Answered step by step

Verified Expert Solution

Question

1 Approved Answer

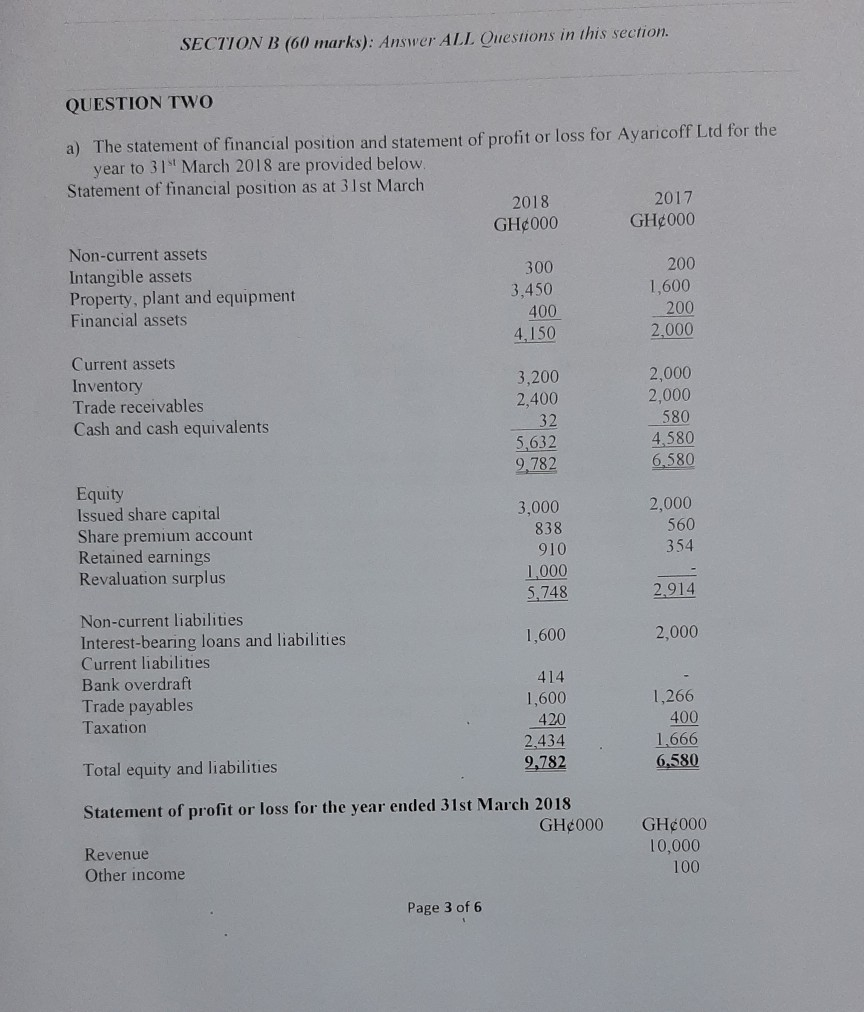

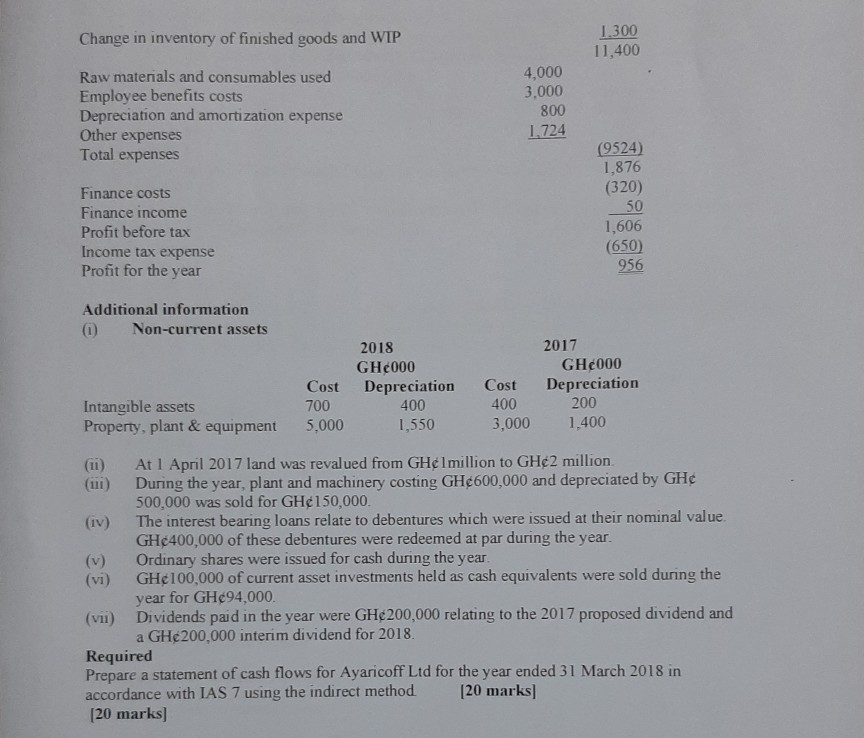

SECTION B (60 marks): Answer ALL Questions in this section. QUESTION TWO a) The statement of financial position and statement of profit or loss for

