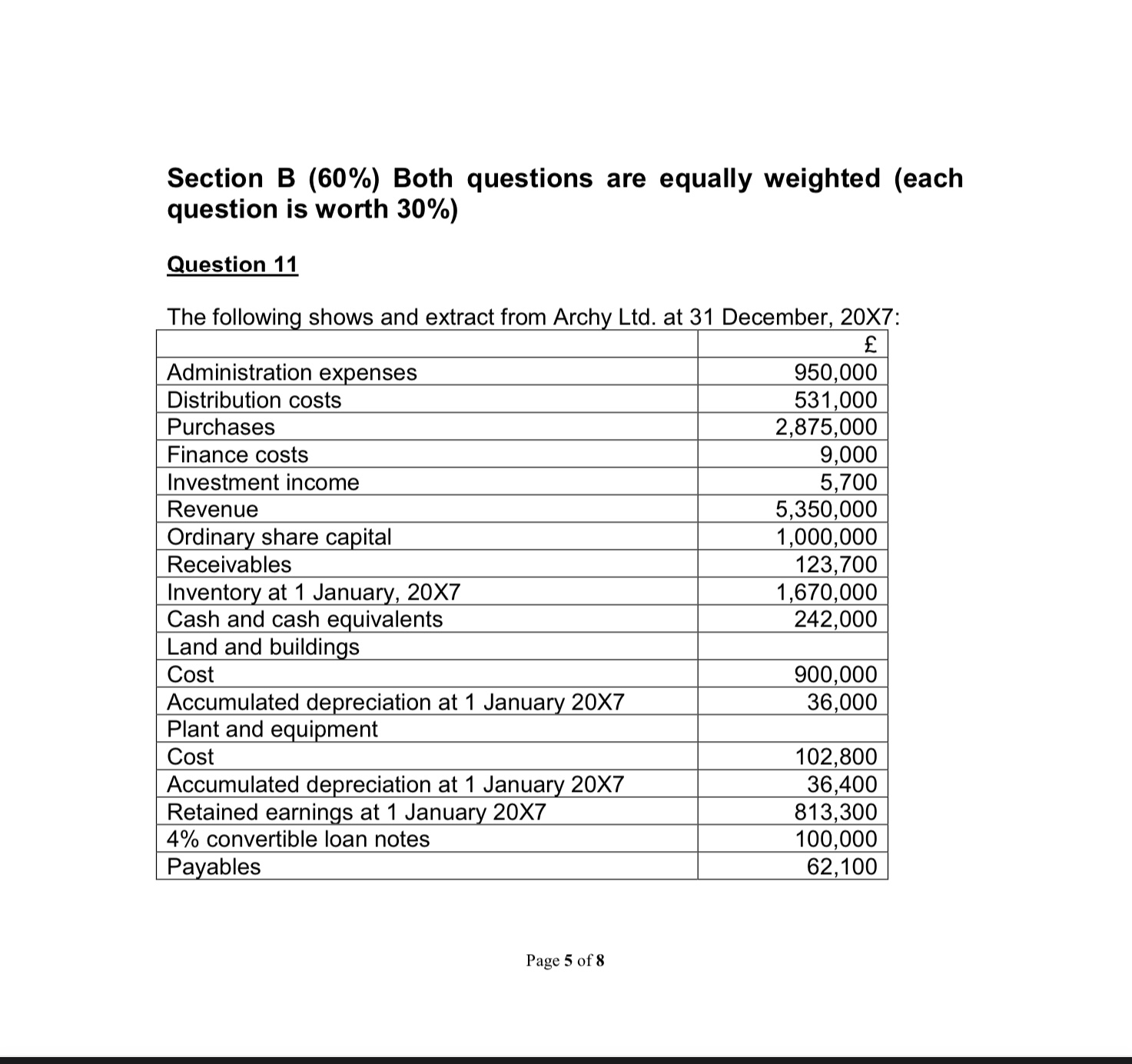

Section B (60 Both questions are equally weighted (each question is worth 30 ) Question 11 The followina shows and extract from Archv Ltd. at

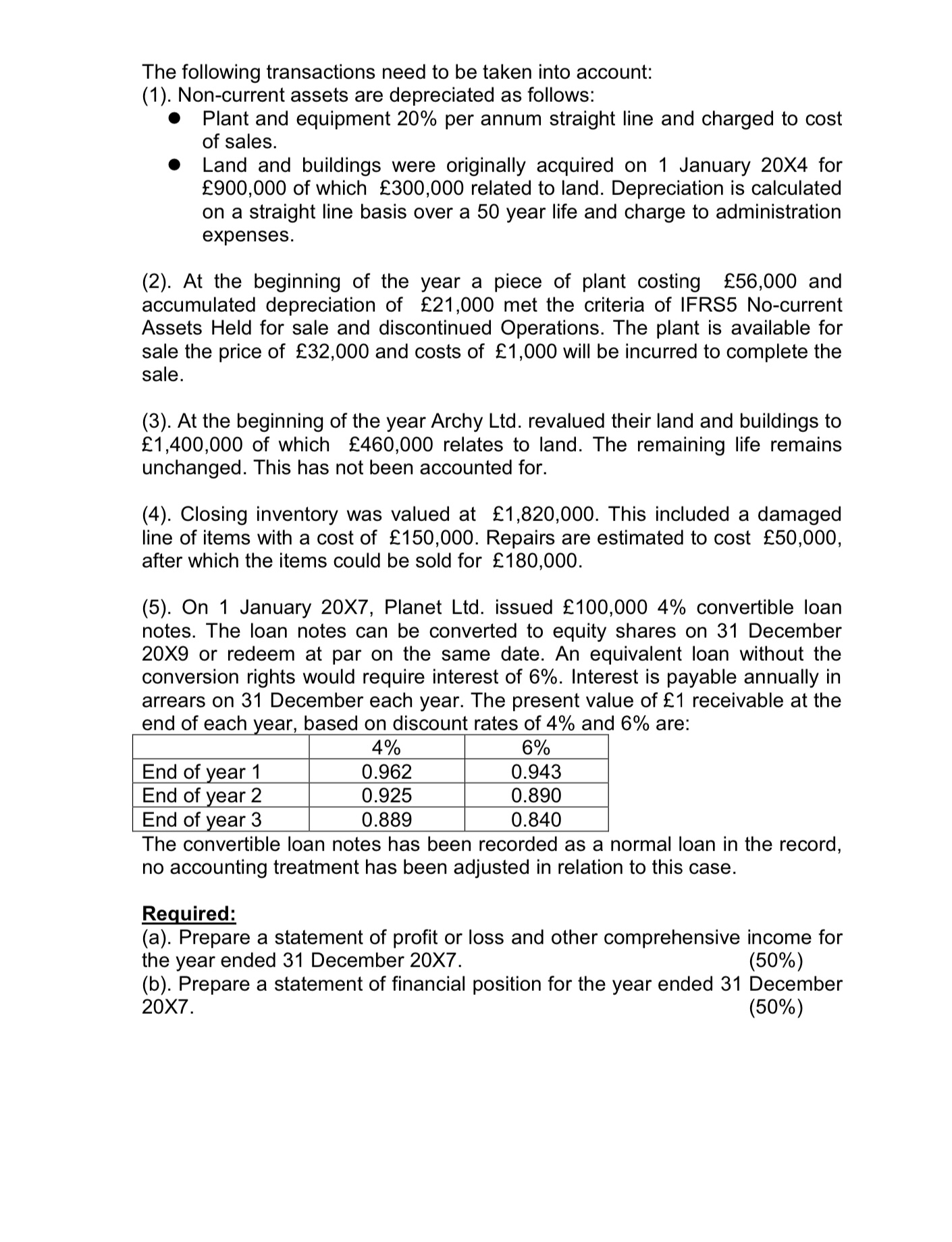

Section B \(60 Both questions are equally weighted (each question is worth \30 ) Question 11 The followina shows and extract from Archv Ltd. at 31 December. 20X7: Page 5 of 8 The following transactions need to be taken into account: (1). Non-current assets are depreciated as follows: - Plant and equipment \20 per annum straight line and charged to cost of sales. - Land and buildings were originally acquired on 1 January 20X4 for \\( 900,000 \\) of which \\( 300,000 \\) related to land. Depreciation is calculated on a straight line basis over a 50 year life and charge to administration expenses. (2). At the beginning of the year a piece of plant costing \\( 56,000 \\) and accumulated depreciation of \\( 21,000 \\) met the criteria of IFRS5 No-current Assets Held for sale and discontinued Operations. The plant is available for sale the price of \\( 32,000 \\) and costs of \\( 1,000 \\) will be incurred to complete the sale. (3). At the beginning of the year Archy Ltd. revalued their land and buildings to \\( 1,400,000 \\) of which \\( 460,000 \\) relates to land. The remaining life remains unchanged. This has not been accounted for. (4). Closing inventory was valued at \\( 1,820,000 \\). This included a damaged line of items with a cost of \\( 150,000 \\). Repairs are estimated to cost \\( 50,000 \\), after which the items could be sold for \\( 180,000 \\). (5). On 1 January 20X7, Planet Ltd. issued \100,0004 convertible loan notes. The loan notes can be converted to equity shares on 31 December 20X9 or redeem at par on the same date. An equivalent loan without the conversion rights would require interest of \6. Interest is payable annually in arrears on 31 December each year. The present value of \\( 1 \\) receivable at the end of each vear, based on discount rates of \4 and \6 are: The convertible loan notes has been recorded as a normal loan in the record, no accounting treatment has been adjusted in relation to this case. Required: (a). Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December \\( 20 \\times 7 \\). \(50 (b). Prepare a statement of financial position for the year ended 31 December \\( 20 \\times 7 \\). \(50

Section B \(60 Both questions are equally weighted (each question is worth \30 ) Question 11 The followina shows and extract from Archv Ltd. at 31 December. 20X7: Page 5 of 8 The following transactions need to be taken into account: (1). Non-current assets are depreciated as follows: - Plant and equipment \20 per annum straight line and charged to cost of sales. - Land and buildings were originally acquired on 1 January 20X4 for \\( 900,000 \\) of which \\( 300,000 \\) related to land. Depreciation is calculated on a straight line basis over a 50 year life and charge to administration expenses. (2). At the beginning of the year a piece of plant costing \\( 56,000 \\) and