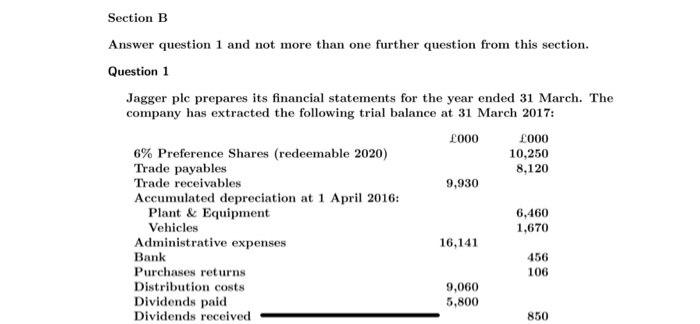

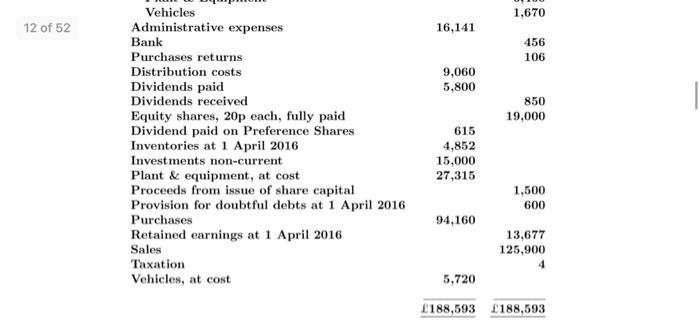

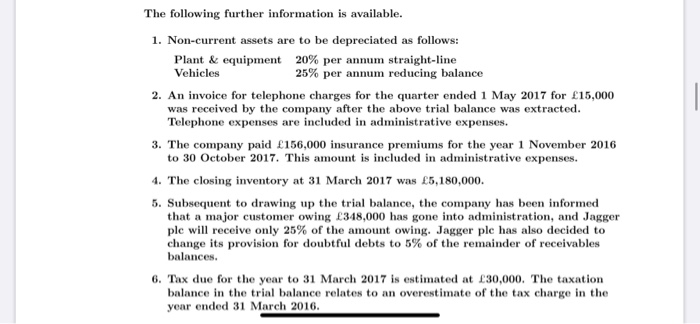

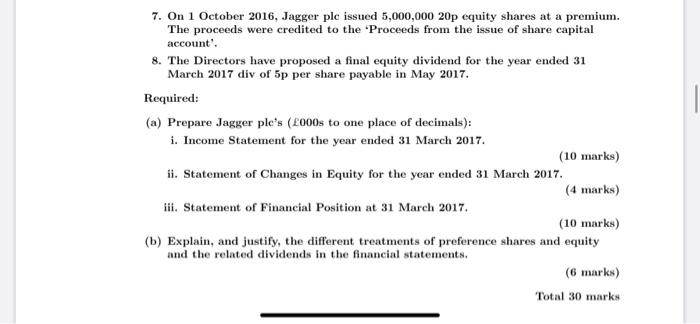

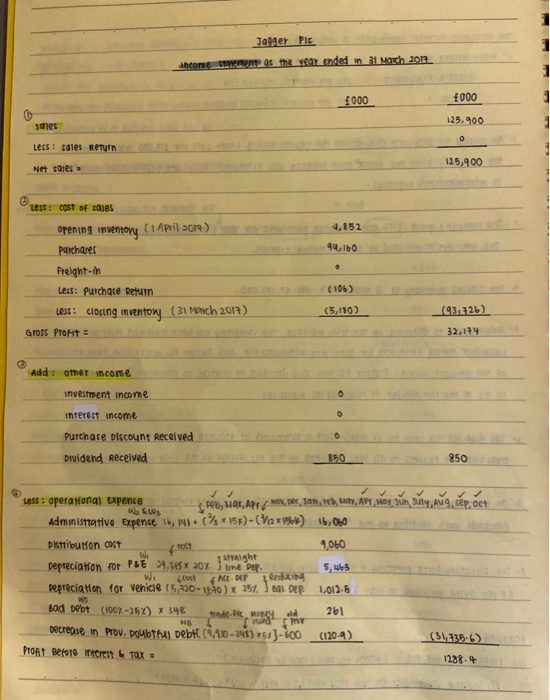

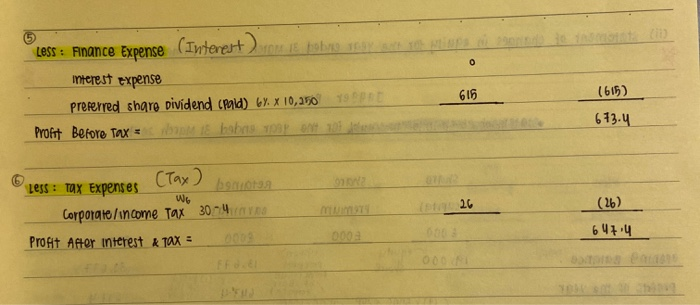

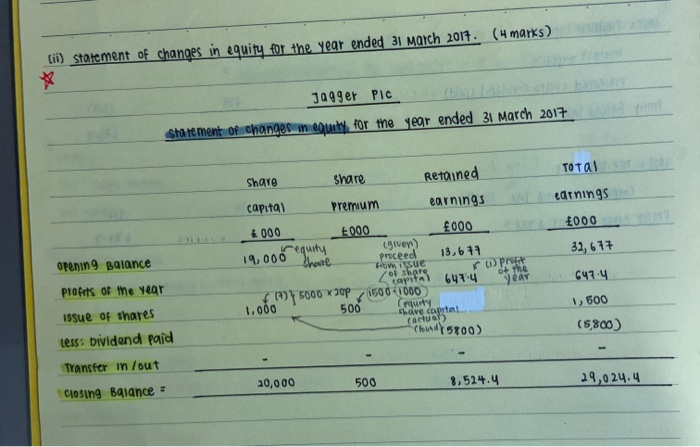

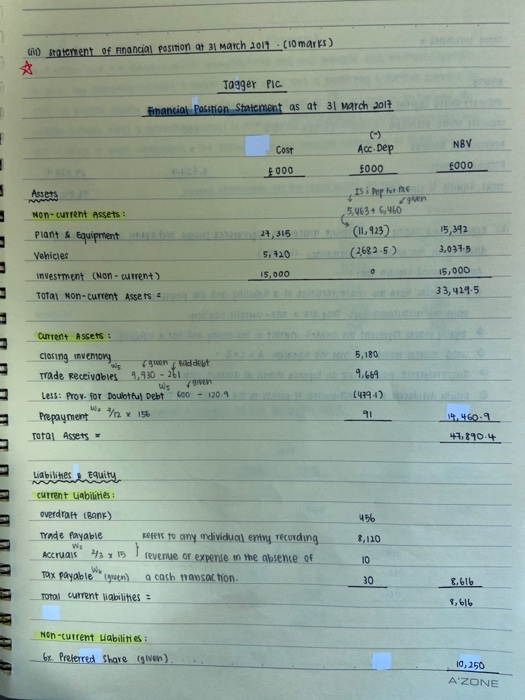

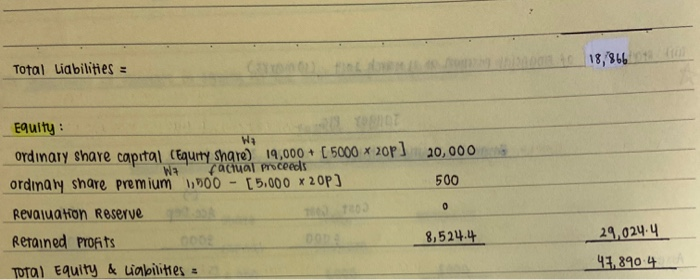

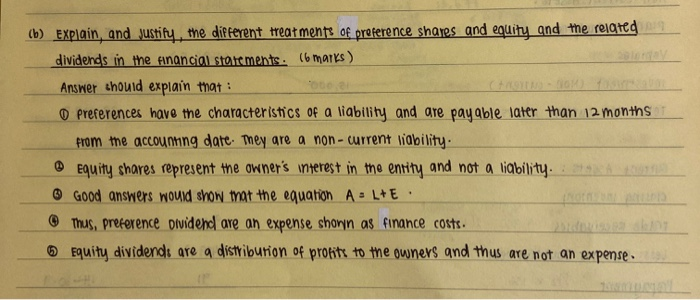

Section B Answer question 1 and not more than one further question from this section. Question 1 Jagger ple prepares its financial statements for the year ended 31 March. The company has extracted the following trial balance at 31 March 2017: 000 000 6% Preference Shares (redeemable 2020) 10,250 Trade payables 8,120 Trade receivables 9,930 Accumulated depreciation at 1 April 2016: Plant & Equipment 6,460 Vehicles 1,670 Administrative expenses 16,141 Bank Purchases returns Distribution costs 9,060 Dividends paid 5,800 Dividends received 456 106 850 1,670 12 of 52 16,141 456 106 9,060 5,800 850 19,000 Vehicles Administrative expenses Bank Purchases returns Distribution costs Dividends paid Dividends received Equity shares, 20p each, fully paid Dividend paid on Preference Shares Inventories at 1 April 2016 Investments non-current Plant & equipment, at cost Proceeds from issue of share capital Provision for doubtful debts at 1 April 2016 Purchases Retained earnings at 1 April 2016 Sales Taxation Vehicles, at cost 615 4,852 15,000 27,315 1,500 600 94,160 13,677 125,900 4 5,720 188,593 188,593 The following further information is available. 1. Non-current assets are to be depreciated as follows: Plant & equipment 20% per annum straight-line Vehicles 25% per annum reducing balance 2. An invoice for telephone charges for the quarter ended 1 May 2017 for 15,000 was received by the company after the above trial balance was extracted. Telephone expenses are included in administrative expenses. 