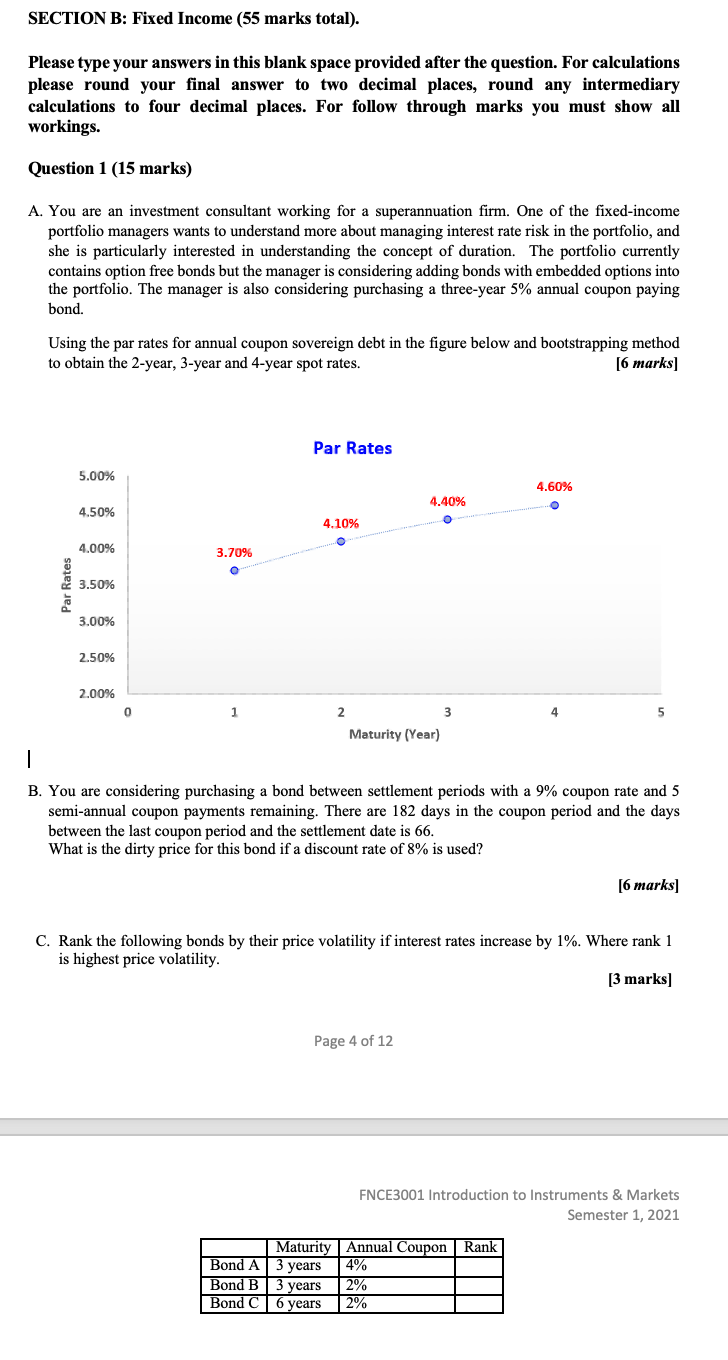

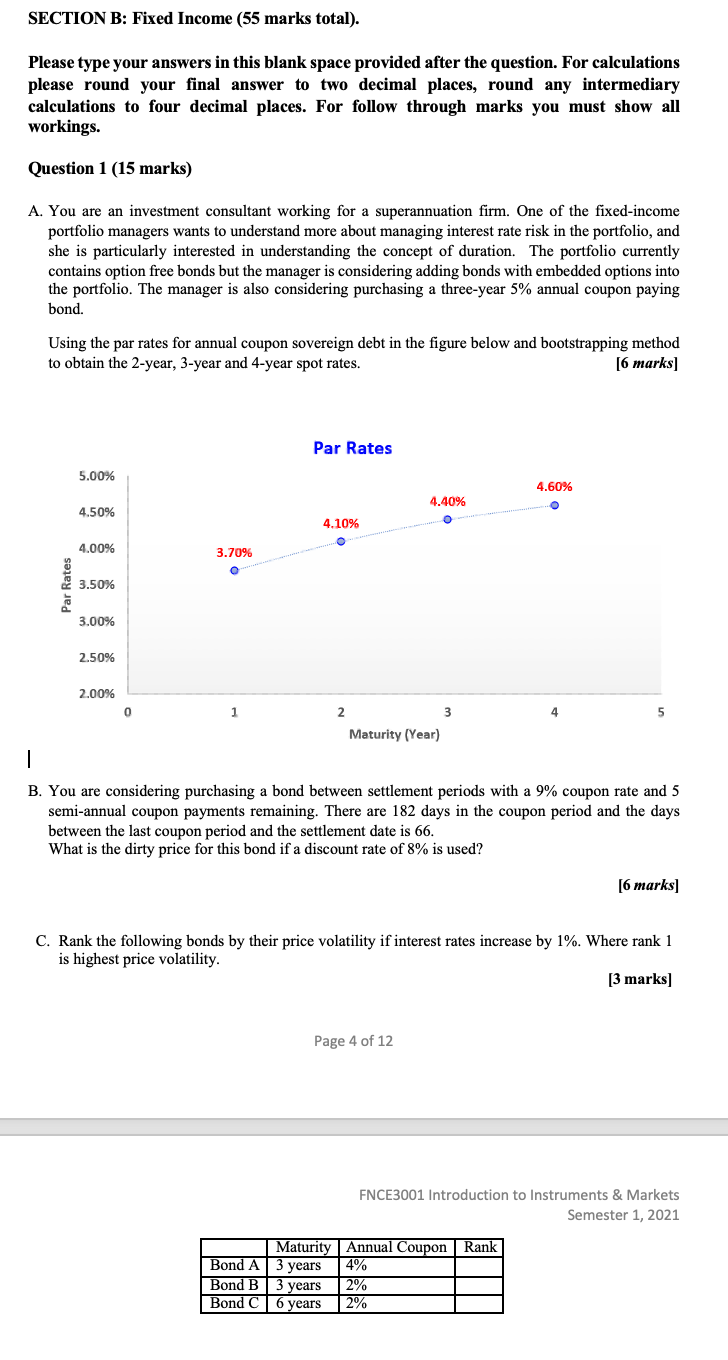

SECTION B: Fixed Income (55 marks total). Please type your answers in this blank space provided after the question. For calculations please round your final answer to two decimal places, round any intermediary calculations to four decimal places. For follow through marks you must show all workings. Question 1 (15 marks) A. You are an investment consultant working for a superannuation firm. One of the fixed-income portfolio managers wants to understand more about managing interest rate risk in the portfolio, and she is particularly interested in understanding the concept of duration. The portfolio currently contains option free bonds but the manager is considering adding bonds with embedded options into the portfolio. The manager is also considering purchasing a three-year 5% annual coupon paying bond Using the par rates for annual coupon sovereign debt in the figure below and bootstrapping method to obtain the 2-year, 3-year and 4-year spot rates. [6 marks] Par Rates 5.00% 4.60% 4.40% 4.50% O 4.10% 4.00% 3.70% o Par Rates 3.50% 3.00% 2.50% 2.00% 0 1 2 3 4 Maturity (Year) 1 B. You are considering purchasing a bond between settlement periods with a 9% coupon rate and 5 semi-annual coupon payments remaining. There are 182 days in the coupon period and the days between the last coupon period and the settlement date is 66. What is the dirty price for this bond if a discount rate of 8% is used? [6 marks] C. Rank the following bonds by their price volatility if interest rates increase by 1%. Where rank 1 is highest price volatility. [3 marks) Page 4 of 12 FNCE3001 Introduction to Instruments & Markets Semester 1, 2021 Maturity Annual Coupon Rank Bond A 3 