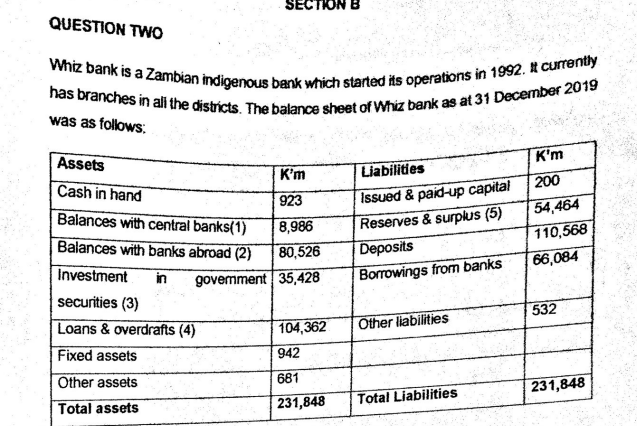

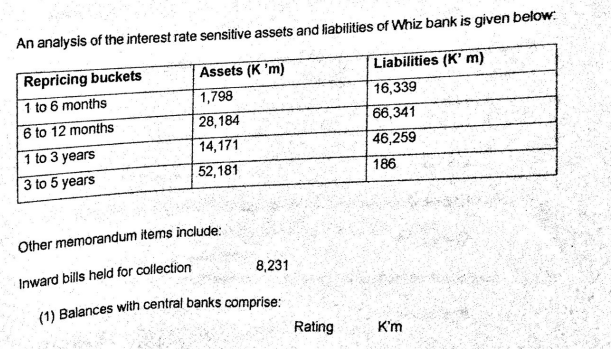

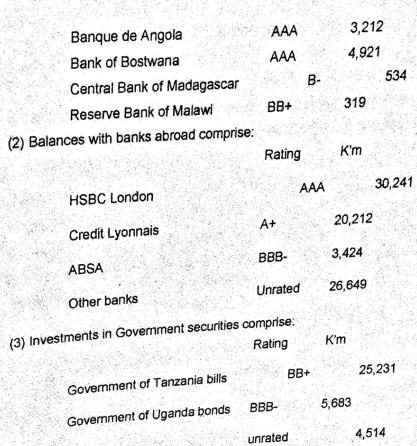

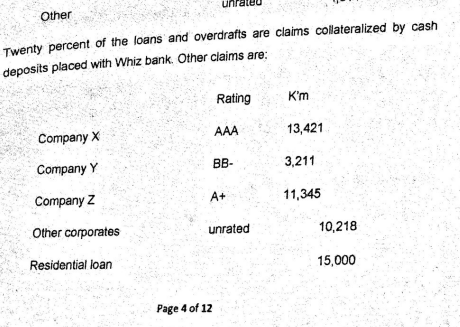

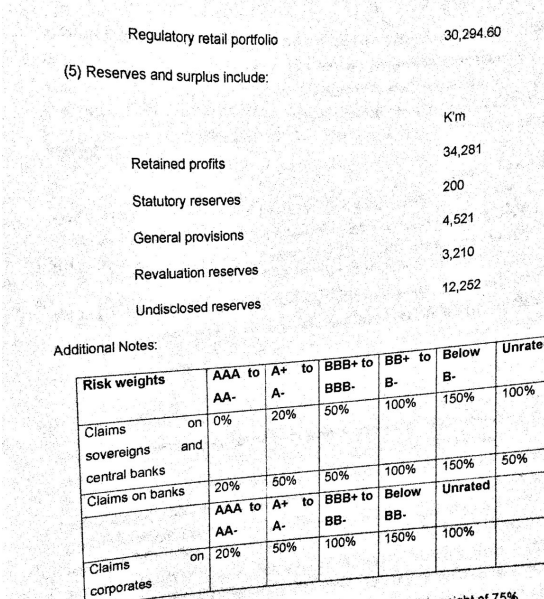

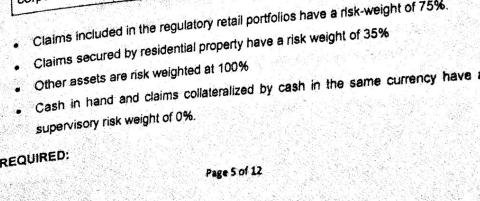

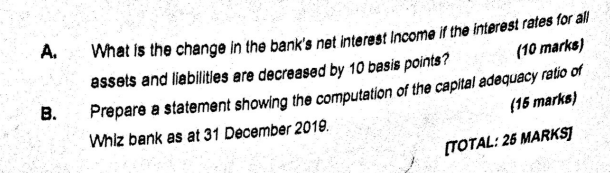

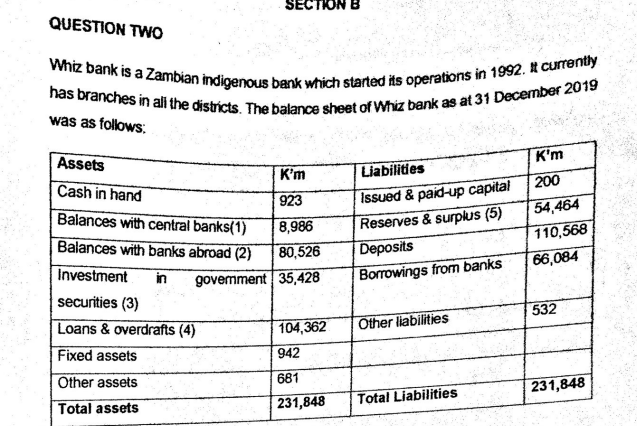

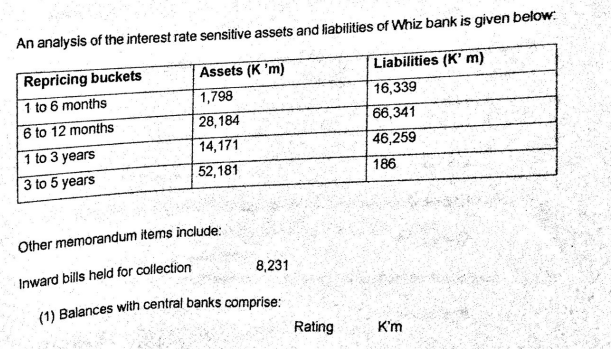

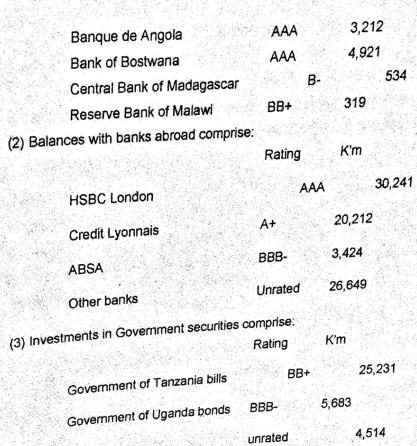

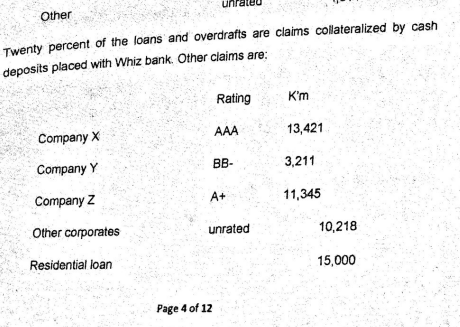

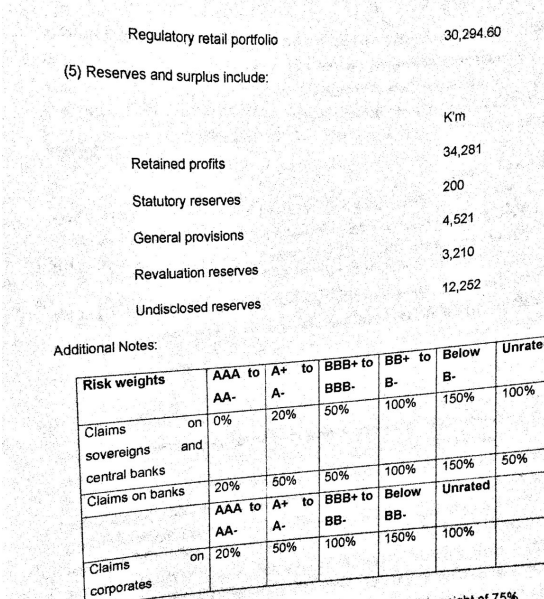

SECTION B QUESTION TWO Whiz bank is a Zambian indigenous bank which started its operations in 1992. I currently has branches in all the districts. The balance sheet of Whiz bank as at 31 December 2019 was as follows: Assets Cash in hand Balances with central banks(1) Balances with banks abroad (2) Investment in securities (3) Loans & overdrafts (4) Kim 923 8,986 80,526 government 35,428 Liabilities Issued & paid-up capital Reserves & surplus (5) Deposits Borrowings from banks Kim 200 54,464 110,568 66,084 532 Other liabilities 104,362 942 Fixed assets Other assets 681 231,848 231,848 Total assets Total Liabilities An analysis of the interest rate sensitive assets and liabilities of Whiz bank is given below. Repricing buckets 1 to 6 months 6 to 12 months 1 to 3 years 3 to 5 years Assets (K 'm) 1,798 28,184 14,171 52, 181 Liabilities (Km) 16,339 66,341 46,259 186 Other memorandum items include: 8,231 Inward bills held for collection (1) Balances with central banks comprise: Rating Km AAA AAA 3,212 4,921 534 B- Banque de Angola Bank of Bostwana Central Bank of Madagascar Reserve Bank of Malawi (2) Balances with banks abroad comprise: BB+ 319 Rating 'm AAA 30,241 HSBC London A+ 20,212 Credit Lyonnais BBB- 3,424 ABSA Unrated 26,649 Other banks (3) Investments in Goverment securities comprise: Rating Km BB+ 25,231 Government of Tanzania bills BBB- 5,683 Government of Uganda bonds unrated 4,514 Other Twenty percent of the loans and overdrafts are claims collateralized by cash deposits placed with Whiz bank. Other