3. The company paid 156,000 insurance premiums for the year 1 November 2016 to 30 October 2017. This amount is included in administrative expenses. 4. The closing inventory at 31 March 2017 was 5,180,000. 5. Subsequent to drawing up the trial balance, the company has been informed that a major customer owing 348,000 has gone into administration, and Jagger ple will receive only 25% of the amount owing. Jagger ple has also decided to change its provision for doubtful debts to 5% of the remainder of receivables balances. 6. Tax due for the year to 31 March 2017 is estimated at 30,000. The taxation balance in the trial balance relates to an overestimate of the tax charge in the year ended 31 March 2016. 7. On 1 October 2016, Jagger plc issued 5,000,000 20p equity shares at a premium. The proceeds were credited to the 'Proceeds from the issue of share capital account'. 8. The Directors have proposed a final equity dividend for the year ended 31 March 2017 div of 5p per share payable in May 2017. Required: (a) Prepare Jagger ple's (000s to one place of decimals): i. Income Statement for the year ended 31 March 2017. (10 marks) ii. Statement of Changes in Equity for the year ended 31 March 2017. (4 marks) ili. Statement of Financial Position at 31 March 2017 (10 marks) (b) Explain, and justify, the different treatments of preference shares and equity and the related dividends in the financial statements. (6 marks) Total 30 marks Joter PLC ancome somentes the rear ended on March 2012 1000 f000 sales 125.900 0 Less : sales Return 125,400 Net ties - 4,852 94,160 . Tess: cost of sales opening