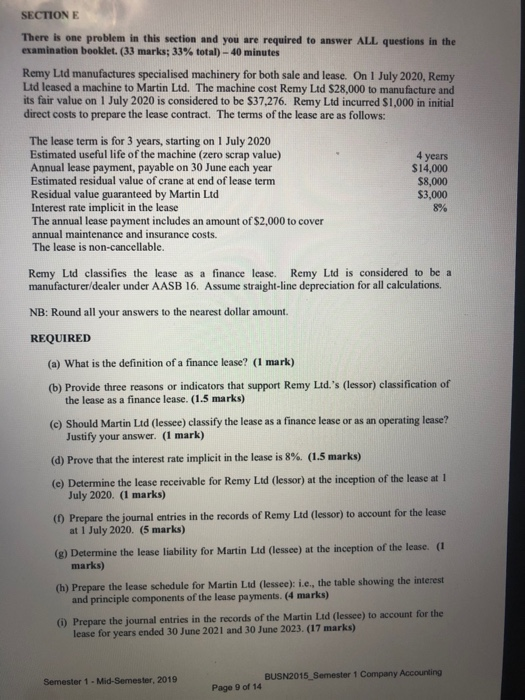

SECTION E 4 years There is one problem in this section and you are required to answer ALL questions in the examination booklet. (33 marks; 33% total) - 40 minutes Remy Ltd manufactures specialised machinery for both sale and lease. On 1 July 2020, Remy Ltd leased a machine to Martin Ltd. The machine cost Remy Ltd $28,000 to manufacture and its fair value on 1 July 2020 is considered to be $37,276. Remy Ltd incurred $1,000 in initial direct costs to prepare the lease contract. The terms of the lease are as follows: The lease term is for 3 years, starting on 1 July 2020 Estimated useful life of the machine (zero scrap value) Annual lease payment, payable on 30 June each year $14,000 Estimated residual value of crane at end of lease term $8,000 Residual value guaranteed by Martin Ltd $3,000 Interest rate implicit in the lease 8% The annual lease payment includes an amount of $2,000 to cover annual maintenance and insurance costs. The lease is non-cancellable. Remy Ltd classifies the lease as a finance lease. Remy Ltd is considered to be a manufacturer/dealer under AASB 16. Assume straight-line depreciation for all calculations. NB: Round all your answers to the nearest dollar amount. REQUIRED (a) What is the definition of a finance lease? (1 mark) (b) Provide three reasons or indicators that support Remy Ltd.'s (lessor) classification of the lease as a finance lease. (1.5 marks) (e) Should Martin Ltd (lessee) classify the lease as a finance lease or as an operating lease? Justify your answer. (1 mark) (d) Prove that the interest rate implicit in the lease is 8% (1.5 marks) (e) Determine the lease receivable for Remy Ltd (lessor) at the inception of the lease at 1 July 2020. (1 marks) (1) Prepare the journal entries in the records of Remy Ltd (lessor) to account for the lease at 1 July 2020. (5 marks) (8) Determine the lease liability for Martin Ltd (lessee) at the inception of the lease. (1 marks) (h) Prepare the lease schedule for Martin Ltd (lessee): i.e., the table showing the interest and principle components of the lease payments. (4 marks) () Prepare the journal entries in the records of the Martin Ltd (lessee) to account for the lease for years ended 30 June 2021 and 30 June 2023. (17 marks) Semester 1 - Mid-Semester, 2019 BUSN2015_Semester 1 Company Accounting Page 9 of 14