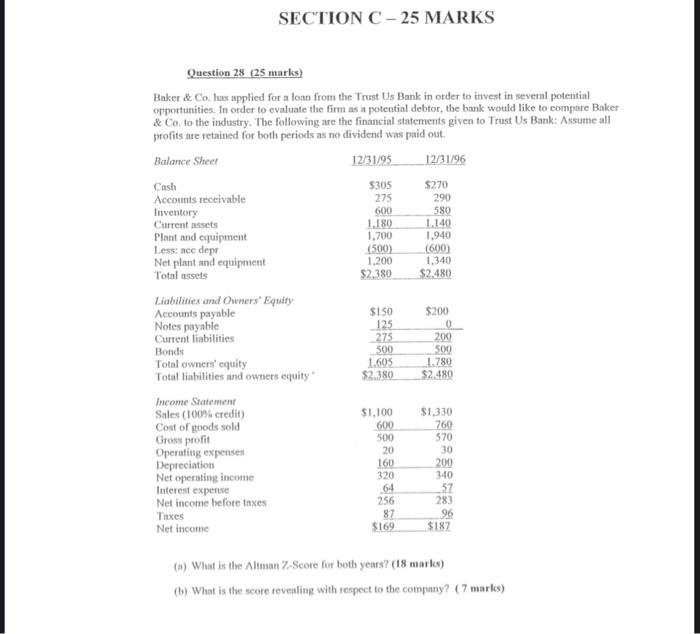

SECTION C - 25 MARKS Question 28 (25 marks) Baker & Co. luas applied for a loan from the Trust Us Bank in order to invest in several potential opportunities. In order to evaluate the firm as a potential debtor, the bank would like to compare Baker & Co to the industry. The following are the financial statements given to Trust Us Bank: Assume all profits are retained for both periods as no dividend was paid out Balance Sheet 12/31/95 12/31/96 Cash $305 $270 Accounts receivable 275 290 Inventory 600 580 Current assets 1.180 1.140 Plant and equipment 1,700 1,940 Less: nee depr (500) (600) Net plant and equipment 1.200 1.340 Total sets $2.380 $2.480 Liabilities and Owners' Equity Accounts payable SISO $200 Notes payable 125 0 Current liabilities 275 200 Bonds 500 500 Total owners' equity 1.605 1.780 Total liabilities and owners equity $2.380 $2.480 Income Statement Sales (100% credit) $1,100 $1,330 Cost of goods sold 600 760 Gross profit 500 570 Operating expenses 20 30 Depreciation 160 200 Net operating income 320 340 Interest expense 57 Net income before taxes 256 283 Tixes 87 96 Net income $169 $187 64 (1) What is the Alman Z-Score for both years? (18 marks) (b) What is the score revealing with respect to the company? (7 mars) SECTION C - 25 MARKS Question 28 (25 marks) Baker & Co. luas applied for a loan from the Trust Us Bank in order to invest in several potential opportunities. In order to evaluate the firm as a potential debtor, the bank would like to compare Baker & Co to the industry. The following are the financial statements given to Trust Us Bank: Assume all profits are retained for both periods as no dividend was paid out Balance Sheet 12/31/95 12/31/96 Cash $305 $270 Accounts receivable 275 290 Inventory 600 580 Current assets 1.180 1.140 Plant and equipment 1,700 1,940 Less: nee depr (500) (600) Net plant and equipment 1.200 1.340 Total sets $2.380 $2.480 Liabilities and Owners' Equity Accounts payable SISO $200 Notes payable 125 0 Current liabilities 275 200 Bonds 500 500 Total owners' equity 1.605 1.780 Total liabilities and owners equity $2.380 $2.480 Income Statement Sales (100% credit) $1,100 $1,330 Cost of goods sold 600 760 Gross profit 500 570 Operating expenses 20 30 Depreciation 160 200 Net operating income 320 340 Interest expense 57 Net income before taxes 256 283 Tixes 87 96 Net income $169 $187 64 (1) What is the Alman Z-Score for both years? (18 marks) (b) What is the score revealing with respect to the company? (7 mars)