claims are: Rating K'm AAA 13,421 Company X BB- 3,211 Company Y A+ 11,345 Company z Other corporates unrated 10,218 Residential loan 15,000 Page 4 of 12 Regulatory retail portfolio 30,294.60 (5) Reserves and surplus include: K'm 34,281 Retained profits 200 Statutory reserves 4,521 General provisions 3,210 Revaluation reserves 12,252 Undisclosed reserves Additional Notes: Unrate 100% 50% Risk weights AAA to A+ to BBB+ to BB+ to Below AA- A- BBB- B- B- Claims on 0% 20% 50% 100% 150% sovereigns and central banks Claims on banks 20% 50% 50% 100% 150% AAA to A+ to BBB+ to Below Unrated AA- A BB- BB- Claims on 20% 50% 100% 150% 100% corporates hof 75% . Claims included in the regulatory retail portfolios have a risk-weight of 75% Claims secured by residential property have a risk weight of 35% Other assets are risk weighted at 100% Cash in hand and claims collateralized by cash in the same currency have supervisory risk weight of 0%. REQUIRED: Page 5 of 12 A. B. What is the change in the bank's net interest Income if the interest rates for all assets and liabilities are decreased by 10 basis points? (10 marks) Prepare a statement showing the computation of the capital adequacy ratio of Whiz bank as at 31 December 2019. (16 marks) [TOTAL: 25 MARKSI SECTION B QUESTION TWO Whiz bank is a Zambian indigenous bank which started its operations in 1992. I currently has branches in all the districts. The balance sheet of Whiz bank as at 31 December 2019 was as follows: Assets Cash in hand Balances with central banks(1) Balances with banks abroad (2) Investment in securities (3) Loans & overdrafts (4) Kim 923 8,986 80,526 government 35,428 Liabilities Issued & paid-up capital Reserves & surplus (5) Deposits Borrowings from banks Kim 200 54,464 110,568 66,084 532 Other liabilities 104,362 942 Fixed assets Other assets 681 231,848 231,848 Total assets Total Liabilities An analysis of the interest rate sensitive assets and liabilities of Whiz bank is given below. Repricing buckets 1 to 6 months 6 to 12 months 