Answered step by step

Verified Expert Solution

Question

1 Approved Answer

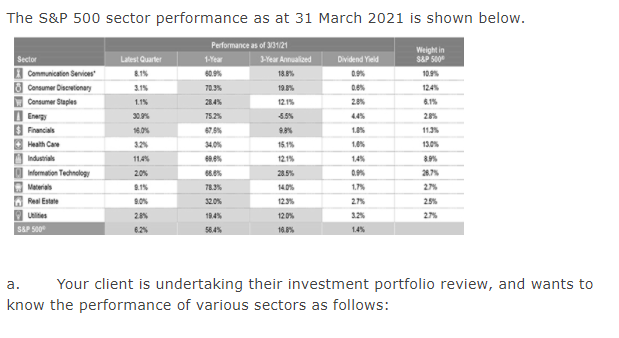

Sectoral Performance and Portfolio Weighting Review i. Which 2 sectors were highest outperformers against the S&P index after 3-year annualized returns? ii. What are the

Sectoral Performance and Portfolio Weighting Review

i. Which 2 sectors were highest outperformers against the S&P index after 3-year annualized returns?

ii. What are the 2 heaviest weighted sectors in the S&P index?

iii. How many sectors and which sectors achieved lower dividend yield than the S&P index?

iv. Your client had allocated 20% of their portfolio to Information Technology. Briefly outline whether you think they should review their allocation based on the table above.

The S&P 500 sector performance as at 31 March 2021 is shown below. Latest Quarter Dividend Yield 0.9% Weight in S&P 500 10.95 12.45 6.15 3.15 1.1% Performance as of 33121 3-Year Armalized 80.9% 18.8% 70.35 19.8% 12.15 75.25 5.5% 87.5% . 15.15 12.15 2.8% 30.95 16.0% Sector Communication Services Consumer Dissionary Consumer Staples Energy S Francis Health Care Industrials Information Technology Materials Real Estate Us 10% 11.35 13.0% 114% 28.5% 78.3% 14.0% 14% 0. 17% 275 3.2% 1.4% 28.75 27% 2.5% 275 12.3% 120% 20% 6.23 18.45 58.45 S&P 500 18.8% a. Your client is undertaking their investment portfolio review, and wants to know the performance of various sectors as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started