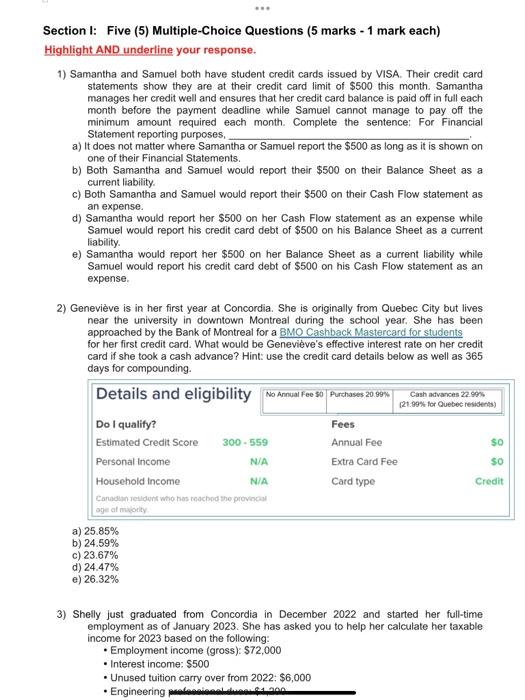

Section I: Five (5) Multiple-Choice Questions (5 marks - 1 mark each) Highlight AND underline your response. 1) Samantha and Samuel both have student credit cards issued by VISA. Their credit card statements show they are at their credit card limit of $500 this month. Samantha manages her credit well and ensures that her credit card balance is paid off in full each month before the payment deadline while Samuel cannot manage to pay off the minimum amount required each month. Complete the sentence: For Financial Statement reporting purposes, a) It does not matter where Samantha or Samuel report the $500 as long as it is shown on one of their Financial Statements. b) Both Samantha and Samuel would report their $500 on their Balance Sheet as a current liability. c) Both Samantha and Samuel would report their $500 on their Cash Flow statement as an expense. d) Samantha would report her $500 on her Cash Flow statement as an expense while Samuel would report his credit card debt of $500 on his Balance Sheet as a current liability. e) Samantha would report her $500 on her Balance Sheet as a current liability while Samuel would report his credit card debt of $500 on his Cash Flow statement as an expense. 2) Genevive is in her first year at Concordia. She is originally from Quebec City but lives near the university in downtown Montreal during the school year. She has been approached by the Bank of Montreal for a BMO Cashback Mastercard for students for her first credit card. What would be Genevieve's effective interest rate on her credit card if she took a cash advance? Hint: use the credit card details below as well as 365 days for compounding. a) 25.85% b) 24.59% c) 23.67% d) 24.47% e) 26.32% 3) Shelly just graduated from Concordia in December 2022 and started her full-time employment as of January 2023. She has asked you to help her calculate her taxable income for 2023 based on the following: - Employment income (gross): $72,000 - Interest income: $500 - Unused tuition carry over from 2022: $6,000 d) 24.47% e) 26.32% 3) Shelly just graduated from Concordia in December 2022 and started her full-time employment as of January 2023. She has asked you to help her calculate her taxable income for 2023 based on the following: - Employment income (gross): $72,000 - Interest income: $500 - Unused tuition carry over from 2022: $6,000 - Engineering professional dues: $1,200 - Annual union dues: $550 - RRSP contribution: $3,000 - TFSA contribution: $2,000 - Sold 300 shares in XYZ company at $32 per share on January 10, 2023 (paid a total of $8,700 for 600 shares when she purchased them in 2022) - Net capital loss from other years of $1,400 a) $66,525 b) $61,525 c) $68,975 d) $68,700 e) $66,975 4) Maryse contributes $1,000 of her pre-tax income to her employer's Group Registered Retirement Savings Plan (RRSP). Her employer will match her contribution to her Group RRSP. Ignore income taxes. Her disposable income will then: a) Decline by $1,000 b) Increase by $1,000 c) Decline by $2,000 d) Increase by $2,000 e) Remain the same 5) Jax and Jackie are signing their mortgage today with regards to the purchase of their first condo. As they have no other savings other than their Registered Retirement Savings Plan (RRSP), they are required to participate in the Home Buyers Plan (HBP) for the entire down payment. To date, Jax has contributed $25,700 while Jackie has contributed $41,200. At the beginning of the year on January 1,2023 , the market value of their RRSP's was $43,890 for Jax and $52,310 for Jackie. With the recent downturn in the markets, as of today, the market value of Jax's RRSP is $34,150 and Jackie's is $35,350. They need to let the bank know today how much they have for a down payment. What is the maximum amount they can withdraw from their respective RRSP's to put towards their down payment on a home under the HBP? a) $70,000 b) $69,500 c) $66,900 d) $96,200 e) $69,150 Section I completed, continue to Section II. Section II: Five (5) Mini-Cases (20 marks) Write your response in the template or space provided