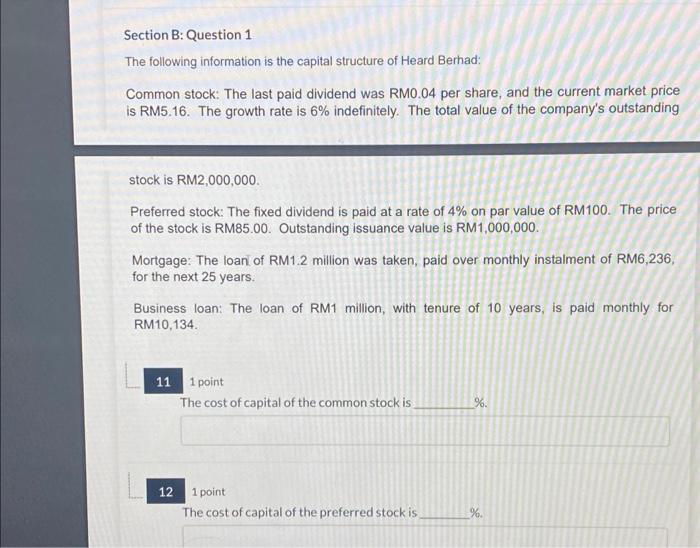

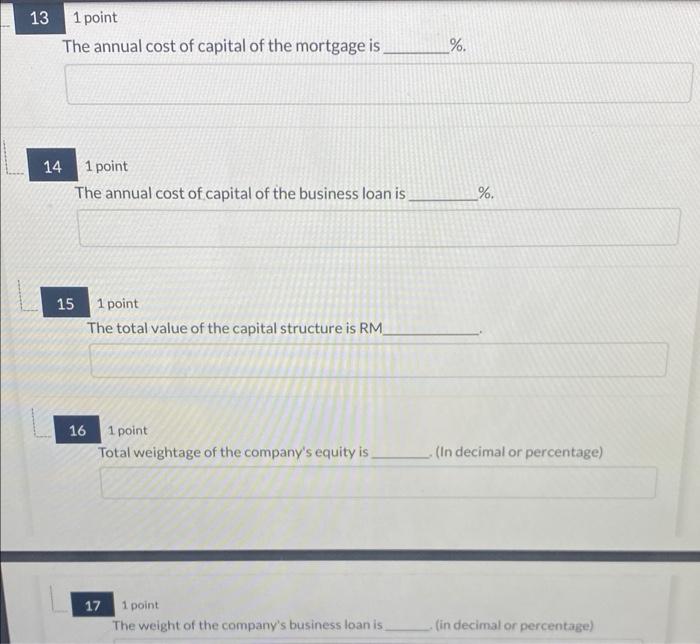

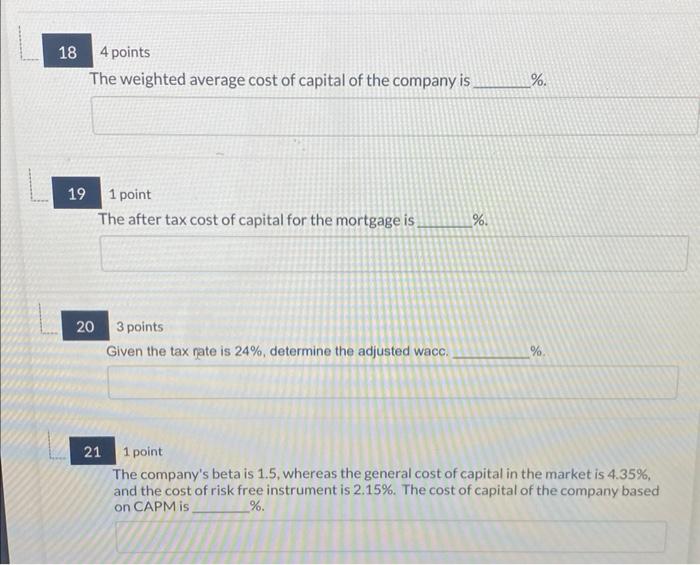

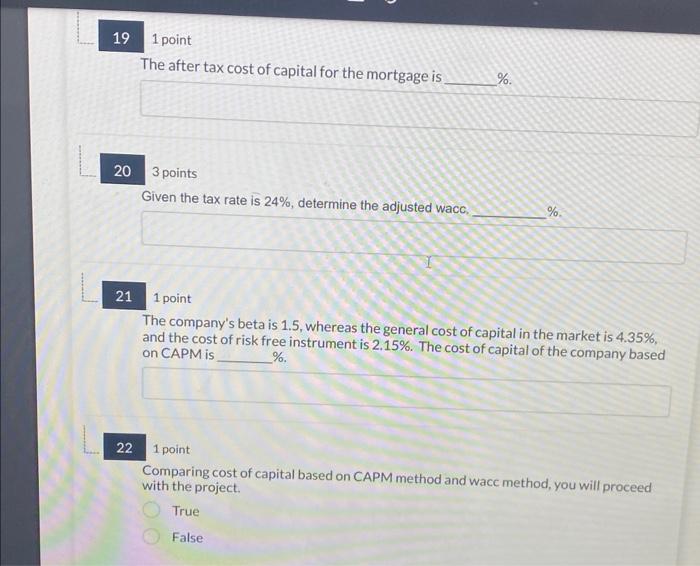

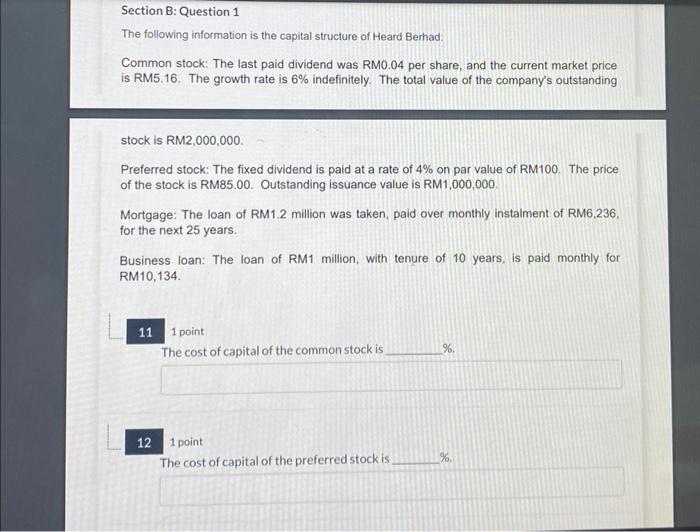

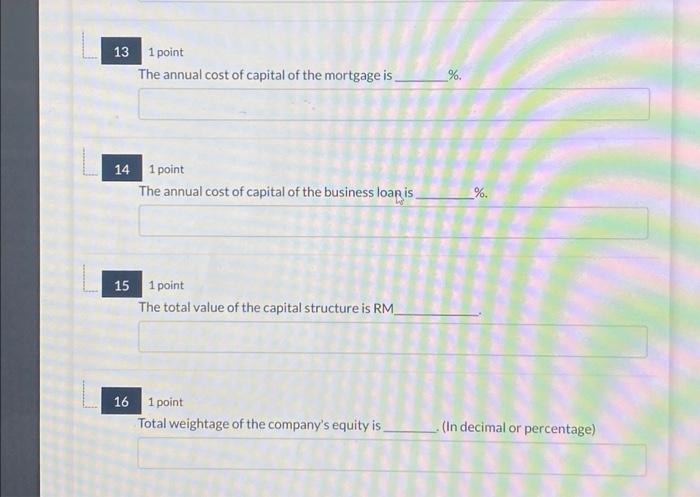

Section B: Question 1 The following information is the capital structure of Heard Berhad: Common stock: The last paid dividend was RM0.04 per share, and the current market price is RM5.16. The growth rate is 6% indefinitely. The total value of the company's outstanding stock is RM2,000,000. Preferred stock: The fixed dividend is paid at a rate of 4% on par value of RM100. The price of the stock is RM85.00. Outstanding issuance value is RM1,000,000. Mortgage: The loan of RM1.2 million was taken, paid over monthly instalment of RM6,236, for the next 25 years. Business loan: The loan of RM1 million, with tenure of 10 years, is paid monthly for RM10,134. 1 point The cost of capital of the common stock is 6. 1 point The cost of capital of the preferred stock is The annual cost of capital of the mortgage is %. 1 point The annual cost of capital of the business loan is % 1 point The total value of the capital structure is RM 16 1 point Total weightage of the company's equity is (In decimal or percentage) 17 1 point The weight of the company's business loan is (in decimal or percentage) 4 points The weighted average cost of capital of the company is % 1 point The after tax cost of capital for the mortgage is 16. 