inventory (1 April Bor) purchaser Freight-in Less: Purchate Return Lest: closing inventon ( 31 March 2017) GROSS Profit (105) (5.110) (93.726) 32,174 Add: other income investment income O interest income O Purchase Discount Received Dividend Received 850 850 Less: opera angl expense Teb, MOR, APP No, pec, Tan, teh, Way, APY, May, wn, Buty, Aug, sep, oct Was Administrative Expense 1,141c) * 158)-(Vax96) 16,060 Distribution cost 4,060 Depreciation for PLE 24,315 * 202 lime Dep. 5,465 wi Depreciation for Vehicle (5,420-10) x 251. Bl. Der 1,012.5 Bod debt (1007.-254) X 348 hedefe med 261 FA Decrease in prov. Doubtful Debt. (9,130-247) 751)-600 (120-4) (31,720.6) Pront Befoto interest LTOX 1288.4 MEDEP ws WS 0 Less : Finance Expense (Interest) Ebone mterest Expense preferred share dividend (Mald) by. X 10,2501SPD Profit Before Tax = 18 babe 103 00 101 616 (615) 613.4 26 (26) Less : Tax Expenses (Tax) bspot W6 Corporate/income Tax 304 Profit After interest & Tax = Ef de 000 64714 000 li) statement of changes in equity for the year ended 31 March 2017. (4 marks) Jagger PIC Statement of changes in equity for the year ended 31 March 2017 Total earnings 000 Share Share Retained capital Premium earnings 6 000 1000 000 requity Lower) 19,000 Share proceed 13,6 11 How issue of Share 647-4 (1) 5000 w20p 1500 1000 1.000 500 Crusty have capital (actuals 32,677 openin 9 Balance PE ot the Year 647.4 capital Profets of the Year 1,500 issue of shares ters: bividend paid Cloudy 5800) (5,800) Transfer in/out 20,000 500 8.524.4 29,024.4 closing Balance - 00 Statement of Financial position at 31 March 2011 (10 marks) X Tagger PIC Financial Position Statement as at 31 March 2017 NBV Cost Acc Dep $000 1000 000 Assets y Is i pep hi guer Non-current Assets Plant & Equipment