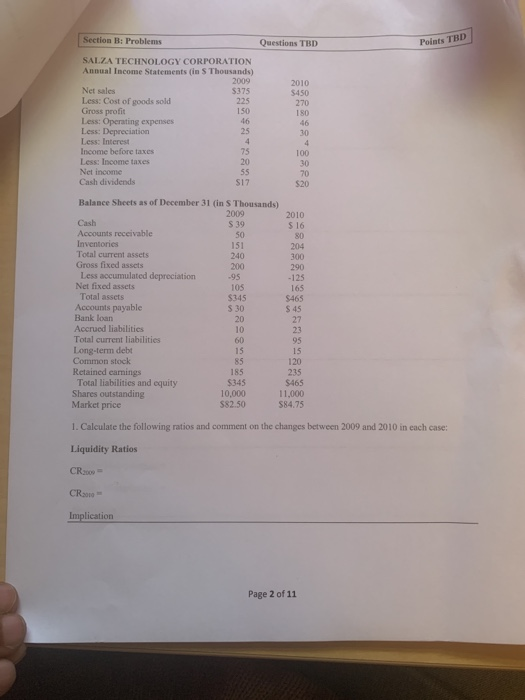

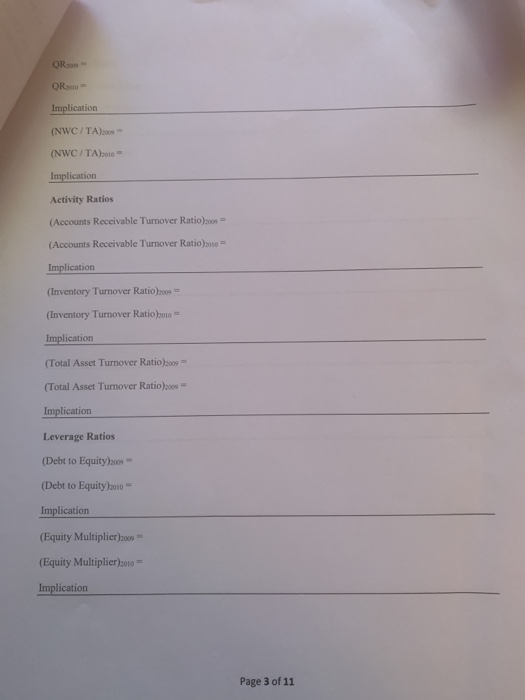

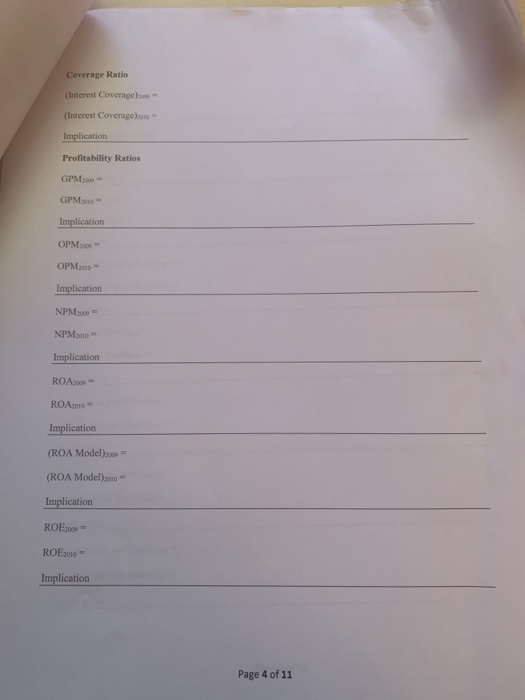

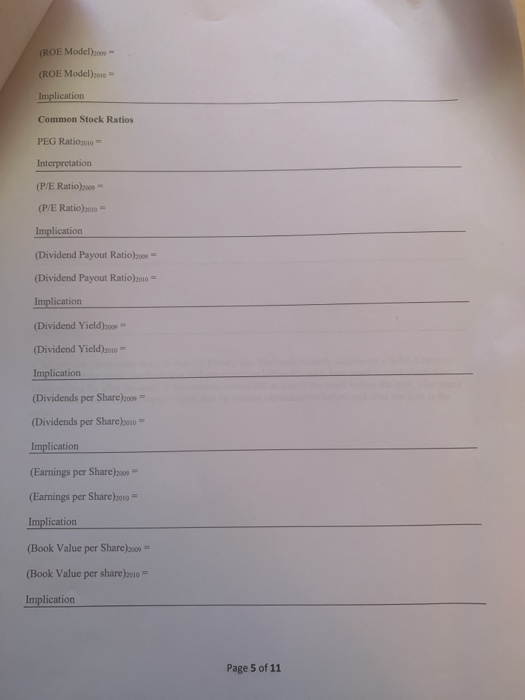

Section B: Problems Questions TBD Points TBD 2010 $450 270 ISO SALZA TECHNOLOGY CORPORATION Annual Income Statements in S Thousands) 2009 Net sales $175 Less: Cost of goods sold 225 Gross profit 150 Less: Operating expenses Less: Depreciation 25 Less: Interest Income before taxes 75 Less Income taxes Net income Cash dividends 46 30 100 30 S12 520 300 290 -95 5145 Balance Sheets as of December 31 (in S Thousands) 2009 2010 Cash S 39 5 16 Accounts receivable Inventories 151 204 Total current assets 240 Gross fixed assets 200 Less accumulated depreciation -125 Net fixed assets 105 165 Total assets $465 Accounts payable S 30 $ 45 Bank loan Accrued liabilities Total current liabilities 95 Long-term debt Common stock Retained earnings 185 235 Total liabilities and equity S345 $465 Shares outstanding 10,000 11,000 Market price 582.50 $84.75 20 15 120 1. Calculate the following ratios and comment on the changes between 2009 and 2010 in each case: Liquidity Ratios CR. CR300 Implication Page 2 of 11 QR- OR300 Implication (NWC/TA) (NWC/TA) Implication Activity Ratios (Accounts Receivable Turnover Ratio) = (Accounts Receivable Turnover Ratio) = Implication (Inventory Turnover Ratio) (Inventory Turnover Ratio) Implication (Total Asset Turnover Ratio) 2009 - (Total Asset Turnover Ratio) Implication Leverage Ratios (Debt to Equity (Debt to Equity Implication (Equity Multiplier) 2009 (Equity Multiplier)2010 Implication Page 3 of 11 Coverage Ratio (Interest Coverage)2009 (Interest Coverage) - Implication Profitability Ratios GPM- GPM Implication OPM3009 OPM310 Implication NPM2009 NPM 2010 - Implication ROA2000 - ROA2010 Implication (ROA Model) = (ROA Model)2010 - Implication ROE2009 ROE2010 Implication Page 4 of 11 (ROE Model) - (ROE Model)2010 Implication Common Stock Ratios PEG Ratio Interpretation (P/E Ratio) (P/E Ratio)10 - Implication (Dividend Payout Ratio) = (Dividend Payout Ratio Implication (Dividend Yield) (Dividend Yield)2010 Implication (Dividends per Share) = (Dividends per Share) = Implication (Earnings per Share)2009 (Earnings per Share)2010 = Implication (Book Value per Share)2009 = (Book Value per share)2010 = Implication Page 5 of 11 (P/B Ratio)2009 = (P/B Ratio)2010 = Implication (P/S Ratio)2009 = (P/S Ratio)2010 = Implication Growth Rates IGR2009 = IGR2010 = Implication SGR2009 = SGR2010 = Implication