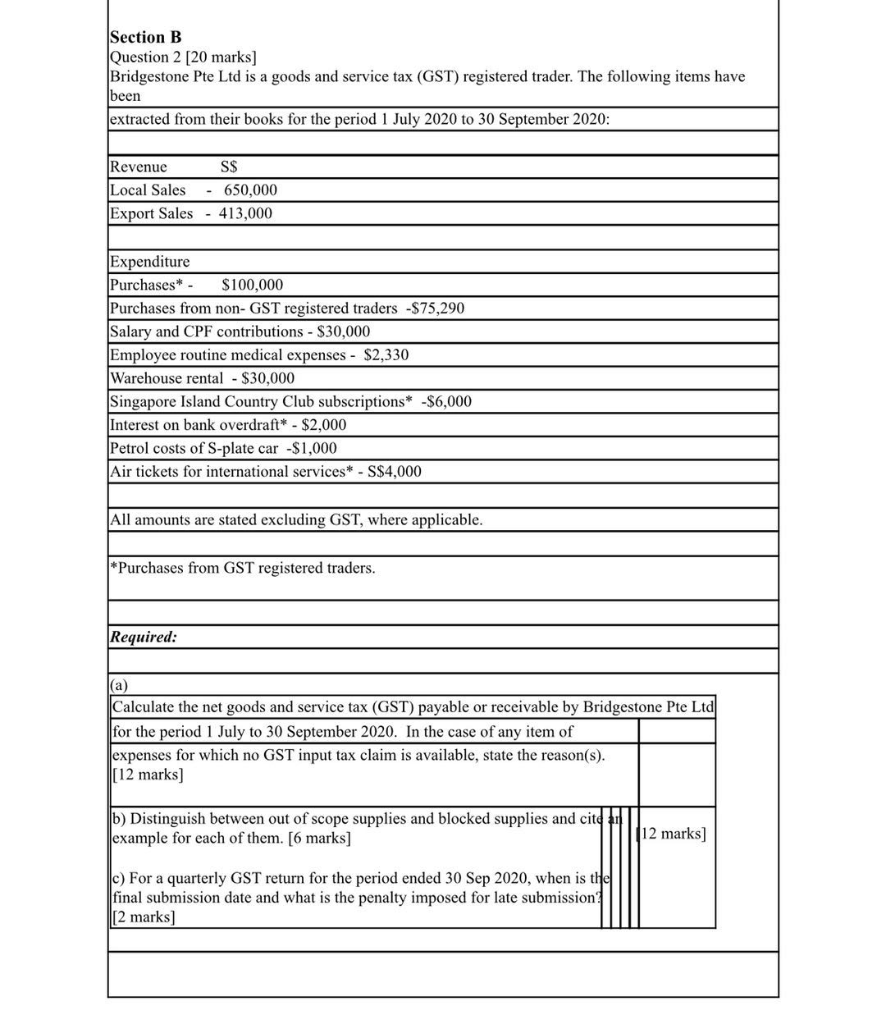

Section B Question 2 [20 marks] Bridgestone Pte Ltd is a goods and service tax (GST) registered trader. The following items have been extracted from their books for the period 1 July 2020 to 30 September 2020: S$ Revenue Local Sales Export Sales 650,000 413,000 Expenditure Purchases $100,000 Purchases from non-GST registered traders -$75,290 Salary and CPF contributions - $30,000 Employee routine medical expenses - $2,330 Warehouse rental - $30,000 Singapore Island Country Club subscriptions* -$6,000 Interest on bank overdraft* - $2,000 Petrol costs of S-plate car -$1,000 Air tickets for international services* - S$4,000 All amounts are stated excluding GST, where applicable. *Purchases from GST registered traders. Required: (a) Calculate the net goods and service tax (GST) payable or receivable by Bridgestone Pte Ltd for the period 1 July to 30 September 2020. In the case of any item of expenses for which no GST input tax claim is available, state the reason(s). 112 marks] b) Distinguish between out of scope supplies and blocked supplies and cite example for each of them. [6 marks] 12 marks] C) For a quarterly GST return for the period ended 30 Sep 2020, when is the final submission date and what is the penalty imposed for late submission [2 marks] Section B Question 2 [20 marks] Bridgestone Pte Ltd is a goods and service tax (GST) registered trader. The following items have been extracted from their books for the period 1 July 2020 to 30 September 2020: S$ Revenue Local Sales Export Sales 650,000 413,000 Expenditure Purchases $100,000 Purchases from non-GST registered traders -$75,290 Salary and CPF contributions - $30,000 Employee routine medical expenses - $2,330 Warehouse rental - $30,000 Singapore Island Country Club subscriptions* -$6,000 Interest on bank overdraft* - $2,000 Petrol costs of S-plate car -$1,000 Air tickets for international services* - S$4,000 All amounts are stated excluding GST, where applicable. *Purchases from GST registered traders. Required: (a) Calculate the net goods and service tax (GST) payable or receivable by Bridgestone Pte Ltd for the period 1 July to 30 September 2020. In the case of any item of expenses for which no GST input tax claim is available, state the reason(s). 112 marks] b) Distinguish between out of scope supplies and blocked supplies and cite example for each of them. [6 marks] 12 marks] C) For a quarterly GST return for the period ended 30 Sep 2020, when is the final submission date and what is the penalty imposed for late submission [2 marks]