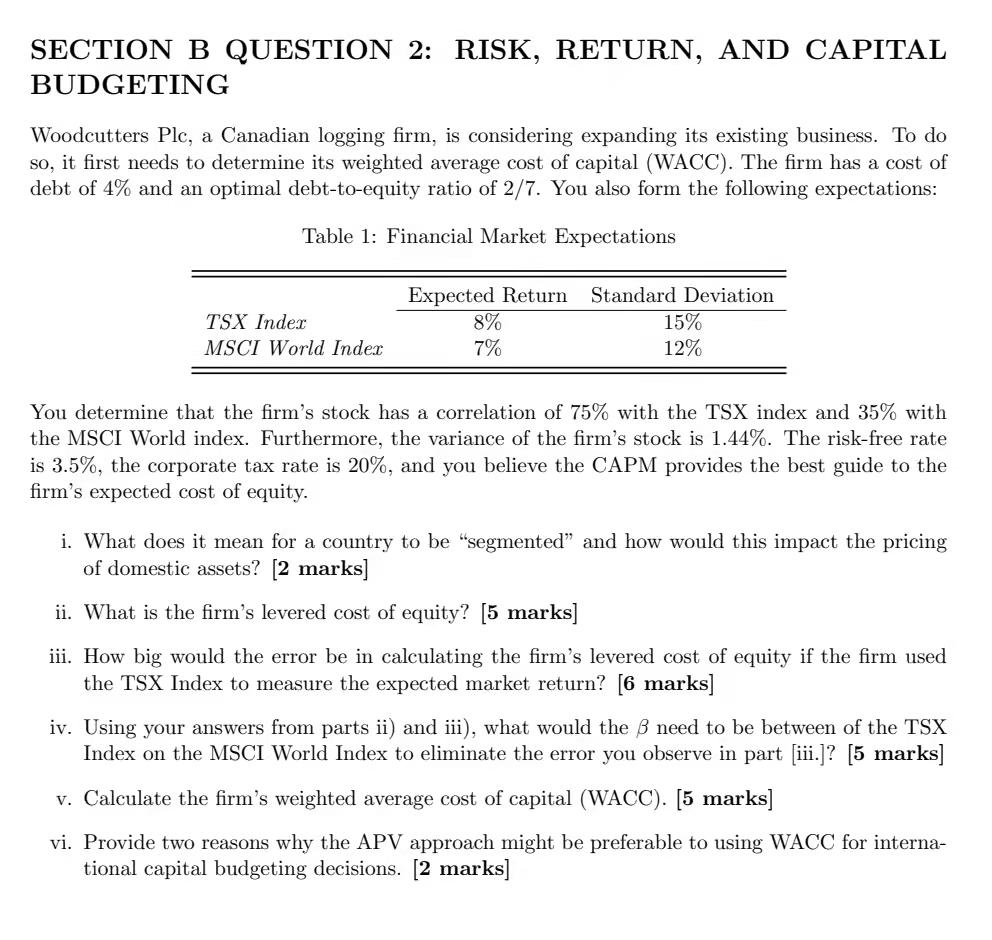

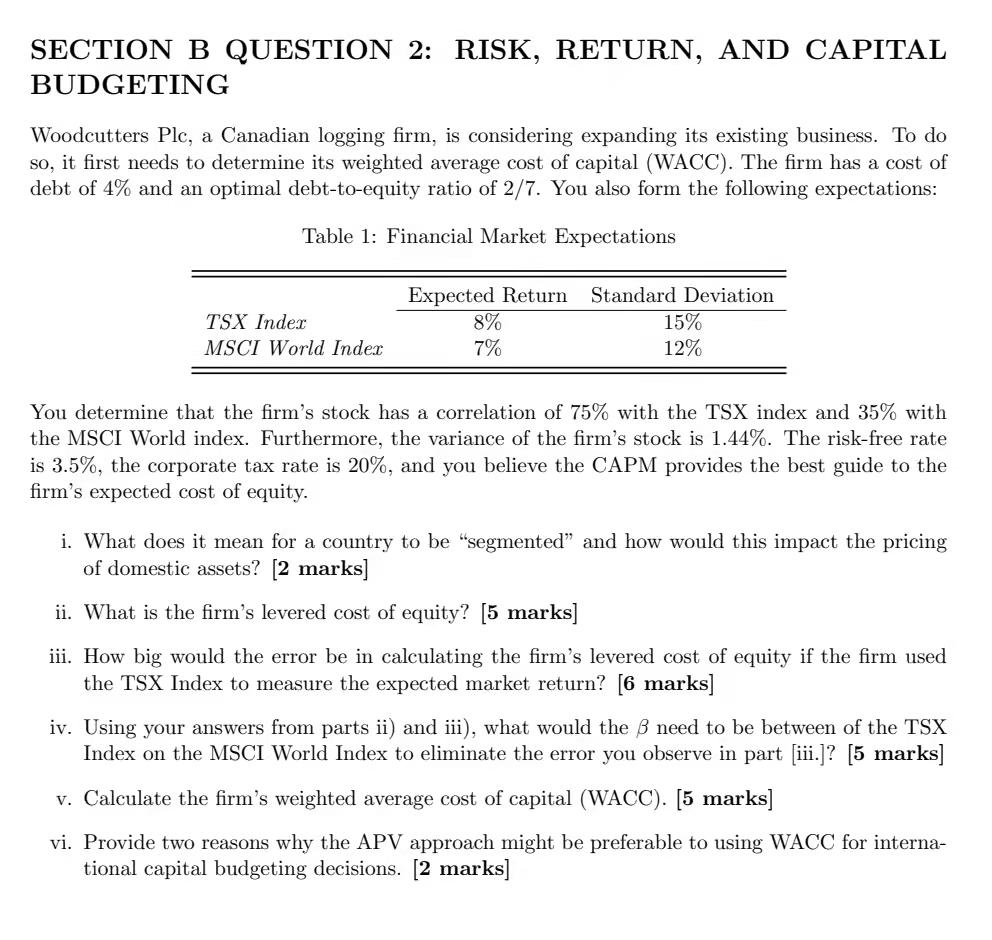

SECTION B QUESTION 2: RISK, RETURN, AND CAPITAL BUDGETING Woodcutters Plc, a Canadian logging firm, is considering expanding its existing business. To do so, it first needs to determine its weighted average cost of capital (WACC). The firm has a cost of debt of 4% and an optimal debt-to-equity ratio of 2/7. You also form the following expectations: Table 1: Financial Market Expectations TSX Inder MSCI World Inder Expected Return 8% 7% Standard Deviation 15% 12% You determine that the firm's stock has a correlation of 75% with the TSX index and 35% with the MSCI World index. Furthermore, the variance of the firm's stock is 1.44%. The risk-free rate is 3.5%, the corporate tax rate is 20%, and you believe the CAPM provides the best guide to the firm's expected cost of equity. i. What does it mean for a country to be "segmented and how would this impact the pricing of domestic assets? [2 marks] ii. What is the firm's levered cost of equity? (5 marks] iii. How big would the error be in calculating the firm's levered cost of equity if the firm used the TSX Index to measure the expected market return? [6 marks] iv. Using your answers from parts ii) and iii), what would the B need to be between of the TSX Index on the MSCI World Index to eliminate the error you observe in part (iii.)