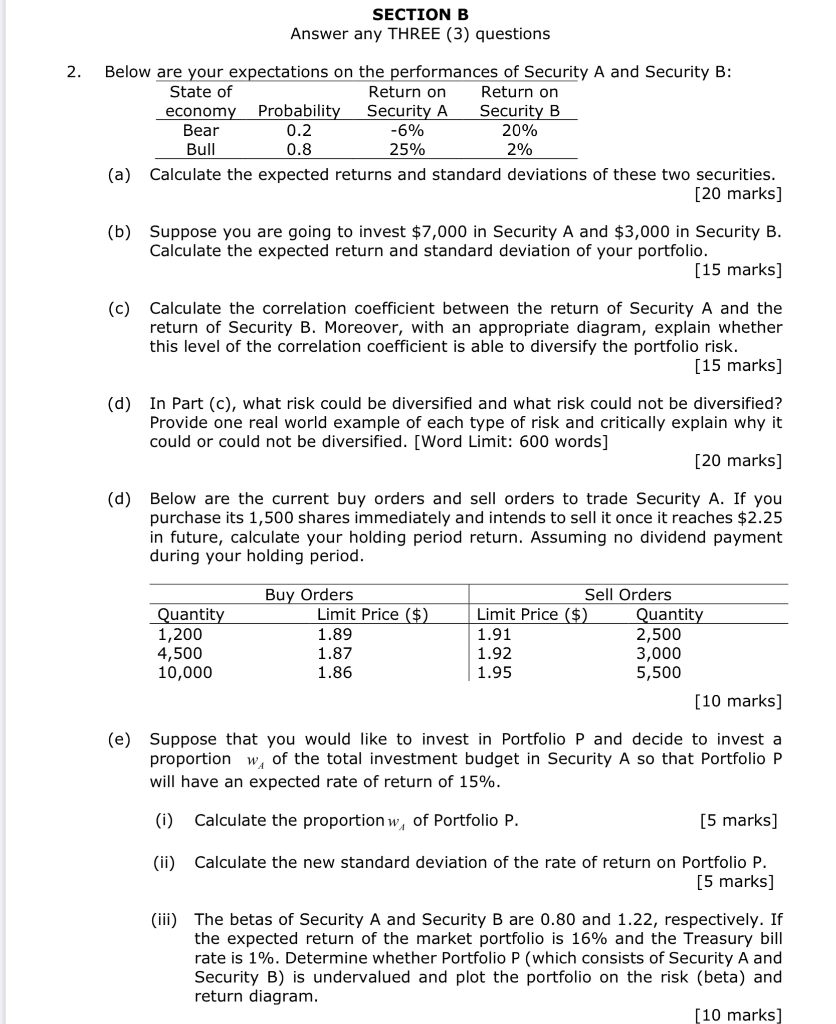

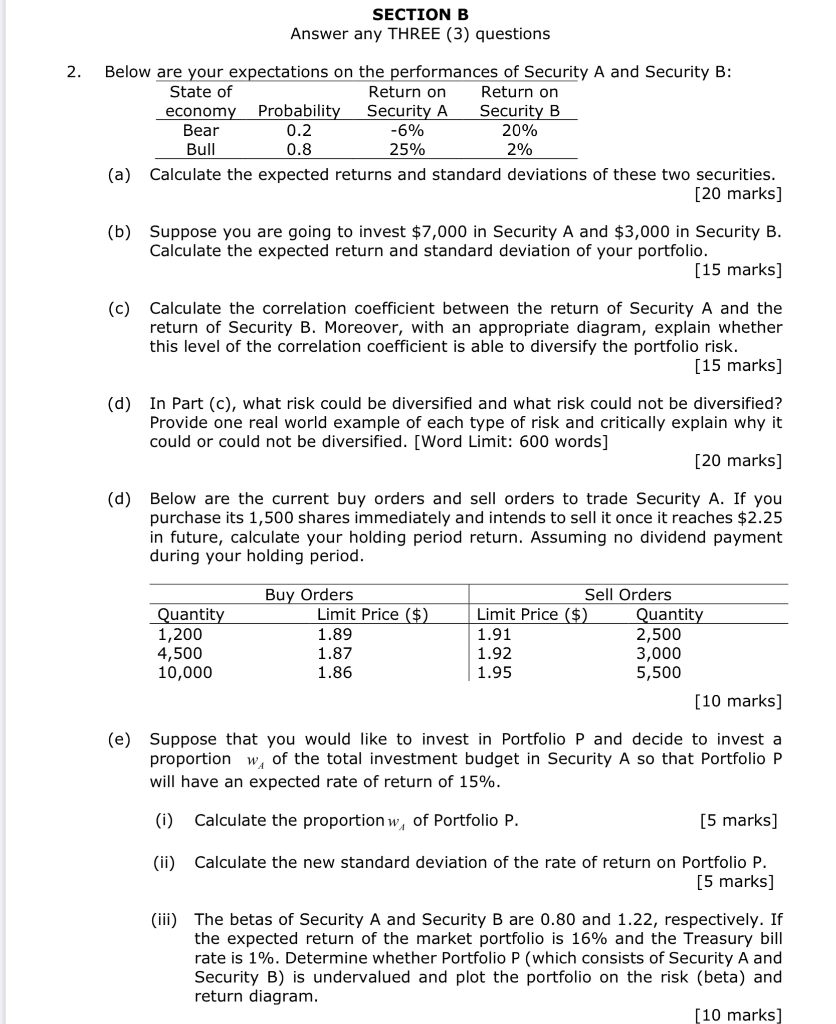

SECTION B Answer any THREE (3) questions 2. Below are your expectations on the performances of Security A and Security B: State of Return on Return on economy Probability Security A Security B Bear 0.2 -6% 20% Bull 0.8 25% 2% (a) Calculate the expected returns and standard deviations of these two securities. [20 marks] (b) Suppose you are going to invest $7,000 in Security A and $3,000 in Security B. Calculate the expected return and standard deviation of your portfolio. [15 marks] (c) Calculate the correlation coefficient between the return of Security A and the return of Security B. Moreover, with an appropriate diagram, explain whether this level of the correlation coefficient is able to diversify the portfolio risk. [15 marks] (d) In Part (c), what risk could be diversified and what risk could not be diversified? Provide one real world example of each type of risk and critically explain why it could or could not be diversified. [Word Limit: 600 words] [20 marks] (d) Below are the current buy orders and sell orders to trade Security A. If you purchase its 1,500 shares immediately and intends to sell it once it reaches $2.25 in future, calculate your holding period return. Assuming no dividend payment during your holding period. Quantity 1,200 4,500 10,000 Buy Orders Limit Price ($) 1.89 1.87 1.86 Sell Orders Limit Price ($) Quantity 1.91 2,500 1.92 3,000 1.95 5,500 [10 marks] () Suppose that you would like to invest in Portfolio P and decide to invest a proportion w, of the total investment budget in Security A so that Portfolio P will have an expected rate of return of 15%. (i) Calculate the proportion w, of Portfolio P. [5 marks] (ii) Calculate the new standard deviation of the rate of return on Portfolio P. [5 marks] (iii) The betas of Security A and Security B are 0.80 and 1.22, respectively. If the expected return of the market portfolio is 16% and the Treasury bill rate is 1%. Determine whether Portfolio P (which consists of Security A and Security B) is undervalued and plot the portfolio on the risk (beta) and return diagram. [10 marks]