SECTION B (60 marks): Answer ALL Questions in this section. QUESTION TWO a) The statement of financial position and statement of profit or loss for Ayaricoff Ltd for the year to 31 March 2018 are provided below. Statement of financial position as at 31st March 2018 2017 GH000 GH000 Non-current assets Intangible assets 300 200 Property, plant and equipment 3.450 1,600 Financial assets 400 200 4,150 2.000 Current assets Inventory 3,200 2,000 Trade receivables 2,400 2,000 Cash and cash equivalents 32 580 5,632 4.580 2.782 6.580 Equity Issued share capital 3,000 2,000 Share premium account 838 560 Retained earnings 910 354 Revaluation surplus 1,000 5,748 2,914 Non-current liabilities Interest-bearing loans and liabilities 1,600 2,000 Current liabilities Bank overdraft 414 Trade payables 1,600 1,266 Taxation 420 2.434 1,666 Total equity and liabilities 2,782 6.580 400 Statement of profit or loss for the year ended 31st March 2018 GH4000 Revenue Other income GH000 10,000 100 Page 3 of 6 Change in inventory of finished goods and WIP 1.300 11,400 Raw materials and consumables used Employee benefits costs Depreciation and amortization expense Other expenses Total expenses 4,000 3.000 800 1.724 Finance costs Finance income Profit before tax Income tax expense Profit for the year (9524) 1,876 (320) 50 1,606 (650) 956 Additional information ( Non-current assets 2018 GH000 Depreciation 400 1,550 Cost 700 5,000 Intangible assets Property, plant & equipment 2017 GH000 Depreciation 200 1,400 Cost 400 3,000 (11) At 1 April 2017 land was revalued from GH Imillion to GH2 million During the year, plant and machinery costing GH600,000 and depreciated by GH 500,000 was sold for GH150,000. (IV) The interest bearing loans relate to debentures which were issued at their nominal value. GH400,000 of these debentures were redeemed at par during the year. Ordinary shares were issued for cash during the year. (vi) GH100,000 of current asset investments held as cash equivalents were sold during the year for GH94,000. (vii) Dividends paid in the year were GH200,000 relating to the 2017 proposed dividend and a GH200,000 interim dividend for 2018. Required Prepare a statement of cash flows for Ayaricoff Ltd for the year ended 31 March 2018 in accordance with IAS 7 using the indirect method [20 marks [20 marks] SECTION B (60 marks): Answer ALL Questions in this section. QUESTION TWO a) The statement of financial position and statement of profit or loss for Ayaricoff Ltd for the year to 31 March 2018 are provided below. Statement of financial position as at 31st March 2018 2017 GH000 GH000 Non-current assets Intangible assets 300 200 Property, plant and equipment 3.450 1,600 Financial assets 400 200 4,150 2.000 Current assets Inventory 3,200 2,000 Trade receivables 2,400 2,000 Cash and cash equivalents 32 580 5,632 4.580 2.782 6.580 Equity Issued share capital 3,000 2,000 Share premium account 838 560 Retained earnings 910 354 Revaluation surplus 1,000 5,748 2,914 Non-current liabilities Interest-bearing loans and liabilities 1,600 2,000 Current liabilities Bank overdraft 414 Trade payables 1,600 1,266 Taxation 420 2.434 1,666 Total equity and liabilities 2,782 6.580 400 Statement of profit or loss for the year ended 31st March 2018 GH4000 Revenue Other income GH000 10,000 100 Page 3 of 6 Change in inventory of finished goods and WIP 1.300 11,400 Raw materials and consumables used Employee benefits costs Depreciation and amortization expense Other expenses Total expenses 4,000 3.000 800 1.724 Finance costs Finance income Profit before tax Income tax expense Profit for the year (9524) 1,876 (320) 50 1,606 (650) 956 Additional information ( Non-current assets 2018 GH000 Depreciation 400 1,550 Cost 700 5,000 Intangible assets Property, plant & equipment 2017 GH000 Depreciation 200 1,400 Cost 400 3,000 (11) At 1 April 2017 land was revalued from GH Imillion to GH2 million During the year, plant and machinery costing GH600,000 and depreciated by GH 500,000 was sold for GH150,000. (IV) The interest bearing loans relate to debentures which were issued at their nominal value. GH400,000 of these debentures were redeemed at par during the year. Ordinary shares were issued for cash during the year. (vi) GH100,000 of current asset investments held as cash equivalents were sold during the year for GH94,000. (vii) Dividends paid in the year were GH200,000 relating to the 2017 proposed dividend and a GH200,000 interim dividend for 2018. Required Prepare a statement of cash flows for Ayaricoff Ltd for the year ended 31 March 2018 in accordance with IAS 7 using the indirect method [20 marks [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started