? [5 marks] v. Calculate the firm's weighted average cost of capital (WACC). [5 marks] vi. Provide two reasons why the APV approach might be preferable to using WACC for interna- tional capital budgeting decisions. [2 marks] SECTION B QUESTION 2: RISK, RETURN, AND CAPITAL BUDGETING Woodcutters Plc, a Canadian logging firm, is considering expanding its existing business. To do so, it first needs to determine its weighted average cost of capital (WACC). The firm has a cost of debt of 4% and an optimal debt-to-equity ratio of 2/7. You also form the following expectations: Table 1: Financial Market Expectations TSX Inder MSCI World Inder Expected Return 8% 7% Standard Deviation 15% 12% You determine that the firm's stock has a correlation of 75% with the TSX index and 35% with the MSCI World index. Furthermore, the variance of the firm's stock is 1.44%. The risk-free rate is 3.5%, the corporate tax rate is 20%, and you believe the CAPM provides the best guide to the firm's expected cost of equity. i. What does it mean for a country to be "segmented and how would this impact the pricing of domestic assets? [2 marks] ii. What is the firm's levered cost of equity? (5 marks] iii. How big would the error be in calculating the firm's levered cost of equity if the firm used the TSX Index to measure the expected market return? [6 marks] iv. Using your answers from parts ii) and iii), what would the B need to be between of the TSX Index on the MSCI World Index to eliminate the error you observe in part (iii.)? [5 marks] v. Calculate the firm's weighted average cost of capital (WACC). [5 marks] vi. Provide two reasons why the APV approach might be preferable to using WACC for interna- tional capital budgeting decisions. [2 marks]