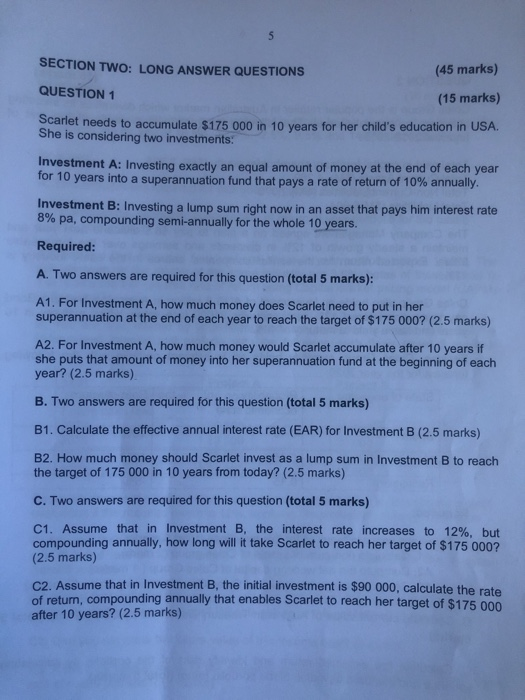

SECTION TWO: LONG ANSWER QUESTIONS QUESTION 1 (45 marks) (15 marks) Scarlet needs to accumulate $175 000 in 10 years for her child's education in USA. She is considering two investments: Investment A: Investing exactly an equal amount of money at the end of each year for 10 years into a superannuation fund that pays a rate of return of 10% annually. Investment B: Investing a lump sum right now in an asset that pays him interest rate 8% pa, compounding semi-annually for the whole 10 years. Required: A. Two answers are required for this question (total 5 marks): A1. For Investment A, how much money does Scarlet need to put in her superannuation at the end of each year to reach the target of $175 000? (2.5 marks) A2. For Investment A, how much money would Scarlet accumulate after 10 years if she puts that amount of money into her superannuation fund at the beginning of each year? (2.5 marks) B. Two answers are required for this question (total 5 marks) B1. Calculate the effective annual interest rate (EAR) for Investment B (2.5 marks) B2. How much money should Scarlet invest as a lump sum in Investment B to reach the target of 175 000 in 10 years from today? (2.5 marks) C. Two answers are required for this question (total 5 marks) C1. Assume that in Investment B, the interest rate increases to 12%, but compounding annually, how long will it take Scarlet to reach her target of $175 000? (2.5 marks) C2 Assume that in Investment B, the initial investment is $90 000, calculate the rate of natum compounding annually that enables Scarlet to reach her target of $175 000 after 10 years? (2.5 marks) SECTION TWO: LONG ANSWER QUESTIONS QUESTION 1 (45 marks) (15 marks) Scarlet needs to accumulate $175 000 in 10 years for her child's education in USA. She is considering two investments: Investment A: Investing exactly an equal amount of money at the end of each year for 10 years into a superannuation fund that pays a rate of return of 10% annually. Investment B: Investing a lump sum right now in an asset that pays him interest rate 8% pa, compounding semi-annually for the whole 10 years. Required: A. Two answers are required for this question (total 5 marks): A1. For Investment A, how much money does Scarlet need to put in her superannuation at the end of each year to reach the target of $175 000? (2.5 marks) A2. For Investment A, how much money would Scarlet accumulate after 10 years if she puts that amount of money into her superannuation fund at the beginning of each year? (2.5 marks) B. Two answers are required for this question (total 5 marks) B1. Calculate the effective annual interest rate (EAR) for Investment B (2.5 marks) B2. How much money should Scarlet invest as a lump sum in Investment B to reach the target of 175 000 in 10 years from today? (2.5 marks) C. Two answers are required for this question (total 5 marks) C1. Assume that in Investment B, the interest rate increases to 12%, but compounding annually, how long will it take Scarlet to reach her target of $175 000? (2.5 marks) C2 Assume that in Investment B, the initial investment is $90 000, calculate the rate of natum compounding annually that enables Scarlet to reach her target of $175 000 after 10 years? (2.5 marks)