Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Section B Question 1 i. You put in GH 10,000 today in an investment account that will yield 10% p.a. for 4 years. What is

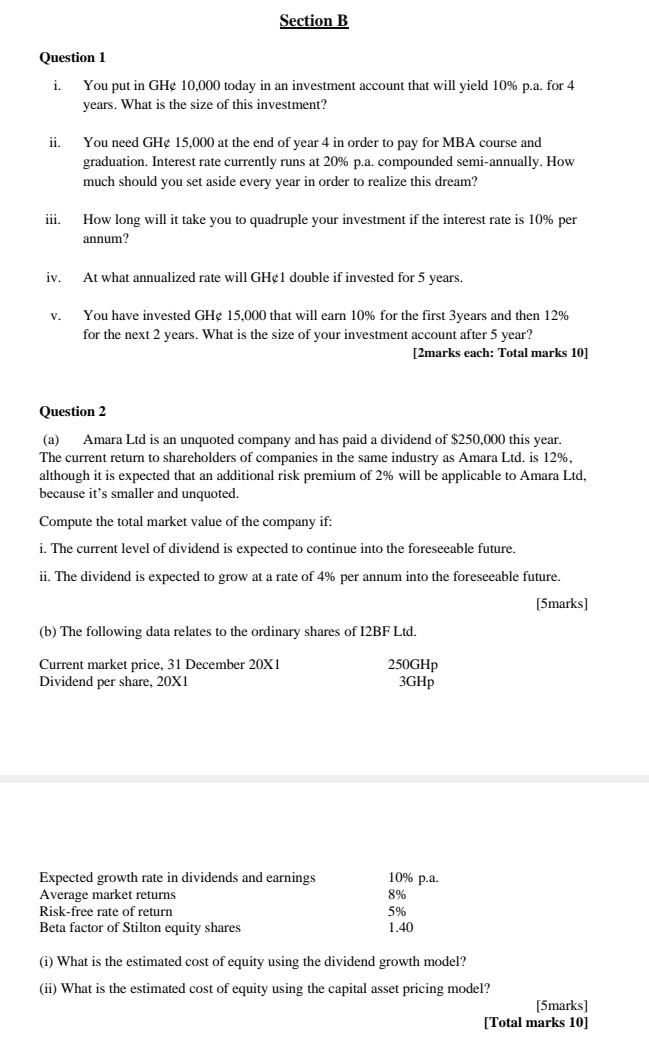

Section B Question 1 i. You put in GH 10,000 today in an investment account that will yield 10% p.a. for 4 years. What is the size of this investment? ii. You need GH 15,000 at the end of year 4 in order to pay for MBA course and graduation. Interest rate currently runs at 20% p.a. compounded semi-annually. How much should you set aside every year in order to realize this dream? iii. How long will it take you to quadruple your investment if the interest rate is 10% per annum? iv. At what annualized rate will GH1 double if invested for 5 years. V. You have invested GH 15,000 that will earn 10% for the first 3 years and then 12% for the next 2 years. What is the size of your investment account after 5 year? [2marks each: Total marks 10] Question 2 (a) Amara Ltd is an unquoted company and has paid a dividend of $250,000 this year. The current return to shareholders of companies in the same industry as Amara Ltd. is 12%, although it is expected that an additional risk premium of 2% will be applicable to Amara Ltd, because it's smaller and unquoted. Compute the total market value of the company if: i. The current level of dividend is expected to continue into the foreseeable future. ii. The dividend is expected to grow at a rate of 4% per annum into the foreseeable future. [5marks) (b) The following data relates to the ordinary shares of 12BF Ltd. Current market price, 31 December 20X1 Dividend per share, 20X1 250GHp 3GHp Expected growth rate in dividends and earnings Average market returns Risk-free rate of return Beta factor of Stilton equity shares 10% p.a. 8% 5% 1.40 (1) What is the estimated cost of equity using the dividend growth model? (ii) What is the estimated cost of equity using the capital asset pricing model? (5marks) [Total marks 10]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started