Vehicles 5,463 + 6,960 (11 423) (2682.5) 15,342 5, 120 3,037.5 15,000 0 Investment (Non-current) 15,000 33,429.5 Total Non-Current Assets Current Assets: 5,180 closing inventory ws gerad det Trade Receivables 4.430 - 261 us Less: Prov. for Doubtful Debt 600 130.4 Prepayment Total Assets - 4.64 (4794) syn x 15 91 1.460.9 47.890.4 456 Liabilines Equity current Liabilities: overdratt (BANK) Trade Payable Refers to any individual entry recording W; Accruals 43 Y 15 revenue or expense in the absence of Tax Payallegum a cash transaction. Total current liabilities: 8,120 1 10 30 8.616 8,616 NON "Current Liabilities: bx Prelerred Shave given) 10, 250 A'ZONE to 18,866 Total Liabilities : WA Equity : ordinary share capital (Equity share) 14,000+ [ 5000 x 20p] 20,000 Wa factual proceeds ordinary share premium 1,900 - [5,000 x 20p] 500 0 Revaluation Reserve Retained profits CODE 8,524.4 29,024.4 47.890 4_ Total Equity & Liabilities : (b) Explain, and justify, the different treatments of preference shares and equity and the related dividends in the financial statements. (6 marks) Answer should explain that: o preferences have the characteristics of a liability and are payable later than 12 months from the accounting date. They are a non-current liability. Equity shares represent the owner's interest in the entity and not a liability. Good answers would show that the equation A : LE Thus, preference dividend are an expense shown as finance costs. Equity dividends are a distribution of profits to the owners and thus are not an expense. I have completed an ! () : income statement, Statement of Financial position & statement of changes. I need help with ani(b). I attached the guideline to an ilb), but I need Cg detailed answer wrth explanation. Thank You