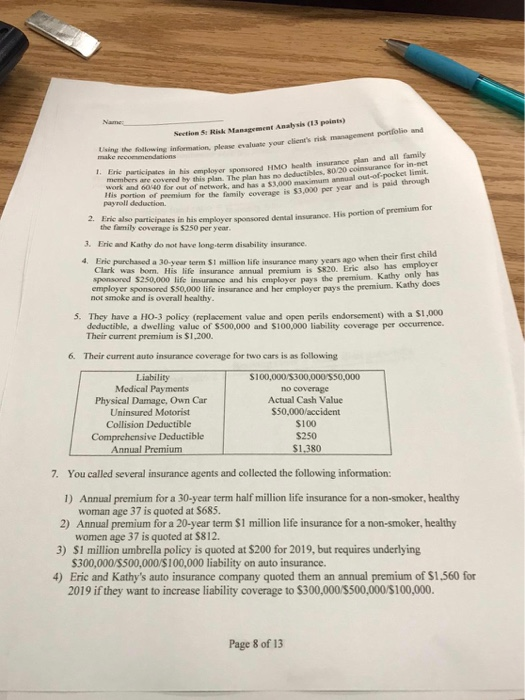

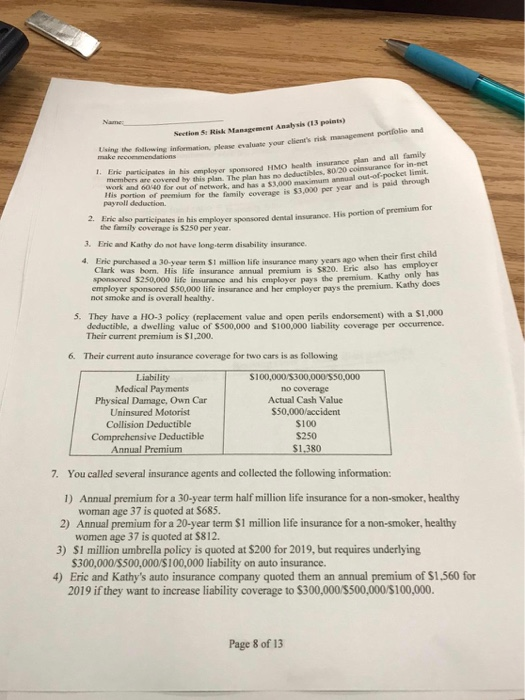

Sections Risk Management Analysis (13 points) the following information, please evaluate your client's risk management portland make recommendations Participates in his employer sponsored HMO health insurance plan and all family are covered by this plan. The plan has no deductibles, 80/20 coinsurance for in-net 0040 for out of network, and has a $1.000 maximum annual out-of-pocket ution of premium for the family coverage is $3,000 per year and is paid through payroll deduction. Anc also participates in his employer sponsored dental insurance. His portion of prendimo the family coverage is $250 per year. 3. Eric and Kathy do not have long term disability insurance. 4 Erie purchased a 30 year term S1 millian life insurance many years ago when their first child Clark was bom. His life insurance annual premium is 820, Eric also has employer sponsored $250.000 life insurance and his smployer pays the premium. Kathy only has employer sponsored S50,000 life insurance and her employer pays the premium. Kathy does not smoke and is overall healthy 5. They have a HO-3 policy (replacement value and open perils endorsement) with a $1,000 deductible, a dwelling value of $500,000 and $100.000 liability coverage per occurrence. Their current premium is $1.200. 6. Their current auto insurance coverage for two cars is as following Liability Medical Payments Physical Damage, Own Car Uninsured Motorist Collision Deductible Comprehensive Deductible Annual Premium $100,000/$300,000/S50,000 no coverage Actual Cash Value $50,000/accident $100 $250 $1,380 7. You called several insurance agents and collected the following information: 1) Annual premium for a 30-year term half million life insurance for a non-smoker, healthy woman age 37 is quoted at $685. 2) Annual premium for a 20-year term $1 million life insurance for a non-smoker, healthy women age 37 is quoted at $812. 3) $1 million umbrella policy is quoted at $200 for 2019, but requires underlying $300,000/$500,000/$100,000 liability on auto insurance. 4) Eric and Kathy's auto insurance company quoted them an annual premium of $1,560 for want to increase liability coverage to $300,000/$500,000/$100,000. Page 8 of 13 Sections Risk Management Analysis (13 points) the following information, please evaluate your client's risk management portland make recommendations Participates in his employer sponsored HMO health insurance plan and all family are covered by this plan. The plan has no deductibles, 80/20 coinsurance for in-net 0040 for out of network, and has a $1.000 maximum annual out-of-pocket ution of premium for the family coverage is $3,000 per year and is paid through payroll deduction. Anc also participates in his employer sponsored dental insurance. His portion of prendimo the family coverage is $250 per year. 3. Eric and Kathy do not have long term disability insurance. 4 Erie purchased a 30 year term S1 millian life insurance many years ago when their first child Clark was bom. His life insurance annual premium is 820, Eric also has employer sponsored $250.000 life insurance and his smployer pays the premium. Kathy only has employer sponsored S50,000 life insurance and her employer pays the premium. Kathy does not smoke and is overall healthy 5. They have a HO-3 policy (replacement value and open perils endorsement) with a $1,000 deductible, a dwelling value of $500,000 and $100.000 liability coverage per occurrence. Their current premium is $1.200. 6. Their current auto insurance coverage for two cars is as following Liability Medical Payments Physical Damage, Own Car Uninsured Motorist Collision Deductible Comprehensive Deductible Annual Premium $100,000/$300,000/S50,000 no coverage Actual Cash Value $50,000/accident $100 $250 $1,380 7. You called several insurance agents and collected the following information: 1) Annual premium for a 30-year term half million life insurance for a non-smoker, healthy woman age 37 is quoted at $685. 2) Annual premium for a 20-year term $1 million life insurance for a non-smoker, healthy women age 37 is quoted at $812. 3) $1 million umbrella policy is quoted at $200 for 2019, but requires underlying $300,000/$500,000/$100,000 liability on auto insurance. 4) Eric and Kathy's auto insurance company quoted them an annual premium of $1,560 for want to increase liability coverage to $300,000/$500,000/$100,000. Page 8 of 13