20 3 points Given the tax nate is 24%, determine the adjusted wacc. % 211 point The company's beta is 1.5, whereas the general cost of capital in the market is 4.35%, and the cost of risk free instrument is 2.15%. The cost of capital of the company based on CAPM is %. The after tax cost of capital for the mortgage is %. 3 points Given the tax rate is 24%, determine the adiustar warn 1 point The company's beta is 1.5, whereas the general cost of capital in the market is 4.35%, and the cost of risk free instrument is 2.15%. The cost of capital of the company based on CAPM is %. 221 point Comparing cost of capital based on CAPM method and wacc method, you will proceed with the project. True False Section B: Question 1 The following information is the capital structure of Heard Berhad: Common stock: The last paid dividend was RM0.04 per share, and the current market price is RM5.16. The growth rate is 6% indefinitely. The total value of the company's outstanding stock is RM2,000,000. Preferred stock: The fixed dividend is paid at a rate of 4% on par value of RM100. The price of the stock is RM85.00. Outstanding issuance value is RM1,000,000. Mortgage: The loan of RM1.2 million was taken, paid over monthly instalment of RM6,236, for the next 25 years. Business loan: The loan of RM1 million, with tenure of 10 years, is paid monthly for RM10,134. 1 point The cost of capital of the common stock is 1 point The cost of capital of the preferred stock is 131 point The annual cost of capital of the mortgage is 1.. 141 point The annual cost of capital of the business loan is 1/2. 15 point The total value of the capital structure is RM. 1 point Total weightage of the company's equity is (In decimal or percentage)