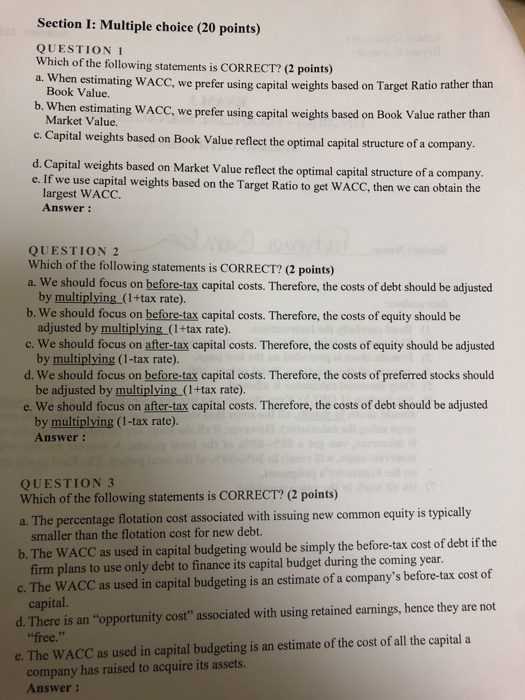

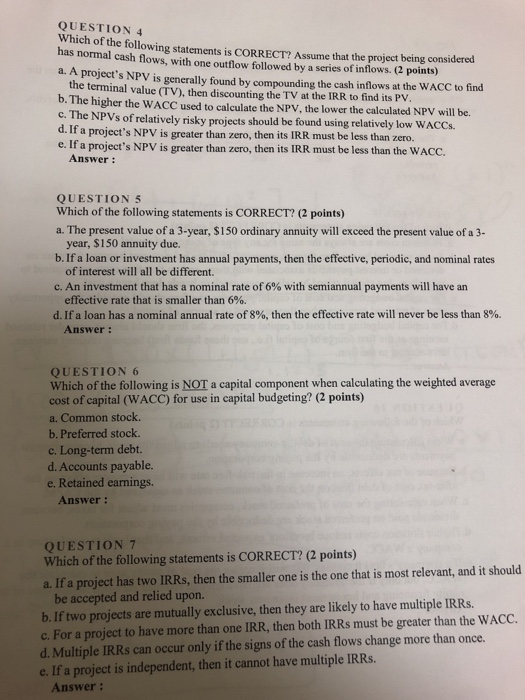

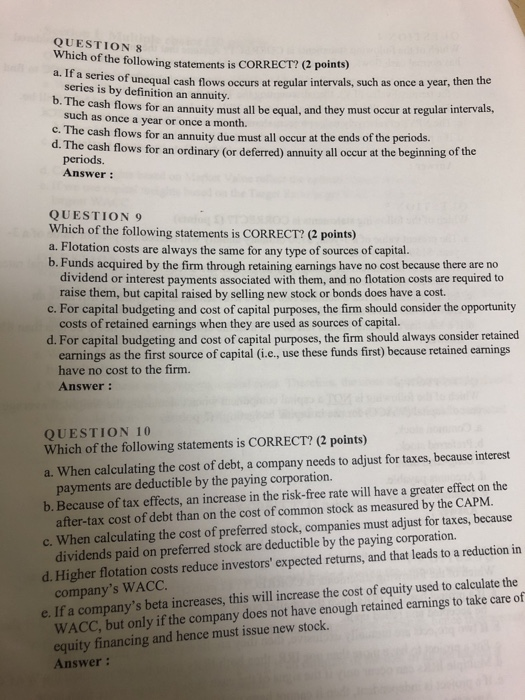

Section I: Multiple choice (20 points) QUESTION 1 Which of the following statements is CORRECT? (2 points) a. When estimating WACC, Book Value. b. When estimating WACC, we Market Value c. Capital weights based on Book Value reflect the optimal capital structure of a company. prefer using capital weights based on we Target Ratio rather than prefer using capital weights based on Book Value rather than d. Capital weights based on Market Value reflect the optimal capital structure of a company. e. If we use capital weights based on the Target Ratio to get WACC, then we can obtain the largest WACC. Answer QUESTION 2 Which of the following statements is CORRECT? (2 points) a. We should focus on before-tax capital costs. Therefore, the costs of debt should be adjusted by multiplying(1+tax rate). b. We should focus on before-tax capital costs. Therefore, the costs of equity should be adjusted by multiplying (1+tax rate). after-tax capital costs. Therefore, the costs of equity should be adjusted c. We should focus on by multiplying (1-tax rate). d. We should focus on before-tax capital be adjusted by multiplying (1+tax rate). e. We should focus on after-tax capital costs. Therefore, the costs of debt should be adjusted by multiplying (1-tax rate). costs. Therefore, the costs of preferred stocks should Answer: QUESTION 3 Which of the following statements is CORRECT? (2 points) a. The percentage flotation cost associated with issuing new common equity is typically smaller than the flotation cost for new debt. b.The WACC as used in capital budgeting would be simply the before-tax cost of debt if the firm plans to use c. The WACC as used in capital budgeting is an estimate of a company's before-tax cost of capital. d. There is an "opportunity cost" associated with using retained earnings, hence they are not "free." only debt to finance its capital budget during the coming year. 11 a as used in capital budgeting is an estimate of the cost of all the capital e. The WACC company has raised to acquire its assets. Answer: QUESTION 4 Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. (2 points) a. A project's NPV is generally found by compounding the cash inflows at the WACC to find the terminal value (TV), then discounting the TV at the IRR to find its PV. b. The higher the WACC used to calculate the NPV, the lower the calculated NPV will be. c. The NPVS of relatively risky projects should be found using relatively low WACCS. d. If a project's NPV is greater than zero, then its IRR must be less than zero. e. If a project's NPV is greater than zero, then its IRR must be less than the WACC Answer c. QUESTION 5 Which of the following statements is CORRECT? (2 points) a. The present value of a 3-year, $150 ordinary annuity will exceed the present value of a 3- year, $150 annuity due. b. If a loan or investment has annual payments, then the effective, periodic, and nominal rates of interest will all be different. c. An investment that has a nominal rate of 6 % with semiannual payments will