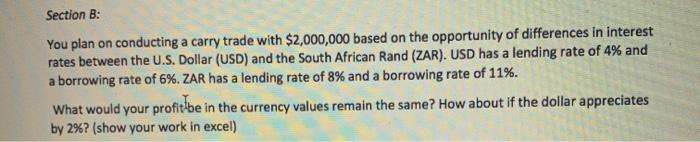

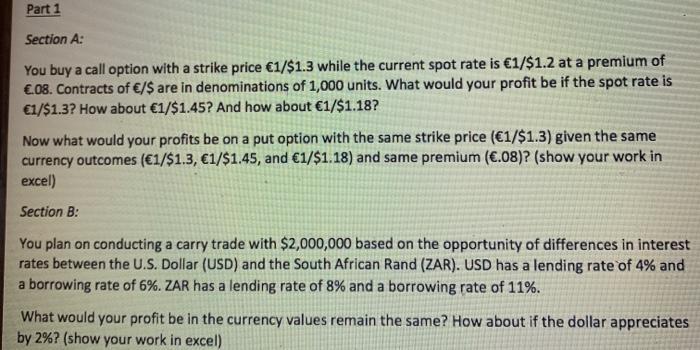

Section B: You plan on conducting a carry trade with $2,000,000 based on the opportunity of differences in interest rates between the U.S. Dollar (USD) and the South African Rand (ZAR). USD has a lending rate of 4% and a borrowing rate of 6%. ZAR has a lending rate of 8% and a borrowing rate of 11%. What would your profit be in the currency values remain the same? How about if the dollar appreciates by 2%? (show your work in excel) Part 1 Section A: You buy a call option with a strike price 1/$1.3 while the current spot rate is 1/$1.2 at a premium of .08. Contracts of /$ are in denominations of 1,000 units. What would your profit be if the spot rate is 1/$1.3? How about 1/$1.45? And how about 1/$1.18? Now what would your profits be on a put option with the same strike price (1/$1.3) given the same currency outcomes (1/$1.3, 1/$1.45, and 1/$1.18) and same premium (.08)? (show your work in excel) Section B: You plan on conducting a carry trade with $2,000,000 based on the opportunity of differences in interest rates between the U.S. Dollar (USD) and the South African Rand (ZAR). USD has a lending rate of 4% and a borrowing rate of 6%. ZAR has a lending rate of 8% and a borrowing rate of 11%. What would your profit be in the currency values remain the same? How about if the dollar appreciates by 2%? (show your work in excel) Section B: You plan on conducting a carry trade with $2,000,000 based on the opportunity of differences in interest rates between the U.S. Dollar (USD) and the South African Rand (ZAR). USD has a lending rate of 4% and a borrowing rate of 6%. ZAR has a lending rate of 8% and a borrowing rate of 11%. What would your profit be in the currency values remain the same? How about if the dollar appreciates by 2%? (show your work in excel) Part 1 Section A: You buy a call option with a strike price 1/$1.3 while the current spot rate is 1/$1.2 at a premium of .08. Contracts of /$ are in denominations of 1,000 units. What would your profit be if the spot rate is 1/$1.3? How about 1/$1.45? And how about 1/$1.18? Now what would your profits be on a put option with the same strike price (1/$1.3) given the same currency outcomes (1/$1.3, 1/$1.45, and 1/$1.18) and same premium (.08)? (show your work in excel) Section B: You plan on conducting a carry trade with $2,000,000 based on the opportunity of differences in interest rates between the U.S. Dollar (USD) and the South African Rand (ZAR). USD has a lending rate of 4% and a borrowing rate of 6%. ZAR has a lending rate of 8% and a borrowing rate of 11%. What would your profit be in the currency values remain the same? How about if the dollar appreciates by 2%? (show your work in excel)