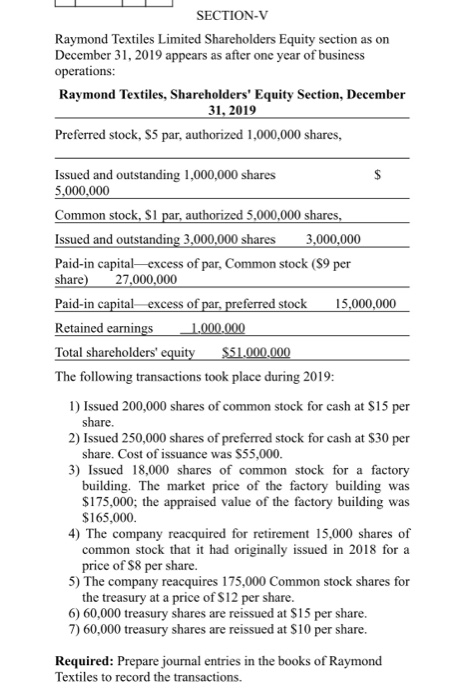

SECTION-V Raymond Textiles Limited Shareholders Equity section as on December 31, 2019 appears as after one year of business operations: Raymond Textiles, Shareholders' Equity Section, December 31, 2019 Preferred stock, 85 par, authorized 1,000,000 shares, Issued and outstanding 1,000,000 shares $ 5,000,000 Common stock, $1 par, authorized 5,000,000 shares, Issued and outstanding 3,000,000 shares 3,000,000 Paid-in capital excess of par, Common stock (89 per share) 27,000,000 Paid-in capital excess of par, preferred stock 15,000,000 Retained earnings 1.000.000 Total shareholders' equity $51.000.000 The following transactions took place during 2019: 1) Issued 200,000 shares of common stock for cash at $15 per share. 2) Issued 250,000 shares of preferred stock for cash at $30 per share. Cost of issuance was $55,000. 3) Issued 18,000 shares of common stock for a factory building. The market price of the factory building was $175,000; the appraised value of the factory building was $165,000. 4) The company reacquired for retirement 15,000 shares of common stock that it had originally issued in 2018 for a price of $8 per share. 5) The company reacquires 175,000 Common stock shares for the treasury at a price of $12 per share. 6) 60,000 treasury shares are reissued at $15 per share. 7) 60,000 treasury shares are reissued at $10 per share. Required: Prepare journal entries in the books of Raymond Textiles to record the transactions. SECTION-V Raymond Textiles Limited Shareholders Equity section as on December 31, 2019 appears as after one year of business operations: Raymond Textiles, Shareholders' Equity Section, December 31, 2019 Preferred stock, 85 par, authorized 1,000,000 shares, Issued and outstanding 1,000,000 shares $ 5,000,000 Common stock, $1 par, authorized 5,000,000 shares, Issued and outstanding 3,000,000 shares 3,000,000 Paid-in capital excess of par, Common stock (89 per share) 27,000,000 Paid-in capital excess of par, preferred stock 15,000,000 Retained earnings 1.000.000 Total shareholders' equity $51.000.000 The following transactions took place during 2019: 1) Issued 200,000 shares of common stock for cash at $15 per share. 2) Issued 250,000 shares of preferred stock for cash at $30 per share. Cost of issuance was $55,000. 3) Issued 18,000 shares of common stock for a factory building. The market price of the factory building was $175,000; the appraised value of the factory building was $165,000. 4) The company reacquired for retirement 15,000 shares of common stock that it had originally issued in 2018 for a price of $8 per share. 5) The company reacquires 175,000 Common stock shares for the treasury at a price of $12 per share. 6) 60,000 treasury shares are reissued at $15 per share. 7) 60,000 treasury shares are reissued at $10 per share. Required: Prepare journal entries in the books of Raymond Textiles to record the transactions