1 to 3 years 3 to 5 years Assets (K 'm) 1,798 28,184 14,171 52, 181 Liabilities (Km) 16,339 66,341 46,259 186 Other memorandum items include: 8,231 Inward bills held for collection (1) Balances with central banks comprise: Rating Km AAA AAA 3,212 4,921 534 B- Banque de Angola Bank of Bostwana Central Bank of Madagascar Reserve Bank of Malawi (2) Balances with banks abroad comprise: BB+ 319 Rating 'm AAA 30,241 HSBC London A+ 20,212 Credit Lyonnais BBB- 3,424 ABSA Unrated 26,649 Other banks (3) Investments in Goverment securities comprise: Rating Km BB+ 25,231 Government of Tanzania bills BBB- 5,683 Government of Uganda bonds unrated 4,514 Other Twenty percent of the loans and overdrafts are claims collateralized by cash deposits placed with Whiz bank. Other claims are: Rating K'm AAA 13,421 Company X BB- 3,211 Company Y A+ 11,345 Company z Other corporates unrated 10,218 Residential loan 15,000 Page 4 of 12 Regulatory retail portfolio 30,294.60 (5) Reserves and surplus include: K'm 34,281 Retained profits 200 Statutory reserves 4,521 General provisions 3,210 Revaluation reserves 12,252 Undisclosed reserves Additional Notes: Unrate 100% 50% Risk weights AAA to A+ to BBB+ to BB+ to Below AA- A- BBB- B- B- Claims on 0% 20% 50% 100% 150% sovereigns and central banks Claims on banks 20% 50% 50% 100% 150% AAA to A+ to BBB+ to Below Unrated AA- A BB- BB- Claims on 20% 50% 100% 150% 100% corporates hof 75% . Claims included in the regulatory retail portfolios have a risk-weight of 75% Claims secured by residential property have a risk weight of 35% Other assets are risk weighted at 100% Cash in hand and claims collateralized by cash in the same currency have supervisory risk weight of 0%. REQUIRED: Page 5 of 12 A. B. What is the change in the bank's net interest Income if the interest rates for all assets and liabilities are decreased by 10 basis points? (10 marks) Prepare a statement showing the computation of the capital adequacy ratio of Whiz bank as at 31 December 2019. (16 marks) [TOTAL: 25 MARKSI