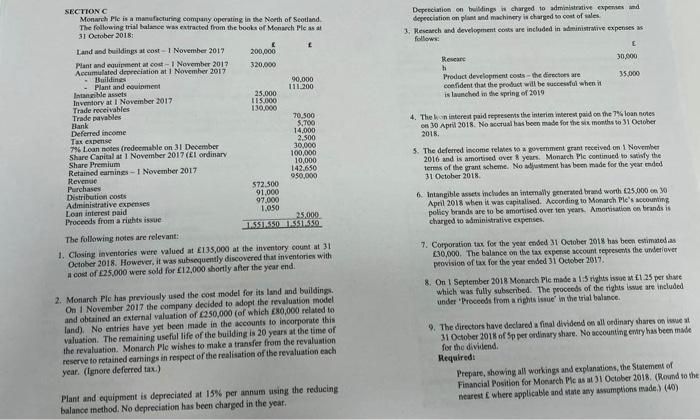

SECTIONC Monareh Ple is a mantucturing eompany operating in the Neeth of Scotland. The following trial balastee was extracted from the books of Monach Ple as at si October 2018: Deperecimion on buldings is eharged to administrative expenies and depecciation on plates and machinery is charged to coet of wales. 3. Heseach and development eows are included in administrative expenses as: follows: Researt h Prodect development conds - the diectoen are 30,000 ceefident that the probsict will be wuccesaful when it 35,000 4. The h in intereat paid segecsents the interim inverest paid co the 7\%: loan notes en 30Aprill2018. No acerual lass been made for the sis, month so 31 October 2018 . 5. The deferred income relutes to a government gant received on 1 November 2016 and is amortised over 8 years. Monaech Ple continued to swisty the teress of the gent icheme. No abjetsment has been made fos the year enided 31 Oetober 2018. 6. Intangible assets includes an internally generated braid worth 625,000 ee 90 April 2018 when it was capitalised. Acoording to Monarch Ple's wocounting, policy brands are to be amortised over ien yeark. Amortisaties en brands is charyed to administralive expenses. The fouswieg nones are reveran- Closing inventories were valued at $135,000 at the inventory count at 31 October 2018 . However, it was subsoquendly discovered that inventories with a cost of $25,000 were sold for $12,000 whortly after the year end. 2. Monarch Ple has previously used the coot model for its land and baildings: On 1 November 2017 the company decided to adopt the tevaluation model and obtained an external valuation of $250,000 (of which 880,000 related to land). No entries bave yet been made in the accounts to iscorperate this valuation. The renaining usefal life of the buiding is 20 years at the time of the revaluation. Monarch Ple wishes to make a transfer from the revaluation rescrve to retained eamings in respect of the realisation of the revaluation each year. (fgnore deferred tax) Plant and equipment is depreciated at 15% per annam using the reducing balanoe incthod. No depreciation has been charged in the year. 7. Corporation tas, for the year croled 31 Ostober 2018 has been evtimatod as 60,000. The balance on the tax experse account sepersents the underiover peovision of bx for the ycar ended 31 October 2017. 8. On 1 September 2018 Monarch Ple made a is sigpts issout at f1.25 per thase Which was fully subseribed. The pooceds of the rights isuse are included. under 'Proceods from a rights issue' in the trial balunce. 9. The directors have declared a fitial divideed os all ordinary thares on isve at 31 October 2018 of 5 p per critinary share. No accountinge entry has been made for the dividend. Required: Prepare, showing all workings and explanatioes, the Statemeus of Financial Position for Mocarch Plo as at 31 October 2018. (Round to the Ecarest f where applicable and state aey aswomptions made) (40)