years 4% Bond B3 years 2% Bond C 6 years 2% SECTION B: Fixed Income (55 marks total). Please type your answers in this blank space provided after the question. For calculations please round your final answer to two decimal places, round any intermediary calculations to four decimal places. For follow through marks you must show all workings. Question 1 (15 marks) A. You are an investment consultant working for a superannuation firm. One of the fixed-income portfolio managers wants to understand more about managing interest rate risk in the portfolio, and she is particularly interested in understanding the concept of duration. The portfolio currently contains option free bonds but the manager is considering adding bonds with embedded options into the portfolio. The manager is also considering purchasing a three-year 5% annual coupon paying bond Using the par rates for annual coupon sovereign debt in the figure below and bootstrapping method to obtain the 2-year, 3-year and 4-year spot rates. [6 marks] Par Rates 5.00% 4.60% 4.40% 4.50% O 4.10% 4.00% 3.70% o Par Rates 3.50% 3.00% 2.50% 2.00% 0 1 2 3 4 Maturity (Year) 1 B. You are considering purchasing a bond between settlement periods with a 9% coupon rate and 5 semi-annual coupon payments remaining. There are 182 days in the coupon period and the days between the last coupon period and the settlement date is 66. What is the dirty price for this bond if a discount rate of 8% is used? [6 marks] C. Rank the following bonds by their price volatility if interest rates increase by 1%. Where rank 1 is highest price volatility. [3 marks) Page 4 of 12 FNCE3001 Introduction to Instruments & Markets Semester 1, 2021 Maturity Annual Coupon Rank Bond A 3 years 4% Bond B3 years 2% Bond C 6 years 2%