Answered step by step

Verified Expert Solution

Question

1 Approved Answer

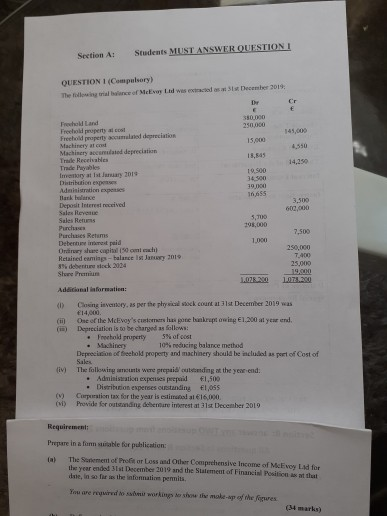

Section : Students MUST ANSWER QUESTIONI QUESTION 1(Compulsory) The trial balance of McEvoyd was extracto December 2016 30.000 Fredhold Land Freel property 141,000 Freeld property

Section : Students MUST ANSWER QUESTIONI QUESTION 1(Compulsory) The trial balance of McEvoyd was extracto December 2016 30.000 Fredhold Land Freel property 141,000 Freeld property accumulated depreciation Machinery acos 15,000 Machinery accumulated depreciation Trade Reches 18,45 Trade Pobles Imory at may 2019 10.500 Distribution expose 34.000 Admiration experts 30 000 laske 1655 Deposit interest received 3,300 Sales Revue 600,000 Sales Returns 3,00 Purchase Purces Reims 7,500 Deberespaid 1.000 Ordrwysel 150 ml 250,000 Retained eam-balance in 2019 7,400 8% deben seck 2124 25.000 Showe Premium 19.000 1.0.1 1072 Additional information: (0) Closing is very, as per the physical account ist December 2019 was 14,000 One of the McEvoy's customer lux gone bankruptcwing 1.200 al year end. Depreciation is to be charged as follows Freehold property 5% of 10% reducing balance method Depreciation of freehold property and machinery should be included as portof Cost of Sales fiv The following amounts were prepaid cutting at the year end. Admission expenses prepaid 1,500 Distribution expenses outstanding 1,055 Corporation tax for the year is estimaal 16.000 Provide for dig debenare interest at 31st December 2019 Requirement Prepare in a fontable for publication: The Surement of Profit or loss and Other Comprehensive Income of McEvoy Lad for the year ended st December 2014 and the Statement of Financial Position des at that date, in so far as the information permit You are required to be working to show the make-up of the figures Section : Students MUST ANSWER QUESTIONI QUESTION 1(Compulsory) The trial balance of McEvoyd was extracto December 2016 30.000 Fredhold Land Freel property 141,000 Freeld property accumulated depreciation Machinery acos 15,000 Machinery accumulated depreciation Trade Reches 18,45 Trade Pobles Imory at may 2019 10.500 Distribution expose 34.000 Admiration experts 30 000 laske 1655 Deposit interest received 3,300 Sales Revue 600,000 Sales Returns 3,00 Purchase Purces Reims 7,500 Deberespaid 1.000 Ordrwysel 150 ml 250,000 Retained eam-balance in 2019 7,400 8% deben seck 2124 25.000 Showe Premium 19.000 1.0.1 1072 Additional information: (0) Closing is very, as per the physical account ist December 2019 was 14,000 One of the McEvoy's customer lux gone bankruptcwing 1.200 al year end. Depreciation is to be charged as follows Freehold property 5% of 10% reducing balance method Depreciation of freehold property and machinery should be included as portof Cost of Sales fiv The following amounts were prepaid cutting at the year end. Admission expenses prepaid 1,500 Distribution expenses outstanding 1,055 Corporation tax for the year is estimaal 16.000 Provide for dig debenare interest at 31st December 2019 Requirement Prepare in a fontable for publication: The Surement of Profit or loss and Other Comprehensive Income of McEvoy Lad for the year ended st December 2014 and the Statement of Financial Position des at that date, in so far as the information permit You are required to be working to show the make-up of the figures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started