have an effective rate that is smaller than 6 %. d. If a loan has a nominal annual rate of 8 %, then the effective rate will never be less than 8% Answer: QUESTION 6 Which of the following is NOTa capital component when calculating the weighted average cost of capital (WACC) for use in capital budgeting? (2 points) a. Common stock b. Preferred stock. c. Long-term debt. d. Accounts payable. e. Retained earnings. Answer: QUESTION 7 Which of the following statements is CORRECT? (2 points) If a project has two IRRS, then the smaller one is the one that is most relevant, and it should. be accepted and relied upon. b.If two projects are c. For a project to have more than one IRR, then both IRRS must be greater than the WACC. d. Multiple IRRS can occur only if the signs of the cash flows change more than e. If a project is independent, then it cannot have multiple IRRS. a. likely to have multiple IRRS. are mutually exclusive, then they once. Answer: QUESTION 8 Which of the following statements is CORRECT? (2 points) a. If a series of unequal cash flows occurs at regular intervals, such as once a year, then the series is by definition an annuity. . The cash flows for an annuity must all be equal, and they must occur at regular intervals, such as once a year or once a month. c. The cash flows for an annuity due must all occur at the ends of the periods. d. The cash flows for an ordinary (or deferred) annuity all occur at the beginning of the periods. Answer QUESTION 9 Which of the following statements is CORRECT? (2 points) a. Flotation costs are always the same for any type of sources of capital. b. Funds acquired by the firm through retaining earnings have no cost because there are no dividend or interest payments associated with them, and no flotation costs are required to raise them, but capital raised by selling new stock or bonds does have a cost. c. For capital budgeting and cost of capital purposes, the firm should consider the opportunity costs of retained earnings when they are used as sources of capital. d. For capital budgeting and cost of capital purposes, the firm should always consider retained earnings as the first source of capital (i.e., use these funds first) because retained earnings have no cost to the firm. Answer: QUESTION 10 Which of the following statements is CORRECT? (2 points) a. When calculating the cost of debt, a company needs to adjust for taxes, because interest payments b. Because of tax effects, an increase in the risk-free rate will have a greater effect on the after-tax cost of debt than on the cost of common stock as measured by the CAPM c. When calculating the cost of preferred stock, companies must adjust for taxes, because dividends paid d.Higher flotation costs reduce investors' expected returns, and that leads to a reduction in company's WACC If a company's beta increases, this will increase the cost of equity used to calculate the WACC, but only if the company does not have enough retained earnings to take care of equity financing and hence must issue new stock. deductible by the paying corporation. are preferred stock are deductible by the paying corporation. on e