accumulated depreciation of \\( 21,000 \\) met the criteria of IFRS5 No-current Assets Held for sale and discontinued Operations. The plant is available for sale the price of \\( 32,000 \\) and costs of \\( 1,000 \\) will be incurred to complete the sale. (3). At the beginning of the year Archy Ltd. revalued their land and buildings to \\( 1,400,000 \\) of which \\( 460,000 \\) relates to land. The remaining life remains unchanged. This has not been accounted for. (4). Closing inventory was valued at \\( 1,820,000 \\). This included a damaged line of items with a cost of \\( 150,000 \\). Repairs are estimated to cost \\( 50,000 \\), after which the items could be sold for \\( 180,000 \\). (5). On 1 January 20X7, Planet Ltd. issued \100,0004 convertible loan notes. The loan notes can be converted to equity shares on 31 December 20X9 or redeem at par on the same date. An equivalent loan without the conversion rights would require interest of \6. Interest is payable annually in arrears on 31 December each year. The present value of \\( 1 \\) receivable at the end of each vear, based on discount rates of \4 and \6 are: The convertible loan notes has been recorded as a normal loan in the record, no accounting treatment has been adjusted in relation to this case. Required: (a). Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December \\( 20 \\times 7 \\). \(50 (b). Prepare a statement of financial position for the year ended 31 December \\( 20 \\times 7 \\). \(50 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started